Zenith Steel Industries Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

Zenith Steel Industries operates in the steel pipe and tube manufacturing sector, catering to industries like oil and gas, water, infrastructure, and construction. The company specializes in producing high-quality steel pipes, leveraging state-of-the-art technology to meet domestic and international standards. Its diversified product portfolio and strong industry presence underline its competitive edge.

Fundamental Analysis

1. Company Overview

Zenith Steel Industries is a prominent player in the steel pipe industry with decades of experience. The company’s manufacturing facilities are strategically located to optimize supply chain efficiency. Its strong distribution network ensures a steady flow of products to various sectors, including infrastructure, which is witnessing significant growth in India.

2. Financial Health

Debt Analysis

The company’s debt levels have fluctuated due to expansion efforts and market conditions. A detailed review of the latest financial reports reveals a concerted effort to reduce debt through operational efficiency and strategic partnerships.

Cash Flow

Positive cash flow trends in the past indicate the company’s ability to manage operations efficiently. However, any adverse market conditions or increased competition could impact this metric.

Liquidity

Liquidity ratios suggest the company is in a stable position to meet short-term obligations. Regular monitoring of liquidity is crucial for ensuring continued stability.

3. Competitive Analysis

Zenith Steel Industries faces competition from both domestic and international players. Its focus on innovation, adherence to quality standards, and strategic market positioning have helped it maintain a competitive edge. However, challenges such as fluctuating steel prices and import/export regulations need careful navigation.

4. Growth Prospects

Market Trends

The steel pipe industry is poised for growth, driven by infrastructure development, increased industrialization, and government initiatives like “Make in India” and the National Infrastructure Pipeline (NIP). Zenith’s ability to capitalize on these trends will be a critical factor in its growth.

Strategic Initiatives

The company’s strategic focus on R&D, customer-centric solutions, and expanding its global footprint will play a pivotal role in driving future growth.

5. Dividend Policy

Zenith Steel Industries’ dividend policy reflects its commitment to rewarding shareholders while retaining sufficient profits for reinvestment. The dividend yield remains modest, aligning with the company’s growth-oriented strategy.

6. ESG (Environmental, Social, and Governance) Factors

The company’s ESG initiatives, such as sustainable manufacturing practices, community engagement, and adherence to governance norms, enhance its reputation and long-term viability. Investors are increasingly valuing such factors while making decisions.

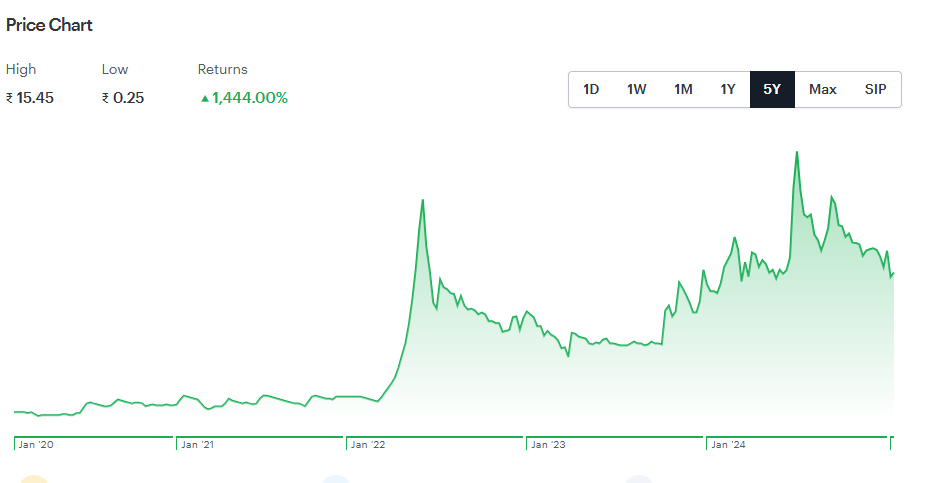

Zenith Steel Industries Share Price Chart of Last 5 years

Key Factors Impacting Zenith Steel Industries Share Price

Understanding the factors that influence the share price of Zenith Steel Industries is crucial for investors looking to make informed decisions. Below is an in-depth analysis of the key elements that play a significant role in shaping the company’s market performance:

1. Economic Conditions

The overall economic environment, both domestic and global, has a profound impact on Zenith Steel Industries’ share price. Key indicators such as GDP growth, industrial output, and infrastructure spending directly influence demand for steel products. A robust economy typically translates to increased construction and industrial activities, driving up demand for the company’s offerings.

- Global Factors: Trade policies, international steel demand, and currency exchange rates.

- Domestic Factors: Government policies on infrastructure development and economic reforms like “Make in India.”

2. Raw Material Costs

Steel production is highly sensitive to fluctuations in the prices of raw materials such as iron ore and coal. Changes in the cost of procurement can significantly affect the company’s profit margins. Efficient procurement strategies and long-term supply agreements can help mitigate this risk.

3. Government Policies and Regulations

Policy decisions and regulations related to the steel industry, environmental compliance, and trade tariffs can directly impact the company’s operations and profitability. For instance:

- Tariffs and Duties: Changes in import/export duties on steel and raw materials.

- Incentives: Government subsidies or incentives for domestic manufacturers.

- Infrastructure Investments: Large-scale government projects drive demand.

4. Technological Advancements

Adoption of advanced manufacturing technologies enhances productivity, reduces costs, and improves product quality. Companies that invest in R&D and modernize their production processes are better positioned to compete in the market.

5. Market Competition

The steel industry is highly competitive, with numerous domestic and international players vying for market share. Factors such as pricing strategies, product differentiation, and customer service can influence Zenith’s ability to retain and expand its market position.

6. Global Steel Demand Trends

Global demand for steel, particularly in sectors like construction, automotive, and infrastructure, impacts Zenith’s sales volumes. Economic recovery in major markets such as the US, Europe, and China can lead to increased export opportunities.

7. ESG (Environmental, Social, and Governance) Compliance

Investors are increasingly prioritizing companies with strong ESG practices. Zenith’s commitment to sustainable manufacturing, community engagement, and transparent governance can attract long-term investors and enhance its reputation.

8. Financial Performance

The company’s financial health, including revenue growth, profit margins, and debt levels, directly influences investor confidence and share price. Key metrics to monitor include:

- Earnings Per Share (EPS): Indicates profitability.

- Debt-to-Equity Ratio: Reflects financial stability.

- Cash Flow: Demonstrates operational efficiency.

9. Geopolitical Risks

Events such as trade wars, political instability, and changes in international relations can disrupt supply chains and affect exports. Investors should remain vigilant about geopolitical developments that may impact the steel industry.

10. Investor Sentiment and Market Trends

Market perceptions, influenced by news, reports, and analyst recommendations, play a significant role in determining share price movements. Positive sentiment around growth prospects or strategic initiatives can drive up stock prices, while negative news can have the opposite effect.

Zenith Steel Industries Share Price Target 2025 to 2030

Zenith Steel Industries Share Price Target 2025

Zenith Steel Industries is poised to benefit from the growing demand for infrastructure-related steel products. Government initiatives such as the National Infrastructure Pipeline (NIP) and the continued push for urbanization are expected to drive demand for steel pipes and tubes. Operational improvements, including better cost management and enhanced production efficiency, contribute to the company’s growth trajectory.

Given these factors, a conservative estimate places the 2025 share price target at ₹12 to ₹15. The target considers steady revenue growth, improved operating margins, and the potential for increased domestic and international sales.

Zenith Steel Industries Share Price Target 2026

In 2026, Zenith Steel Industries is expected to leverage its strategic initiatives, such as expanding its export markets and introducing innovative products. The focus on technological advancements and customer-centric solutions will likely enhance its competitive edge. Furthermore, improved financial health, including reduced debt levels and better cash flow management, will contribute to investor confidence.

As a result, the share price could climb to ₹16 to ₹18, reflecting the company’s enhanced market position and operational excellence.

Zenith Steel Industries Share Price Target 2027

By 2027, sustained growth fueled by market expansion and diversification of product offerings will likely drive Zenith Steel Industries’ performance. Increased investments in renewable energy projects and infrastructure globally could open new avenues for the company’s products. Additionally, its ability to maintain high-quality standards and comply with international regulations will be instrumental in capturing a larger market share.

With these dynamics, the share price target for 2027 is projected to be ₹19 to ₹22.

Zenith Steel Industries Share Price Target 2028

Zenith Steel Industries’ commitment to innovation and market leadership will likely bear fruit by 2028. As the company continues to improve operational efficiency and strengthen its ESG (Environmental, Social, and Governance) profile, it will attract more institutional investors. The steel industry’s growth, especially in emerging markets, will provide additional tailwinds for Zenith’s revenue and profitability.

The 2028 share price target is estimated at ₹23 to ₹26, considering these positive developments.

Zenith Steel Industries Share Price Target 2029

Enhanced profitability, driven by cost optimization and a robust product mix, will likely be the hallmark of Zenith Steel Industries in 2029. The company’s strategic collaborations and partnerships in key markets will further solidify its position. A strong ESG profile, including sustainable manufacturing practices and social responsibility initiatives, will appeal to long-term investors.

Given these factors, the share price target for 2029 could range between ₹27 to ₹30.

Zenith Steel Industries Share Price Target 2030

By 2030, Zenith Steel Industries is expected to achieve significant milestones in terms of revenue growth, market share, and profitability. The company’s ability to adapt to changing market dynamics, coupled with its focus on innovation and sustainability, will likely position it as a market leader. Favorable global economic conditions and increased infrastructure spending will provide further impetus for growth.

Under these assumptions, the share price target for 2030 is forecasted at ₹31 to ₹35, marking a significant appreciation from current levels.

Summary of Zenith Steel Industries Share Price Target 2025 to 2030

| Year | Share Price Target (₹) |

| 2025 | 12-15 |

| 2026 | 16-18 |

| 2027 | 19-22 |

| 2028 | 23-26 |

| 2029 | 27-30 |

| 2030 | 31-35 |

Conclusion

Zenith Steel Pipes & Industries Ltd exhibits strong potential for growth over the next decade, driven by favorable market dynamics, strategic initiatives, and operational efficiencies. While challenges such as market competition and raw material costs exist, the company’s robust fundamentals and focus on innovation position it well for sustained growth. Investors should monitor key metrics and industry trends to make informed decisions.

10 FAQs based on the article about Zenith Steel Industries:

1. What is Zenith Steel Industries’ business model?

Zenith Steel Industries specializes in manufacturing steel pipes and tubes, catering to industries like oil and gas, water, infrastructure, and construction. The company focuses on high-quality, technologically advanced products for both domestic and international markets.

2. What are the key financial metrics for Zenith Steel Industries?

Zenith Steel Industries has fluctuating debt levels due to expansion efforts, but it maintains a positive cash flow and stable liquidity to meet short-term obligations. The company’s strong financial position is crucial for sustaining its growth.

3. What are Zenith Steel Industries’ competitive advantages?

Zenith stands out due to its focus on innovation, quality standards, and strategic market positioning. It competes effectively despite challenges like fluctuating steel prices and import/export regulations.

4. How does Zenith Steel Industries plan to grow?

The company plans to capitalize on infrastructure development, industrialization, and government initiatives such as “Make in India” and the National Infrastructure Pipeline (NIP). Zenith also focuses on strategic R&D and expanding its global footprint.

5. What is Zenith Steel Industries’ dividend policy?

Zenith follows a growth-oriented dividend policy, with a modest yield, focusing on reinvesting profits to support expansion and innovation.

6. How do government policies impact Zenith Steel Industries?

Government policies on infrastructure development, tariffs, and incentives for domestic manufacturers directly influence Zenith’s operations. Positive policy changes can boost demand for steel products.

7. How does raw material cost fluctuation affect Zenith Steel Industries?

Raw material price fluctuations, particularly in iron ore and coal, can impact Zenith’s profit margins. Efficient procurement strategies help manage these risks.

8. What are the key factors influencing Zenith Steel Industries’ share price?

Economic conditions, raw material costs, global steel demand, government policies, technological advancements, and market competition all play a role in determining Zenith’s share price.

9. What is the projected share price target for Zenith Steel Industries in 2025?

The share price target for 2025 is estimated to be ₹12 to ₹15, driven by increasing infrastructure demand and operational improvements.

10. What are Zenith Steel Industries’ share price targets for 2026 to 2030?

Zenith’s share price targets are:

- 2026: ₹16 to ₹18

- 2027: ₹19 to ₹22

- 2028: ₹23 to ₹26

- 2029: ₹27 to ₹30

- 2030: ₹31 to ₹35

2 thoughts on “Zenith Steel Industries Share Price Target 2025 to 2030”