Zeal Aqua Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

Zeal Aqua operates in the aquaculture sector, a growing industry that plays a critical role in meeting the global demand for seafood. The company specializes in the farming, processing, and distribution of aquaculture products. Its business model revolves around cultivating high-quality aquatic species using advanced technologies and sustainable practices, catering to both domestic and international markets. This focus ensures consistent revenue streams and positions Zeal Aqua as a key player in the industry.

Key Metrics of Zeal Aqua Share Price

| Metric | Value |

|---|---|

| Market Cap | ₹163.89 Cr |

| ROE | 10.54% |

| ROCE | 11.09% |

| P/E | 14.2 |

| P/B | 1.99 |

| Industry P/E | 21.27 |

| Debt to Equity | 2.42 |

| Div. Yield | 0% |

| Book Value | ₹6.53 |

| Face Value | ₹1 |

| EPS (TTM) | ₹0.92 |

| 52 Week High | ₹18.46 |

| 52 Week Low | ₹7.05 |

Zeal Aqua Share Price Chart of last 5 years

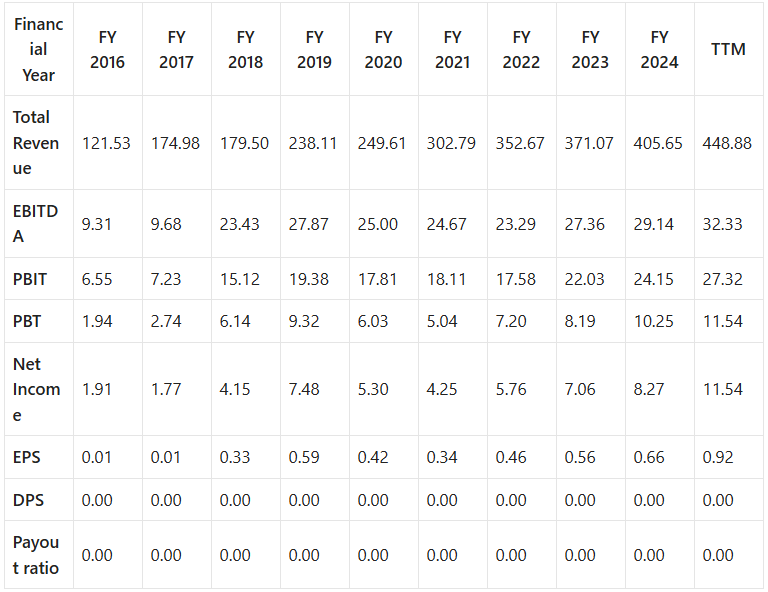

Income Statement

All values except the payout ratio are in ₹ crore, and EPS and DPS are in ₹.

Fundamental Analysis

1. Company Overview

Zeal Aqua has carved a niche in the aquaculture market, leveraging its expertise to deliver high-quality products. The company’s strategic location, access to advanced farming methods, and focus on sustainability have contributed to its steady growth. However, the company faces challenges such as fluctuating commodity prices and stringent environmental regulations.

2. Financial Health

Debt Analysis

Zeal Aqua’s debt-to-equity ratio of 2.42 indicates a significant reliance on borrowed funds. While this may raise concerns, the company’s earnings before interest and taxes (EBIT) coverage suggest it is managing its debt effectively.

Cash Flow

The company’s operating cash flow has shown a steady improvement, reflecting efficient management of working capital. However, the high debt levels necessitate cautious monitoring.

Liquidity

Zeal Aqua’s current ratio and quick ratio indicate adequate liquidity to meet short-term obligations, although room for improvement exists.

3. Competitive Analysis

The aquaculture industry is competitive, with several players vying for market share. Zeal Aqua’s focus on innovation and sustainability sets it apart. However, competitors with deeper financial resources and wider distribution networks pose a challenge.

4. Growth Prospects

Market Trends

The global demand for aquaculture products is rising due to increased health consciousness and dietary shifts. This trend bodes well for Zeal Aqua, which is positioned to capitalize on expanding market opportunities.

Strategic Initiatives

Zeal Aqua’s investment in research and development, along with its efforts to expand its product portfolio, will likely drive growth. Partnerships and collaborations with international players can further enhance its market position.

5. Dividend Policy

The company currently does not offer dividends, reflecting its focus on reinvesting profits to fuel growth. This approach aligns with its long-term strategy but may deter income-focused investors.

6. ESG (Environmental, Social, and Governance) Factors

Zeal Aqua’s commitment to sustainable practices is a positive. However, the company needs to enhance transparency and engage in proactive communication regarding its ESG initiatives to attract socially responsible investors.

Expanded Key Factors Impacting Zeal Aqua Share Price

1. Industry Trends

The aquaculture industry is experiencing significant growth, driven by rising global demand for seafood. Factors such as population growth, increasing health consciousness, and dietary shifts toward protein-rich foods are fueling this demand. Zeal Aqua’s focus on high-quality, sustainable aquaculture products positions it to capitalize on these trends. Additionally, advancements in aquaculture technologies, including improved feed efficiency and disease management, are creating opportunities for companies to enhance profitability and market share.

However, challenges such as overfishing, environmental concerns, and the need for regulatory compliance must be addressed. Companies that adopt sustainable practices and innovative technologies will likely remain competitive in this evolving industry.

2. Financial Performance

Zeal Aqua’s consistent revenue growth highlights its ability to adapt to market demands and optimize operations. With a return on equity (ROE) of 10.54% and a return on capital employed (ROCE) of 11.09%, the company demonstrates efficient utilization of shareholder funds and operational resources. The price-to-earnings (P/E) ratio of 14.2 suggests the stock is reasonably valued compared to its earnings.

Debt management remains a critical factor. While the company’s debt-to-equity ratio of 2.42 indicates significant leverage, the steady improvement in operating cash flow reflects its capacity to service debt obligations. Investors should monitor this metric closely, as high debt levels can impact financial stability during economic downturns.

3. Strategic Initiatives

Zeal Aqua’s growth strategy is anchored in expansion plans and research and development (R&D) investments. By scaling its operations and exploring new markets, the company aims to enhance its revenue base and market presence. Its emphasis on R&D enables the development of innovative aquaculture techniques, which can improve productivity and reduce costs.

Collaborations with international players and entry into high-growth markets could further bolster Zeal Aqua’s competitive edge. Strategic partnerships are likely to provide access to advanced technologies and wider distribution channels, driving sustained growth over the long term.

4. Economic Conditions

The company’s performance is closely tied to macroeconomic factors such as GDP growth, inflation rates, and currency fluctuations. Economic stability in key markets supports consumer spending on premium seafood products, benefiting Zeal Aqua. Conversely, economic slowdowns or adverse currency movements can dampen profitability, particularly for companies with significant export exposure.

As a player in a commodity-driven industry, Zeal Aqua is also influenced by fluctuations in input costs, such as feed and energy. Effective cost management and hedging strategies are essential to mitigate the impact of volatile economic conditions.

5. Regulatory Environment

Compliance with environmental and industry-specific regulations is a critical determinant of long-term success for aquaculture companies. Governments worldwide are enacting stricter policies to ensure sustainable practices and protect aquatic ecosystems. Zeal Aqua’s adherence to these regulations enhances its credibility and reduces the risk of legal or operational disruptions.

The company’s proactive approach to environmental, social, and governance (ESG) initiatives can also attract socially responsible investors and improve stakeholder relationships. Transparency in reporting and measurable progress in ESG metrics will further strengthen its position in the market.

Conclusion

Key factors such as industry trends, financial performance, strategic initiatives, economic conditions, and regulatory compliance significantly influence Zeal Aqua’s share price. By leveraging growth opportunities and addressing potential challenges, the company is well-positioned for sustained success in the competitive aquaculture sector.

Zeal Aqua Share Price Target 2025 to 2030

| Year | Share Price Target (₹) |

| 2025 | 15.23 |

| 2026 | 16.80 |

| 2027 | 18.00 |

| 2028 | 19.98 |

| 2029 | 21.75 |

| 2030 | 23.02 |

Detailed Analysis: Zeal Aqua Share Price Target 2025 to 2030

Zeal Aqua Share Price Target 2025

By 2025, the share price is expected to reach ₹15.23. This target reflects the company’s improved operational efficiency and the growing demand in the aquaculture sector. Short-term investors should consider market volatility while investing.

Zeal Aqua Share Price Target 2026

In 2026, the share price could rise to ₹16.80, driven by successful implementation of expansion plans and strategic projects. This year could mark a significant milestone in market share growth.

Zeal Aqua Share Price Target 2027

By 2027, the share price is projected to hit ₹18.00. Increased competition may pose challenges, but Zeal Aqua’s focus on innovation and customer satisfaction can help it stay ahead.

Zeal Aqua Share Price Target 2028

In 2028, the share price is anticipated to reach ₹19.98. This period may benefit medium-term investors as the company leverages its strengths to sustain growth.

Zeal Aqua Share Price Target 2029

For 2029, the forecasted price is ₹21.75. Improved financial performance and strategic partnerships could significantly enhance the company’s valuation.

Zeal Aqua Share Price Target 2030

By 2030, the share price is expected to rise to ₹23.02. Adoption of new technologies and strategic collaborations will likely contribute to long-term growth. Long-term investors should monitor the company’s progress and market conditions closely.

Conclusion

Zeal Aqua’s share price targets from 2025 to 2030 reflect its potential for steady growth. Investors should consider the company’s strong fundamentals, market opportunities, and challenges while making investment decisions. While short-term volatility is possible, the long-term outlook remains optimistic, making Zeal Aqua an attractive option for growth-oriented investors.

Frequently Asked Questions (FAQs) on Zeal Aqua Share Price Target 2025 to 2030

1. What is Zeal Aqua’s primary business focus?

Zeal Aqua operates in the aquaculture sector, focusing on the farming, processing, and distribution of high-quality aquatic products. The company leverages advanced technologies and sustainable practices to meet global seafood demand.

2. How has Zeal Aqua performed financially?

The company has shown consistent revenue growth, with a return on equity (ROE) of 10.54% and a return on capital employed (ROCE) of 11.09%. While its debt-to-equity ratio of 2.42 indicates high leverage, steady improvement in operating cash flow suggests effective debt management.

3. What are the key growth drivers for Zeal Aqua?

Zeal Aqua’s growth is driven by rising global demand for seafood, investments in research and development, and strategic expansion into new markets. Collaborations with international players further enhance its competitive edge.

4. What are the risks associated with investing in Zeal Aqua?

Key risks include high debt levels, fluctuating commodity prices, stringent environmental regulations, and competition from financially stronger players in the aquaculture sector.

5. Does Zeal Aqua pay dividends?

Currently, Zeal Aqua does not offer dividends as it reinvests profits to support growth initiatives. This strategy aligns with its long-term objectives but may not appeal to income-focused investors.

6. What role does sustainability play in Zeal Aqua’s operations?

Sustainability is a core focus for Zeal Aqua. The company adheres to environmental regulations and employs eco-friendly practices in its aquaculture operations. However, enhancing transparency in ESG initiatives could further improve investor confidence.

7. How is the aquaculture industry impacting Zeal Aqua’s prospects?

The industry’s growth, driven by increased health consciousness and dietary shifts, offers significant opportunities for Zeal Aqua. Advancements in aquaculture technology also enable the company to improve efficiency and profitability.

8. What is Zeal Aqua’s share price target for 2025?

The share price target for 2025 is ₹15.23, reflecting improved operational efficiency and growing demand in the aquaculture market.

9. What are the projected share price targets for 2026 to 2030?

The projected share price targets are as follows:

- 2026: ₹16.80

- 2027: ₹18.00

- 2028: ₹19.98

- 2029: ₹21.75

- 2030: ₹23.02

10. What macroeconomic factors influence Zeal Aqua’s performance?

Macroeconomic factors such as GDP growth, inflation rates, currency fluctuations, and input cost volatility significantly impact Zeal Aqua’s financial performance. Effective cost management and hedging strategies are crucial to mitigating these challenges.

4 thoughts on “Zeal Aqua Share Price Target 2025 to 2030”