Vikas Lifecare Share Price Target 2025 to 2030: Detailed Analysis

Vikas Lifecare Limited, established in 1995, has evolved into a prominent entity in the manufacturing and trading of polymer and rubber compounds, as well as specialty additives for plastics and synthetic and natural rubber. The company is also engaged in upcycling industrial and post-consumer waste materials, contributing to environmental sustainability. As of February 6, 2025, the company’s stock is trading at ₹3.75 per share. Investors are keen to understand the potential trajectory of Vikas Lifecare’s share price from 2025 to 2030. This comprehensive analysis delves into the company’s key metrics, financial health, competitive landscape, growth prospects, dividend policy, and ESG considerations to provide a well-rounded perspective on its future valuation.

Key Metrics of Vikas Lifecare Limited Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹702 Crore |

| 52-Week High | ₹7.48 |

| 52-Week Low | ₹3.50 |

| Face Value | ₹1.00 |

| Book Value Per Share | ₹2.93 |

| Dividend Yield | 0.00% |

| Return on Equity (ROE) | -4.64% |

| Return on Capital Employed (ROCE) | -5.65% |

| Price-to-Earnings (PE) Ratio | 24.70 |

| Price-to-Book (PB) Ratio | 2.19 |

Shareholding Pattern

| Shareholder Category | Share Percentage |

|---|---|

| Retail and Others | 77.69% |

| Promoters | 12.16% |

| Foreign Institutional Investors (FII) | 10.15% |

Vikas Lifecare Share Price Chart of Last 5 years

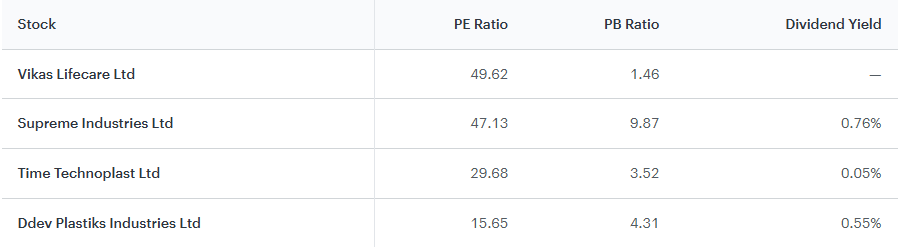

Peers & Comparison

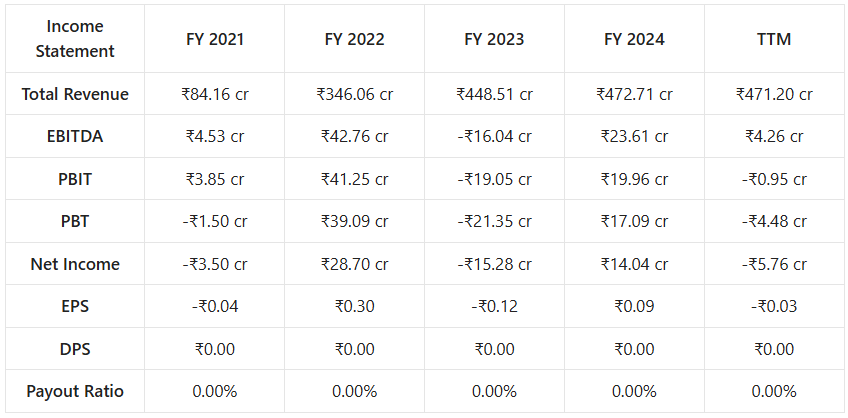

Income Statement

- EPS (Earnings Per Share) and DPS (Dividends Per Share) are presented in ₹.

- All other figures are in ₹ crore (₹ cr).

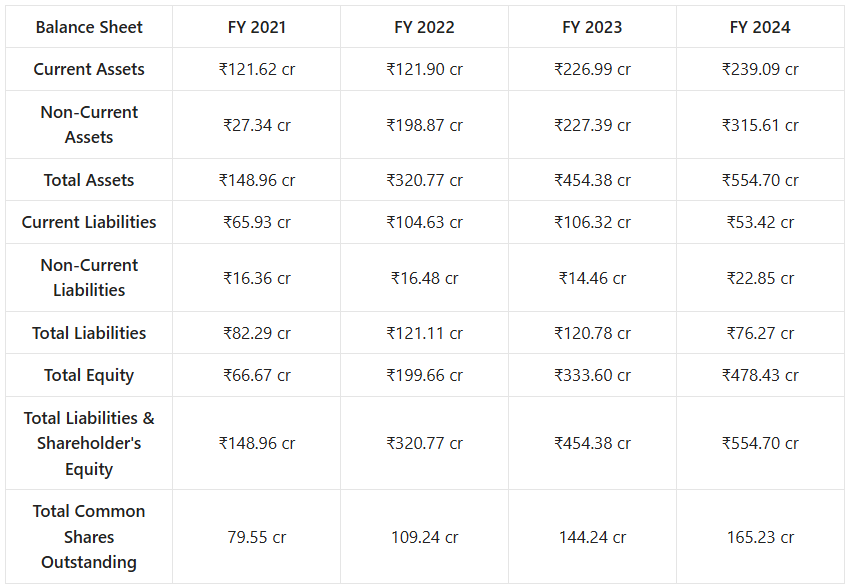

Balance Sheet

Note: All figures are in ₹ crore (₹ cr).

Cash Flow Statement

- Net Change in Cash: Represents the overall change in cash and cash equivalents during the financial year.

- Changes in Working Capital: Indicates the net change in current assets and current liabilities, reflecting the company’s short-term financial health.

- Capital Expenditures (CapEx): Denotes the funds used by the company to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment.

- Free Cash Flow: Calculated as operating cash flow minus capital expenditures, it signifies the cash a company generates after accounting for expenses necessary to maintain or expand its asset base.

Note: All figures are in Indian Rupees (₹) crores.

Fundamental Analysis

- Company Overview : Vikas Lifecare Limited is an ISO 9001:2015 certified company engaged in the manufacturing and trading of polymer and rubber compounds, as well as specialty additives for plastics and synthetic and natural rubber. The company focuses on upcycling industrial and post-consumer waste materials, contributing to environmental sustainability. Additionally, Vikas Lifecare has diversified into the agro-products business and is partnered with organizations like NAFED and HOFED. The company has also ventured into the B2C segment, offering consumer products in the FMCG, agro, and infrastructure sectors.

- Financial Health : A thorough examination of Vikas Lifecare’s financial statements provides insights into its fiscal stability and operational efficiency.

- Debt Analysis: As of the latest financial reports, Vikas Lifecare has a total shareholder equity of ₹5.4 billion and total debt of ₹614.6 million, resulting in a debt-to-equity ratio of 11.3%. This indicates a moderate level of debt relative to equity, suggesting prudent financial management.

- Cash Flow: The company’s cash flow from operating activities has been negative in recent years, which may indicate challenges in generating sufficient cash from core operations. However, cash flows from financing activities have been positive, suggesting reliance on external funding to support operations and growth initiatives.

- Liquidity: The current ratio, which measures the company’s ability to cover short-term obligations with short-term assets, stood at 2.0x during FY23, up from 1.1x in FY22. This improvement indicates better liquidity and a stronger position to meet short-term liabilities.

- Competitive Analysis : In the competitive landscape of polymer and rubber compounds, Vikas Lifecare distinguishes itself through:

- Comprehensive Product Portfolio: The company offers a wide range of products, including polymer compounds, rubber compounds, and specialty additives, catering to diverse industrial applications.

- Environmental Commitment : By focusing on upcycling waste materials, Vikas Lifecare aligns with global sustainability trends, potentially enhancing its market appeal. Diversification : The company’s expansion into the agro-products and FMCG sectors diversifies its revenue streams and reduces dependence on a single market segment.

- Growth Prospects : Vikas Lifecare’s growth trajectory is influenced by several factors:

- Market Trends: The increasing demand for sustainable and eco-friendly products creates favorable conditions for the company’s upcycled materials. Additionally, the growth in the agro-products and FMCG sectors presents new opportunities.

Key Factors Impacting Share Price

- Diversification Strategy : The company’s presence across various sectors helps mitigate sector-specific risks. By not relying on a single industry, Vikas Lifecare can balance downturns in one sector with stability or growth in others. This diversification enhances revenue streams and reduces vulnerability to market fluctuations.

- Technological Advancements : Investment in research and development (R&D) and the adoption of advanced technologies are crucial for improving product quality and operational efficiency. For instance, the company’s collaboration with the Defence Research and Development Organisation (DRDO) to manufacture biodegradable plastics demonstrates its commitment to innovation and sustainability.

- Market Demand : The rising demand for polymer and FMCG products supports revenue growth. As industries like agriculture, infrastructure, and automotive expand, the need for high-quality polymer compounds and related products increases, benefiting companies like Vikas Lifecare.

- Government Policies : Favorable regulatory frameworks can significantly impact business expansion. Policies promoting sustainable practices, such as incentives for biodegradable products, can provide growth opportunities. Conversely, stringent environmental regulations may require additional compliance efforts.

- Investor Confidence : The shareholding pattern reflects investor sentiment. As of December 31, 2024, promoters hold 14.20% of the shares, foreign institutional investors (FIIs) hold 0.49%, and the public holds 85.31%. A higher public shareholding can lead to increased stock volatility due to retail investor activities.

Vikas Lifecare Share Price Target 2025 to 2030 : Detailed Yearly Analysis

Vikas Lifecare Share Price Target 2025:

₹3.78 – ₹4.50

In 2025, the stock price is expected to range between ₹3.78 and ₹4.50. This anticipated growth is attributed to the company’s diversification efforts, strategic partnerships, and market expansion initiatives. The collaboration with DRDO to produce biodegradable plastics positions Vikas Lifecare favorably in the sustainable products market, potentially enhancing revenue streams.

Vikas Lifecare Share Price Target 2026:

₹4.50 – ₹5.25

By 2026, the share price is projected to reach ₹4.50 to ₹5.25. Factors contributing to this growth include product innovation, operational efficiency, and increased brand recognition. The company’s focus on introducing new and improved products to meet evolving customer demands, along with implementing cost-effective measures, is expected to improve profit margins and enhance brand visibility.

Vikas Lifecare Share Price Target 2027:

₹5.25 – ₹6.00

In 2027, the stock price is anticipated to rise to ₹5.25 – ₹6.00. This growth is supported by technological advancements, sustainable practices, and market leadership. Adopting advanced technologies to improve product quality and operational processes, along with a commitment to environmental sustainability, can attract eco-conscious consumers and establish the company as a leader in key industry segments.

Vikas Lifecare Share Price Target 2028:

₹6.00 – ₹7.00

By 2028, the share price is expected to reach ₹6.00 – ₹7.00. Global expansion, continuous investment in R&D, and a focus on customer satisfaction are key drivers. Entering international markets diversifies revenue streams, while ongoing R&D investments ensure the company stays ahead of industry trends. Delivering high-quality products and services fosters customer loyalty and attracts new clients.

Vikas Lifecare Share Price Target 2029:

₹7.00 – ₹8.00

In 2029, the stock price is projected to range between ₹7.00 and ₹8.00. Enhanced market positioning, increased profitability, and technological integration are anticipated to drive this growth. Strengthening its presence in key industry sectors, optimizing operations to improve earnings, and implementing digital transformation strategies can enhance efficiency and customer engagement.

Vikas Lifecare Share Price Target 2030:

₹8.00 – ₹9.00

Looking ahead to 2030, the share price could reach ₹8.00 – ₹9.00. Sustainable growth strategies, global partnerships, and consistent revenue growth are expected to be key drivers. Expanding into eco-friendly and innovative product lines, collaborating with international businesses to scale operations, and maintaining strong financial performance through diversified investments position the company for long-term success.

Summary of Vikas Lifecare Share Price Target 2025 to 2030

| Year | Target Range (₹) |

|---|---|

| 2025 | 3.78 – 4.50 |

| 2026 | 4.50 – 5.25 |

| 2027 | 5.25 – 6.00 |

| 2028 | 6.00 – 7.00 |

| 2029 | 7.00 – 8.00 |

| 2030 | 8.00 – 9.00 |

Conclusion

These projections suggest a steady upward trend in Vikas Lifecare’s share price over the specified period. The anticipated growth is attributed to factors such as diversification efforts, strategic partnerships, market expansion initiatives, product innovation, operational efficiency, technological advancements, sustainable practices, global expansion, and a focus on customer satisfaction. However, it’s important to note that these are projections and actual performance may vary due to market conditions and other external factors.

Frequently Asked Questions (FAQs) about Vikas Lifecare Share Price Target 2025 to 2030

- What is Vikas Lifecare Limited’s primary business? Vikas Lifecare Limited specializes in manufacturing and trading polymer and rubber compounds, as well as specialty additives for plastics and synthetic and natural rubber. The company also focuses on upcycling industrial and post-consumer waste materials, contributing to environmental sustainability.

- What is the current share price of Vikas Lifecare? As of February 6, 2025, Vikas Lifecare’s stock is trading at ₹3.75 per share.

- What is the projected share price for Vikas Lifecare in 2025? The projected share price for 2025 is between ₹3.78 and ₹4.50. This growth is attributed to the company’s diversification efforts, strategic partnerships, and market expansion initiatives.

- What factors contribute to the projected share price increase in 2025? The anticipated growth in 2025 is due to Vikas Lifecare’s collaboration with the Defence Research and Development Organisation (DRDO) to produce biodegradable plastics, positioning the company favorably in the sustainable products market.

- What is the expected share price range for Vikas Lifecare in 2026? In 2026, the share price is projected to reach between ₹4.50 and ₹5.25. This growth is expected to result from product innovation, operational efficiency, and increased brand recognition.

- How does Vikas Lifecare’s diversification strategy impact its share price? Vikas Lifecare’s diversification across various sectors helps mitigate sector-specific risks, balancing downturns in one sector with stability or growth in others. This strategy enhances revenue streams and reduces vulnerability to market fluctuations, positively influencing the share price.

- What is the projected share price for Vikas Lifecare in 2027? In 2027, the stock price is anticipated to rise to between ₹5.25 and ₹6.00. This growth is supported by technological advancements, sustainable practices, and market leadership.

- What role does technological advancement play in Vikas Lifecare’s growth? Investment in research and development (R&D) and the adoption of advanced technologies are crucial for improving product quality and operational efficiency. For instance, the company’s collaboration with DRDO to manufacture biodegradable plastics demonstrates its commitment to innovation and sustainability.

- What is the expected share price range for Vikas Lifecare in 2028? By 2028, the share price is expected to reach between ₹6.00 and ₹7.00. Key drivers include global expansion, continuous investment in R&D, and a focus on customer satisfaction.

- What is the projected share price for Vikas Lifecare in 2030? Looking ahead to 2030, the share price could reach between ₹8.00 and ₹9.00. Sustainable growth strategies, global partnerships, and consistent revenue growth are expected to be key drivers.

2 thoughts on “Vikas Lifecare Share Price Target 2025 to 2030”