Vikas Ecotech Share Price Target 2025 to 2030: Detailed Analysis

Vikas Ecotech Ltd., a prominent player in the Indian specialty chemicals and eco-friendly additives sector, has garnered attention for its innovative solutions and strategic market positioning. As of February 7, 2025, the company’s share price stands at ₹2.94. This comprehensive analysis delves into the company’s key metrics, shareholding pattern, and fundamental aspects to project its share price trajectory from 2025 to 2030.

Key Metrics of Vikas Ecotech Ltd Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹520 Cr. |

| Return on Equity (ROE) | 2.15% |

| Return on Capital Employed (ROCE) | 4.63% |

| Price-to-Earnings (P/E) Ratio | 32.92 |

| Price-to-Book (P/B) Ratio | 0.95 |

| Dividend Yield | 0% |

| Book Value | ₹3.10 |

| Face Value | ₹1 |

| Earnings Per Share (EPS) (TTM) | ₹0.0952 |

| 52-Week High | ₹5.63 |

| 52-Week Low | ₹2.91 |

Shareholding Pattern

| Shareholder Type | Percentage |

|---|---|

| Retail & Other | 89.33% |

| Promoters | 10.65% |

| Foreign Institutions | 0.02% |

| Mutual Funds | 0.00% |

| Other Domestic Institutions | 0.00% |

Vikas Ecotech Share Price Chart of Last 5 Years

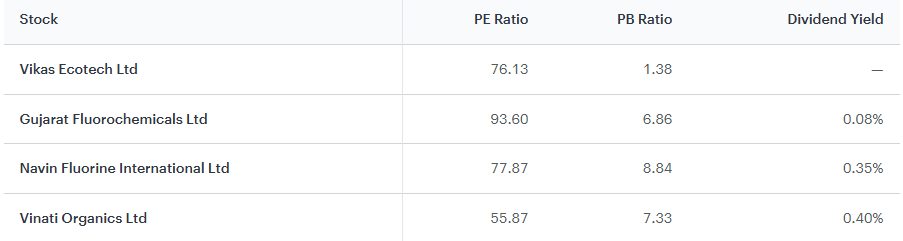

Peers & Comparison

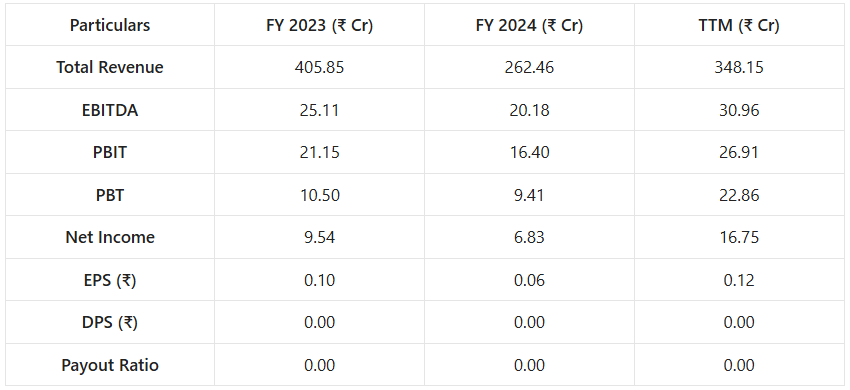

Income Statement

Note: All figures are in ₹ Crores, except for EPS and DPS, which are in ₹.

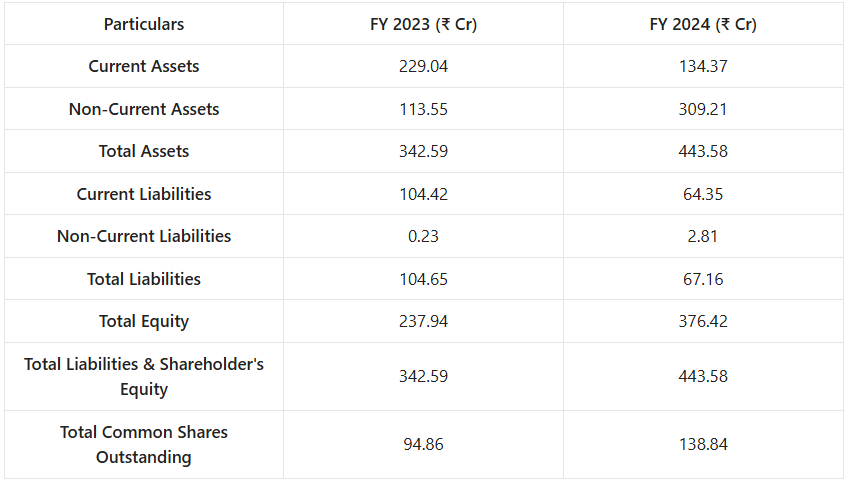

Balance Sheet

Note: All figures are in ₹ Crores. Shares outstanding are in Crores.

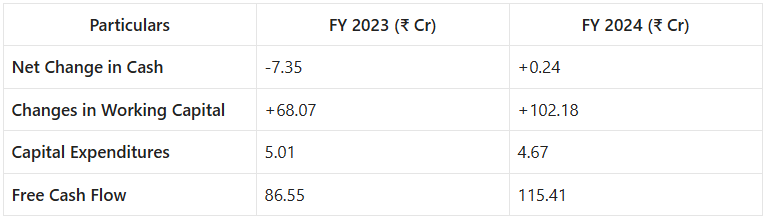

Cash Flow Statement

Note: All figures are in ₹ Crores.

Fundamental Analysis

1. Company Overview

Vikas Ecotech Ltd. specializes in the development and manufacturing of specialty chemicals and eco-friendly additives. Its product portfolio caters to diverse industries, including electronics, agriculture, construction, and packaging. The company’s commitment to sustainability and innovation has positioned it as a key player in the green technology sector.

2. Financial Health

Debt Analysis: The company maintains a conservative approach to debt, with a debt-to-equity ratio of approximately 5.1%, indicating a low reliance on external borrowings.

Cash Flow: Vikas Ecotech has demonstrated robust cash flow management, with a current ratio of 2.19, reflecting its ability to meet short-term obligations.

Liquidity: The company’s liquidity position is healthy, supported by a current ratio exceeding 2, ensuring sufficient short-term assets to cover liabilities.

3. Competitive Analysis

Operating in a competitive landscape, Vikas Ecotech differentiates itself through its focus on eco-friendly additives and specialty chemicals. This strategic emphasis aligns with global sustainability trends, providing a competitive edge in attracting environmentally conscious clients.

4. Growth Prospects

Market Trends: The increasing global demand for sustainable and green products presents significant growth opportunities for Vikas Ecotech. The company’s focus on lead-free additives positions it well across sectors like healthcare and agriculture, driving potential stock value appreciation.

Strategic Initiatives: Vikas Ecotech’s commitment to research and development in green technologies is expected to attract more investors, elevating the stock price. Expansion into global markets and the development of new partnerships are anticipated to enhance its market position and revenue streams.

5. Dividend Policy

The company currently does not offer a dividend, opting to reinvest profits to fuel growth and expansion. This strategy aligns with its focus on innovation and market development.

6. ESG (Environmental, Social, and Governance) Factors

Vikas Ecotech’s dedication to environmental sustainability is evident in its product offerings, which emphasize eco-friendly additives. The company’s governance practices and social responsibility initiatives further bolster its reputation as a responsible corporate entity.

Key Factors Impacting Vikas Ecotech Share Price

- Financial Performance: Earnings growth, revenue stability, and profitability metrics directly affect investor sentiment and stock valuation. Notably, the company’s earnings per share (EPS) has been impacted by a 37% increase in the number of shares outstanding over the past year, leading to a smaller portion of profit per share.

- Market Trends: The global demand for eco-friendly products and sustainable solutions can drive growth in the specialty chemicals sector, benefiting companies like Vikas Ecotech. The company’s focus on lead-free additives positions it well across sectors like healthcare and agriculture.

- Strategic Initiatives: Investments in research and development, expansion into new markets, and strategic partnerships can enhance the company’s competitive edge and growth prospects. The company’s emphasis on R&D in green technologies is expected to attract more investors, elevating the stock price.

- Regulatory Environment: Changes in environmental regulations and policies can impact the demand for eco-friendly additives and chemicals, influencing the company’s operations and profitability.

- Investor Sentiment: Market perceptions, influenced by news, analyst reports, and broader economic conditions can lead to fluctuations in the stock price.

Vikas Ecotech Share Price Target 2025 to 2030: Detailed Yearly Analysis

Vikas Ecotech Share Price Target 2025:

₹3.00– ₹5.00

In 2025, Vikas Ecotech’s share price is projected to range between ₹3.00– ₹5.00. This anticipated growth is attributed to the company’s strategic focus on research and development in green technologies, which is expected to attract more investors and elevate the stock price. Additionally, expansion into global markets is anticipated to further enhance revenues.

Vikas Ecotech Share Price Target 2026:

₹5.00 – ₹7.50

By 2026, the share price is projected to reach between ₹5.00 – ₹7.50. This growth is expected to be driven by the company’s ability to scale up production and meet increasing demand, particularly in response to stricter environmental regulations. Continued innovation in specialty chemicals and broadened revenue streams are also anticipated to elevate the stock price.

Vikas Ecotech Share Price Target 2027:

₹8.00– ₹10.50

In 2027, the stock price is anticipated to rise to between ₹8.00– ₹10.50 . This growth is supported by technological advancements, sustainable practices, and market leadership. Adopting advanced technologies to improve product quality and operational processes, along with a commitment to environmental sustainability, is expected to attract eco-conscious consumers and establish the company as a leader in key industry segments.

Vikas Ecotech Share Price Target 2028:

₹10.00 – ₹13.50

By 2028, the share price is expected to reach between ₹10.00 – ₹13.50. Global expansion, continuous investment in research and development, and a focus on customer satisfaction are key drivers. Entering international markets is expected to diversify revenue streams, while ongoing R&D investments will ensure the company stays ahead of industry trends. Delivering high-quality products and services is anticipated to foster customer loyalty and attract new clients.

Vikas Ecotech Share Price Target 2029:

₹14.50– ₹18.00

In 2029, the stock price is projected to range between ₹14.50– ₹18.00. Enhanced market positioning, increased profitability, and technological integration are anticipated to drive this growth. Strengthening its presence in key industry sectors, optimizing operations to improve earnings, and implementing digital transformation strategies are expected to enhance efficiency and customer engagement.

Vikas Ecotech Share Price Target 2030:

₹18.00 – ₹22.00

Looking ahead to 2030, the share price could reach between ₹18.00 – ₹22.00. Sustainable growth strategies, global partnerships, and consistent revenue growth are expected to be key drivers. Expanding into eco-friendly and innovative product lines, collaborating with international businesses to scale operations, and maintaining strong financial performance through diversified investments are anticipated to position the company for long-term success.

Summary of Vikas Ecotech Share Price Target 2025 to 2030

| Year | Target Price (₹) |

|---|---|

| 2025 | ₹3.00– ₹5.00 |

| 2026 | ₹5.00 – ₹7.50 |

| 2027 | ₹8.00– ₹10.50 |

| 2028 | ₹10.00 – ₹13.50 |

| 2029 | ₹14.50– ₹18.00 |

| 2030 | ₹18.00 – ₹22.00 |

Conclusion

Vikas Ecotech Ltd. is poised for significant growth, with analysts projecting substantial increases in share price over the next five years. These projections are based on the company’s strategic initiatives, market trends, and financial performance. Investors should consider these targets alongside the company’s fundamentals and market conditions when making investment decisions.

Frequently Asked Questions (FAQs) about Vikas Ecotech Share Price Target 2025 to 2030

- What is the current Vikas Ecotech Share Price? As of February 7, 2025, the share price of Vikas Ecotech Ltd. stands at ₹2.94.

- What are the company’s core products and industries served? Vikas Ecotech Ltd. specializes in the development and manufacturing of specialty chemicals and eco-friendly additives. These products cater to diverse industries, including electronics, agriculture, construction, and packaging. The company’s emphasis on green technologies and sustainable solutions makes it a key player in the eco-friendly sector.

- What are the company’s future expansion plans? Vikas Ecotech Ltd. is focusing on global market expansion and increasing its presence in the international markets. The company is also heavily investing in research and development (R&D) of new products, particularly in sustainable and eco-friendly solutions, to broaden its revenue streams and market share.

- What is the company’s approach to debt and liquidity? Vikas Ecotech Ltd. maintains a conservative approach to debt, with a debt-to-equity ratio of approximately 5.1%, indicating low reliance on external borrowings. The company has demonstrated robust cash flow management, with a current ratio of 2.19, reflecting its ability to meet short-term obligations.

- How does Vikas Ecotech Share Price differentiate itself in the market? The company differentiates itself through its focus on eco-friendly additives and specialty chemicals, aligning with global sustainability trends and providing a competitive edge in attracting environmentally conscious clients.

- What are the growth prospects for Vikas Ecotech Share Price? The increasing global demand for sustainable and green products presents significant growth opportunities. The company’s focus on lead-free additives positions it well across sectors like healthcare and agriculture, driving potential stock value appreciation. Strategic initiatives, including investments in research and development and expansion into global markets, are anticipated to enhance its market position and revenue streams.

- What is the company’s dividend policy? Vikas Ecotech Ltd. currently does not offer a dividend, opting to reinvest profits to fuel growth and expansion. This strategy aligns with its focus on innovation and market development.

- How does Vikas Ecotech Ltd. address Environmental, Social, and Governance (ESG) factors?The company is dedicated to environmental sustainability, evident in its product offerings that emphasize eco-friendly additives. Its governance practices and social responsibility initiatives further bolster its reputation as a responsible corporate entity.

- What factors are expected to impact Vikas Ecotech Share Price ? Key factors include financial performance, market trends, strategic initiatives, regulatory environment, and investor sentiment. Earnings growth, revenue stability, and profitability metrics directly affect investor sentiment and stock valuation. The global demand for eco-friendly products and sustainable solutions can drive growth in the specialty chemicals sector, benefiting companies like Vikas Ecotech.

- How does the regulatory environment impact Vikas Ecotech Share Price? Changes in environmental regulations and policies are crucial for Vikas Ecotech Ltd. as they can directly influence the demand for its eco-friendly additives and chemicals. Stricter environmental regulations may create a favorable market for the company’s sustainable products, while regulatory changes could also bring challenges that need to be addressed to maintain profitability. The company keeps a close eye on global regulations and adapts its business strategies accordingly

1 thought on “Vikas Ecotech Share Price Target 2025 to 2030”