Tata Chemicals Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

Tata Chemicals operates as a diversified chemical company with interests spanning basic chemistry, specialty chemicals, and consumer products. Its broad product portfolio includes soda ash, sodium bicarbonate, and other industrial chemicals, catering to industries like glass, detergents, and pharmaceuticals. The company also focuses on innovations in green chemistry, leveraging its R&D capabilities to develop sustainable and efficient solutions.

Key Metrics of the Tata Chemicals Share

| Metric | Value |

|---|---|

| Market Capitalization Value | ₹27,052 crores |

| Total Revenue | ₹7,218 crores |

| Total Share Capital | ₹15,992 crores |

| Total Assets | ₹19,077 crores |

| Total Debt | ₹6,083 crores |

| PE Ratio | 24.14 % |

| Dividend Yield Ratio | 1.80 % |

| ROE | 6.42 % |

| ROCE | 7.81% |

| ROIC | 2.39 % |

| Debt to Equity Ratio | 0.53 % |

| Interest Coverage Ratio | 49.65% |

Shareholder Pattern

| Category | Percentage |

| Promoters | 38% |

| FII | 13.8% |

| DII | 19.9% |

| Public | 28.3% |

Tata Chemicals Share Price Chart of Last 5 years

Fundamental Analysis

1. Company Overview

Tata Chemicals, part of the Tata Group, is a key player in the global chemical industry. With a heritage of excellence, the company has established itself as a trusted supplier of high-quality chemicals and innovative solutions. Its global presence and focus on sustainability ensure a competitive edge.

2. Financial Health

Debt Analysis

The debt-to-equity ratio of 0.53 indicates a balanced approach to leveraging. With an interest coverage ratio of 49.65, Tata Chemicals demonstrates strong capability to meet its debt obligations.

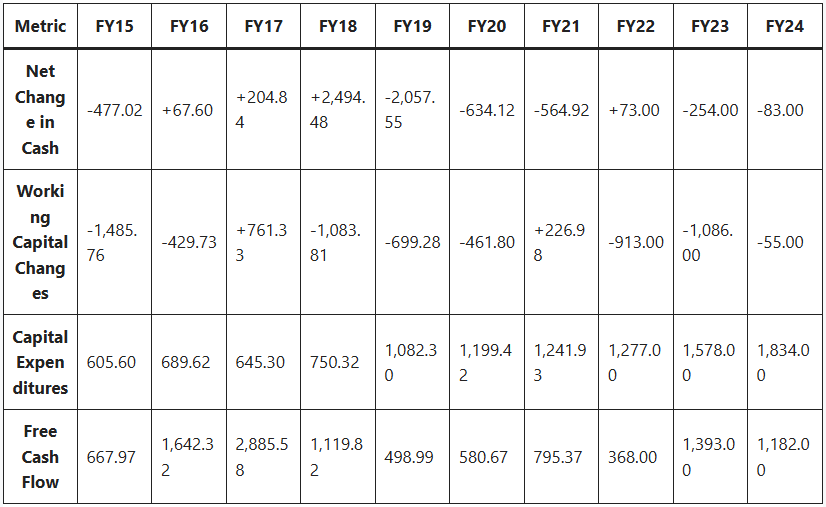

Cash Flow

The company’s operating cash flow remains robust, driven by efficient working capital management and consistent revenue streams. Investments in growth initiatives have been strategically aligned with cash flow generation.

Liquidity

Tata Chemicals maintains a healthy liquidity position, ensuring resilience against market volatilities and enabling timely fulfillment of financial commitments.

3. Competitive Analysis

Tata Chemicals competes with global and domestic players, including GHCL, Nirma, and Solvay. Its focus on innovation, sustainability, and cost leadership positions it well in the competitive landscape.

4. Growth Prospects

Market Trends

The increasing demand for sustainable and specialty chemicals presents significant growth opportunities. Tata Chemicals’ focus on green chemistry aligns with these trends, offering a competitive advantage.

Strategic Initiatives

The company’s strategic initiatives include capacity expansion, diversification into high-margin specialty chemicals, and investments in innovation. These efforts are expected to drive long-term growth.

5. Dividend Policy

Tata Chemicals has a consistent dividend payout history, reflecting its commitment to rewarding shareholders. The dividend yield ratio of 1.80% underscores its focus on shareholder value.

6. ESG (Environmental, Social, and Governance) Factors

Tata Chemicals’ strong ESG practices enhance its reputation and attractiveness to socially responsible investors. The company’s initiatives include reducing its carbon footprint, enhancing employee welfare, and maintaining transparent governance.

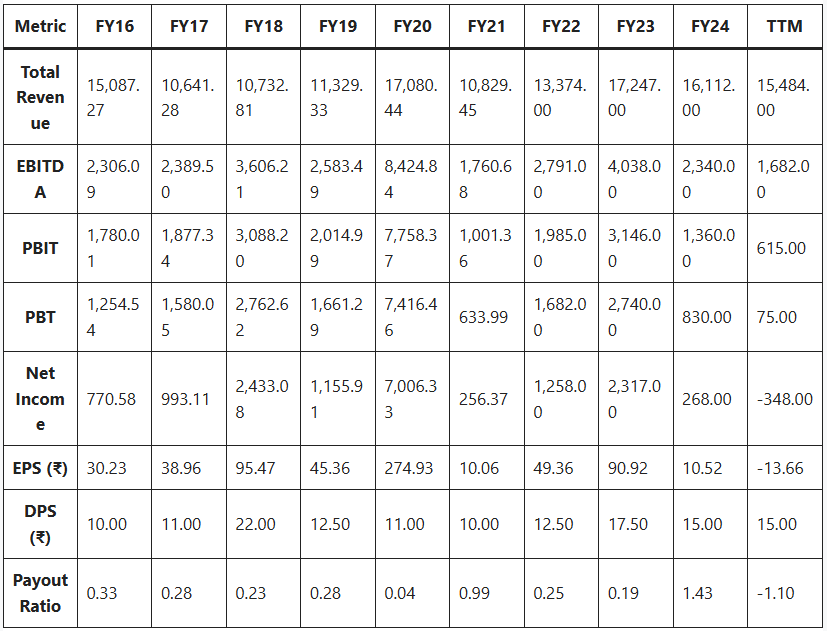

Income Statement

Industry Analysis

- Revenue Growth: Over the last 5 years, revenue grew at an annual rate of 7.3%, compared to the industry average of 9.82%, indicating a slower increase in market share.

- Market Share: Decreased from 19.79% to 14.76% over the last 5 years, reflecting reduced competitiveness within the industry.

- Net Income Growth: Declined at a yearly rate of -25.35%, significantly underperforming the industry average of 2.37%.

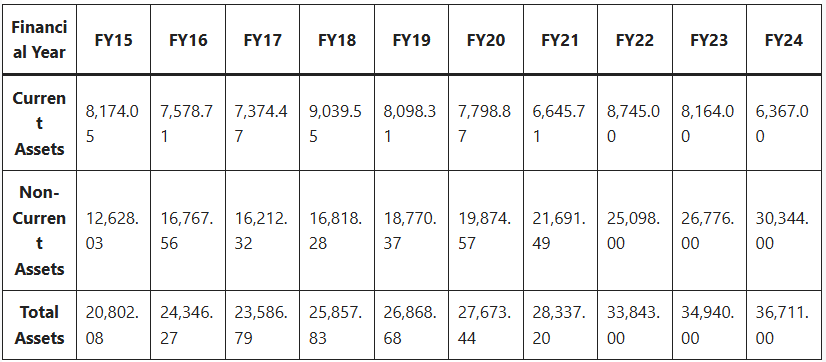

Notes: Other numbers except Payout Ratio are in ₹ crore (cr). Balance Sheet Analysis

EPS (Earnings Per Share) and DPS (Dividend Per Share) are measured in ₹.

Industry Context:

The company operates in a sub-sector where financial stability and liquidity ratios are critical indicators of performance.

- Debt-to-Equity Ratio: Over the last five years, the company’s debt-to-equity ratio averaged 38.68%, which is better than the industry average of 48.42%, indicating a more conservative approach to leveraging debt.

- Current Ratio: The company’s current ratio averaged 130.96%, slightly below the industry average of 140.5%, suggesting room for improvement in managing short-term liquidity.

Financial Performance (₹ Cr)

Assets

Cash Flow Statement (₹ Cr)

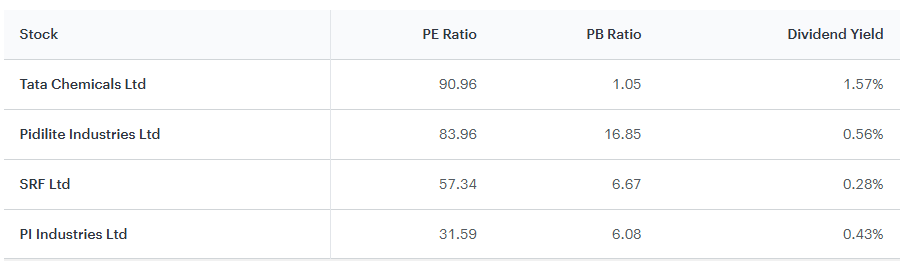

Peers & Comparison

Key Factors Impacting Tata Chemicals Share Price

Financial Performance

The financial performance of Tata Chemicals plays a critical role in determining its share price. Key aspects include:

- Revenue Growth: Consistent revenue growth indicates robust demand for the company’s products and services. Tata Chemicals’ ability to grow its revenue base through market expansion and product diversification is a positive indicator for investors.

- Profitability: Profit margins, including gross and net margins, are crucial for shareholder returns. Effective cost management and operational efficiency contribute to improved profitability, enhancing investor confidence.

- Efficient Debt Management: A low debt-to-equity ratio and strong interest coverage ratio indicate effective leverage utilization. Tata Chemicals’ prudent debt management ensures financial stability while enabling growth investments.

Market Trends

Evolving market dynamics heavily influence Tata Chemicals’ share price. Key trends include:

- Increasing Demand for Specialty Chemicals: As industries shift towards high-value specialty chemicals, Tata Chemicals’ investments in this segment provide a competitive edge. Specialty chemicals offer higher margins and sustainable growth opportunities.

- Focus on Sustainable Solutions: The global transition towards sustainable practices drives demand for eco-friendly products. Tata Chemicals’ commitment to green chemistry aligns with these trends, enhancing its market position.

- Consumer Preferences: Changes in consumer behavior, such as a preference for environmentally friendly products, are also shaping demand patterns and influencing the company’s growth trajectory.

Regulatory Environment

Government policies and regulations significantly impact the chemical industry. For Tata Chemicals, key regulatory factors include:

- Promotion of Green Chemistry: Policies incentivizing sustainable practices and reducing environmental impact create growth opportunities. Tata Chemicals’ adherence to these norms positions it favorably in the regulatory landscape.

- Environmental Compliance: Stricter environmental regulations require investments in cleaner technologies, which can affect short-term profitability but strengthen long-term sustainability.

- Trade Policies: Tariffs, export/import restrictions, and international agreements influence the company’s global operations and profitability.

Global Economic Conditions

External economic factors have a direct impact on Tata Chemicals’ share price. Key considerations include:

- Inflation: Rising input costs due to inflation can compress margins, affecting profitability. Effective pricing strategies help mitigate these challenges.

- Currency Fluctuations: As a global company, exchange rate volatility impacts Tata Chemicals’ revenues and costs. Strategies like hedging help manage currency risks.

- Geopolitical Factors: Political stability, trade relations, and global supply chain dynamics influence operations and investor sentiment.

Innovation and Diversification

Tata Chemicals’ emphasis on innovation and diversification is a cornerstone of its growth strategy. Key aspects include:

- Investments in R&D: The company’s research initiatives focus on developing advanced, sustainable chemical solutions. Breakthroughs in specialty chemicals and green technologies contribute to competitive advantage.

- Entry into New Markets: Geographic expansion and diversification into emerging markets provide growth opportunities while mitigating risks associated with market saturation.

- Product Portfolio Expansion: By introducing innovative products tailored to market needs, Tata Chemicals strengthens its market presence and drives revenue growth.

Tata Chemicals Share Price Target 2025 to 2030

Tata Chemicals Share Price Target 2025

Considering Tata Chemicals’ strong financial fundamentals, ongoing growth initiatives, and the market’s increasing demand for specialty chemicals, the share price target for 2025 is projected to be in the range of ₹1,200 to ₹1,300. Factors contributing to this growth include robust revenue generation, effective debt management, and the company’s strategic focus on sustainability. Additionally, the alignment with global green chemistry trends and investments in R&D are likely to enhance shareholder confidence.

Tata Chemicals Share Price Target 2026

In 2026, Tata Chemicals is expected to further benefit from its market expansion and innovation-focused strategies. The company’s entry into high-margin specialty chemicals and its commitment to operational efficiency will likely yield significant returns. As a result, the share price target for 2026 is anticipated to reach ₹1,400 to ₹1,500. The continued adoption of sustainable practices and favorable market conditions will play a pivotal role in driving this growth.

Tata Chemicals Share Price Target 2027

By 2027, the cumulative impact of Tata Chemicals’ strategic initiatives, including diversification into new markets and an expanded product portfolio, is expected to materialize. The target share price for this year is estimated to be around ₹1,600 to ₹1,700. This growth projection also factors in increasing global demand for eco-friendly and innovative chemical solutions, alongside the company’s improved operational efficiencies.

Tata Chemicals Share Price Target 2028

Tata Chemicals’ focus on sustainability, combined with its strategic investments in R&D and capacity expansion, is likely to drive further growth by 2028. The share price target for this year is forecasted to be in the range of ₹1,800 to ₹1,900. Enhanced global market presence and a strong emphasis on environmental, social, and governance (ESG) factors will further solidify the company’s position as a leader in the industry.

Tata Chemicals Share Price Target 2029

As Tata Chemicals continues to capitalize on its market leadership and strategic positioning, the share price for 2029 is expected to reach ₹2,000 to ₹2,100. The company’s ability to navigate global economic conditions, maintain profitability, and leverage its innovation pipeline will be crucial in sustaining this growth trajectory.

Tata Chemicals Share Price Target 2030

By 2030, Tata Chemicals is poised to achieve significant milestones in revenue, profitability, and market presence. The sustained performance driven by its innovative solutions, strategic market expansions, and commitment to sustainability positions the share price target at ₹2,200 to ₹2,400. The alignment with global trends and continuous delivery of shareholder value make Tata Chemicals a compelling investment choice for the long term.

Summary of Tata Chemicals Share Price Target 2025 to 2030

| Year | Share Price Target (₹) |

|---|---|

| 2025 | 1,200 – 1,300 |

| 2026 | 1,400 – 1,500 |

| 2027 | 1,600 – 1,700 |

| 2028 | 1,800 – 1,900 |

| 2029 | 2,000 – 2,100 |

| 2030 | 2,200 – 2,400 |

Conclusion

Tata Chemicals is poised for sustained growth in the coming decade, leveraging its diversified portfolio, robust financial position, and commitment to innovation. The company’s focus on specialty chemicals, green technologies, and circular economy principles ensures alignment with global sustainability trends. Strategic initiatives such as capacity expansion, entry into high-growth markets, and investments in R&D further strengthen its competitive edge. Despite potential short-term challenges like market volatility or regulatory shifts, Tata Chemicals’ resilience and adaptability position it well to capitalize on emerging opportunities. Its proven track record of value creation, backed by a skilled workforce and visionary leadership, makes it an attractive long-term investment for stakeholders seeking consistent returns.

Frequently Asked Questions (FAQs)

1. What is the projected Tata Chemicals Share Price Target 2025 ?

The projected share price target for Tata Chemicals in 2025 is in the range of ₹1,200 to ₹1,300. This forecast is based on the company’s strong financial performance, increasing demand for specialty chemicals, and strategic focus on sustainability and innovation.

2. How does Tata Chemicals’ business model support its growth?

Tata Chemicals operates a diversified business model spanning basic chemistry, specialty chemicals, and consumer products. Its focus on sustainable solutions and innovations in green chemistry ensures a competitive edge in the global market.

3. What are the key financial metrics influencing Tata Chemicals’ share price?

Key financial metrics include a debt-to-equity ratio of 0.53, an interest coverage ratio of 49.65, and a return on equity (ROE) of 6.42%. These metrics highlight the company’s financial stability and growth potential.

4. What market trends are driving Tata Chemicals Share Price growth?

Market trends include the rising demand for sustainable and specialty chemicals, shifting consumer preferences towards eco-friendly products, and global emphasis on green chemistry. Tata Chemicals’ alignment with these trends positions it for sustained growth.

5. What is the expected Tata Chemicals Share Price Target 2030?

By 2030, the share price of Tata Chemicals is expected to reach ₹2,200 to ₹2,400, driven by its sustained performance, strategic market expansion, and focus on innovation and sustainability.

6. How does Tata Chemicals maintain its competitive edge?

Tata Chemicals maintains its edge through investments in R&D, diversification into high-margin specialty chemicals, and a strong emphasis on sustainability and ESG (Environmental, Social, and Governance) practices.

7. What role does sustainability play in Tata Chemicals’ strategy?

Sustainability is central to Tata Chemicals’ strategy, with initiatives focused on reducing its carbon footprint, developing eco-friendly products, and adhering to strict environmental compliance norms. These efforts enhance the company’s market position and investor appeal.

8. What is the dividend policy of Tata Chemicals?

Tata Chemicals has a consistent dividend payout history, reflecting its commitment to rewarding shareholders. The current dividend yield ratio is 1.80%, signaling a balanced approach to growth and shareholder returns.

9. What factors could impact Tata Chemicals’ share price in the future?

Factors include global economic conditions, regulatory changes, inflation, currency fluctuations, and geopolitical dynamics. Effective management of these variables will be crucial for maintaining growth.

10. Is Tata Chemicals a good long-term investment?

Yes, Tata Chemicals is considered a solid long-term investment due to its robust financial health, strategic initiatives, focus on innovation, and alignment with global sustainability trends. The projected growth trajectory from 2025 to 2030 underscores its potential for consistent value creation.

1 thought on “Tata Chemicals Share Price Target 2025 to 2030”