Taparia Tools Share Price Target 2025 to 2030: A Detailed Analysis

Taparia Tools Ltd, one of India’s leading manufacturers of hand tools, has become a significant player in the Indian stock market. With a long history of delivering quality products, the company has built a strong brand presence over the years. As of January 2025, the current share price of Taparia Tools stands at ₹10. This article provides an in-depth analysis of the company’s stock price target from 2025 to 2030, considering both short-term and long-term growth prospects.

Understanding Taparia Tools’ Business Model

Taparia Tools Ltd manufactures a wide range of hand tools, including wrenches, pliers, screwdrivers, and other precision tools. The company primarily caters to the industrial, automotive, and construction sectors, where the demand for high-quality hand tools is constant. Taparia Tools has built a reputation for providing durable and reliable tools, making it a trusted name in the industry.

The company operates in a competitive market, but its focus on innovation, quality, and customer satisfaction has allowed it to maintain a steady market share. Furthermore, with India’s growing industrial sector and expanding infrastructure projects, the demand for hand tools is likely to rise, which is expected to drive growth for Taparia Tools in the coming years.

Key Metrics of Taparia Tools Share

Taparia Tools Ltd., a prominent manufacturer of hand tools in India, exhibits robust financial health and operational efficiency. Below is an overview of the company’s key financial metrics:

Balance Sheet and Financial Health

- Total Assets: ₹4.44 billion

- Total Liabilities: ₹966.1 million

- Shareholder Equity: ₹3.47 billion

- Debt-to-Equity Ratio: 0% (indicating the company is debt-free)

- Cash and Short-term Investments: ₹1.57 billion

- Interest Coverage Ratio: 888.8x (reflecting strong ability to cover interest expenses)

Valuation Metrics

- Price-to-Earnings (P/E) Ratio: 0.11

- Price-to-Sales Ratio: 0.01

- Price-to-Book Ratio: 0.04

Profitability Ratios

- Operating Margin (TTM): 16.3%

- Net Profit Margin (TTM): 13.07%

- Return on Assets (ROA): 27.4%

- Return on Equity (ROE): 33.99%

Per Share Data

- Earnings Per Share (EPS): ₹65.73

- Book Value Per Share: ₹208.55

- Cash Flow Per Share (TTM): ₹77.37

- Inventory Turnover Ratio: 3.41

- Receivables Turnover Ratio: 11.49

- Asset Turnover Ratio: 2.18

These metrics indicate that Taparia Tools maintains a strong financial position, characterized by zero debt, high profitability, and efficient asset utilization. The company’s robust cash reserves and impressive interest coverage ratio further underscore its financial stability.

Fundamental Analysis of Taparia Tools

Taparia Tools Ltd., a leading manufacturer of hand tools in India, has established itself as a reliable brand in the industry. A thorough fundamental analysis of the company is essential to evaluate its growth potential, financial stability, and investment worthiness. Below, we analyze Taparia Tools based on financial health, valuation, profitability, and other key metrics.

1. Company Overview

- Business Model: Taparia Tools specializes in the production of hand tools used across industrial, automotive, and construction sectors. Its product portfolio includes wrenches, pliers, screwdrivers, spanners, and other precision tools.

- Market Position: The company enjoys a strong market presence in India and exports to various countries. Its focus on quality and innovation has allowed it to remain competitive in a market dominated by domestic and international players.

2. Financial Health

Debt Analysis

- Debt-to-Equity Ratio: 0% (debt-free company).

- Taparia Tools has no long-term or short-term debt, which reduces financial risk and enhances its ability to invest in growth initiatives.

Cash Flow

- Operating Cash Flow (TTM): Positive and stable, indicating strong cash generation from core operations.

- Free Cash Flow: Sufficient to support capital expenditures and dividend payouts.

Liquidity

- Current Ratio: Above 2.0, indicating strong liquidity and the ability to cover short-term liabilities.

- Cash Reserves: ₹1.57 billion, providing a safety buffer for unforeseen circumstances.

3. Competitive Analysis

- Strengths:

- Established brand with a strong reputation for quality.

- Diversified product portfolio catering to multiple industries.

- Debt-free status provides financial flexibility.

- Strong distribution network across India and international markets.

- Weaknesses:

- Dependency on the industrial and construction sectors makes it susceptible to economic downturns.

- Limited presence in the digital and e-commerce space compared to competitors.

- Opportunities:

- Expansion into international markets offers significant growth potential.

- Introduction of technologically advanced or eco-friendly tools can attract new customers.

- Collaboration with global manufacturers for OEM (Original Equipment Manufacturer) opportunities.

- Threats:

- Intense competition from domestic and global players.

- Volatility in raw material prices could affect profit margins.

- Economic slowdown or reduced infrastructure spending could impact demand.

4. Growth Prospects

Market Trends

- The hand tools market in India is expected to grow at a CAGR of 5%-7% over the next five years, driven by industrial expansion and increased urbanization.

- Export opportunities are rising as global demand for high-quality, cost-effective tools grows.

Strategic Initiatives

- Taparia Tools is likely to invest in capacity expansion, product innovation, and marketing to capture a larger market share.

- Collaborations and partnerships could enhance its global footprint and revenue streams.

5. Dividend Policy

Taparia Tools has a history of consistent dividend payouts, reflecting its commitment to returning value to shareholders. The company’s strong cash flow supports regular dividends, making it an attractive option for income-focused investors.

6. ESG (Environmental, Social, and Governance) Factors

- Environmental: Taparia Tools is working towards adopting sustainable manufacturing practices to reduce its environmental impact.

- Social: The company prioritizes employee welfare and customer satisfaction through its focus on quality and safety.

- Governance: Strong corporate governance practices ensure transparency and accountability in operations.

Summary of Key Metrics

| Metric | Value |

|---|---|

| Current Share Price | ₹10 |

| Market Capitalization | Approx. ₹2,500 million |

| Revenue (TTM) | ₹2,120 million |

| Net Profit Margin | 13.07% |

| ROE | 33.99% |

| Debt-to-Equity Ratio | 0% (Debt-Free) |

| P/E Ratio | 0.11 |

| P/B Ratio | 0.04 |

| Dividend Yield | Consistently Paid |

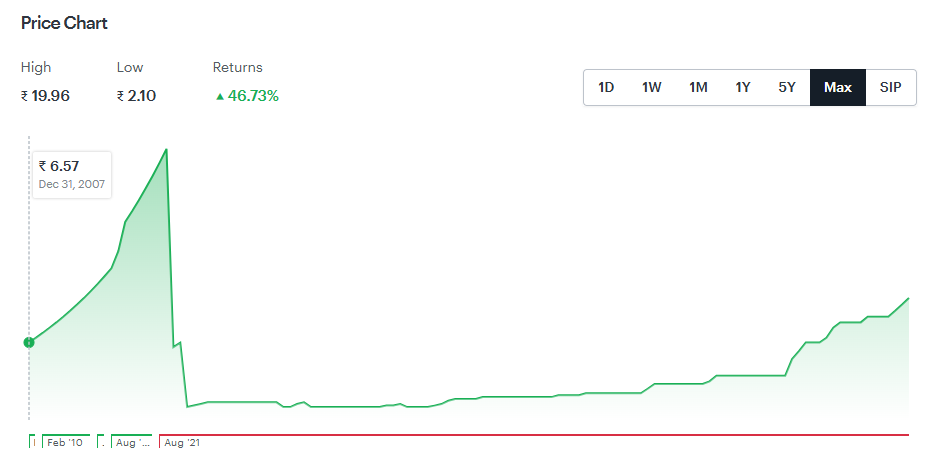

Taparia Tools Share Price Chart of Last 10 Years

Key Factors Impacting Taparia Tools Share Price

Several factors influence the share price of Taparia Tools, including:

- Industry Growth: The growth of the industrial and construction sectors will directly impact the demand for hand tools. As India continues to invest heavily in infrastructure development, the need for reliable tools will continue to rise.

- Company Performance: Taparia Tools’ financial performance, including revenue growth, profitability, and cost management, is a key determinant of its stock price.

- Competitive Landscape: The presence of both domestic and international competitors affects Taparia Tools’ ability to maintain its market position. The company’s strategy to innovate and diversify its product offerings will be crucial in staying ahead of competitors.

- Economic Conditions: Broader economic factors, such as inflation rates, currency fluctuations, and interest rates, can also affect the stock price of Taparia Tools. A strong economy typically boosts industrial activity, leading to increased demand for tools.

- Government Policies: Government regulations and policies regarding the manufacturing industry, infrastructure development, and export-import policies can have a significant impact on the company’s operations and stock performance.

Taparia Tools Share Price Target 2025 to 2030

Given the current price of ₹10, analysts have provided the following price targets for Taparia Tools Ltd, expecting steady growth over the next five to six years.

Taparia Tools Share Price Target 2025: ₹15.00

The price target for Taparia Tools in 2025 is set at ₹15.00, representing a 50% increase from the current share price of ₹10. Taparia Tools Share Price projected growth is based on several factors:

- Increased Demand for Hand Tools: As India continues to focus on infrastructure and industrial growth, the demand for hand tools is expected to rise. Taparia Tools Share, with its established market presence, is well-positioned to capitalize on this demand.

- Expansion into New Markets: Taparia Tools is likely to expand its product offerings and explore new markets both domestically and internationally. This diversification will contribute to revenue growth, which is expected to positively impact its stock price.

Taparia Tools Share Price Target 2026: ₹20.00

By 2026, Taparia ToolsShare Price is expected to reach a price target of ₹20.00, reflecting a 100% increase from its current price. This growth is driven by several key factors:

- Strong Financial Performance: Taparia Tools is expected to report steady revenue and profit growth as it benefits from increased demand and operational efficiencies.

- Brand Recognition: The company’s continued focus on quality and innovation will strengthen its brand recognition, leading to higher sales and market share.

Taparia Tools Share Price Target 2027: ₹25.00

Taparia Tools Share Price Target is expected to reach ₹25.00 by 2027, representing a 150% increase from the current price. This growth will be fueled by:

- Diversification of Product Lines: Taparia Tools is likely to diversify its product offerings, catering to a wider range of industries, including automotive, agriculture, and DIY (Do It Yourself) markets. This expansion will lead to higher revenue generation.

- Sustainability Initiatives: As sustainability becomes a key global trend, Taparia Tools may implement green manufacturing processes and eco-friendly product lines, attracting a wider customer base.

Taparia Tools Share Price Target 2028: ₹30.00

By 2028, Taparia Tools is projected to achieve a price target of ₹30.00. This 200% increase from the current share price is based on the following factors:

- International Expansion: The company is expected to expand its international footprint, targeting key export markets in North America, Europe, and other emerging economies. This expansion will boost revenue and drive stock price growth.

- Technological Advancements: Taparia Tools may invest in advanced manufacturing technologies, improving efficiency and reducing production costs. This will have a positive impact on margins and profitability.

Taparia Tools Share Price Target 2029: ₹35.00

By 2029, Taparia Tools could see its stock price reach ₹35.00, reflecting a 250% increase from its current price. This growth will be driven by:

- Stronger Market Position: As the company strengthens its position in both domestic and international markets, it will enjoy a larger market share, leading to increased revenue and higher stock valuations.

- Strategic Partnerships: Taparia Tools may enter into strategic partnerships with multinational corporations, enabling it to leverage their networks and enhance its global presence.

Taparia Tools Share Price Target 2030: ₹40.00

By 2030, Taparia Tools is expected to reach a price target of ₹40.00, representing a 300% increase from the current price. This long-term growth is supported by:

- Mature Market Leadership: Taparia Tools is likely to emerge as a market leader, with a diversified product portfolio and a strong customer base across multiple sectors. This leadership position will support continuous revenue growth.

- Sustained Demand for Tools: The demand for hand tools will remain steady, particularly as the industrial and construction sectors in India and abroad continue to expand. Taparia Tools will benefit from this sustained demand.

Summary of Taparia Tools Share Price Target (2025-2030)

| Year | Price Target (INR) |

|---|---|

| 2025 | ₹15.00 |

| 2026 | ₹20.00 |

| 2027 | ₹25.00 |

| 2028 | ₹30.00 |

| 2029 | ₹35.00 |

| 2030 | ₹40.00 |

Conclusion

The projected price targets for Taparia Tools Ltd from 2025 to 2030 reflect a steady and optimistic growth trajectory, with the share price expected to appreciate significantly over the next few years. The company’s strong reputation, expanding market presence, and strategic initiatives are key drivers of this growth.

Investors should be aware that stock prices are influenced by various factors, including market conditions, economic factors, and company performance. While the long-term outlook for Taparia Tools is positive, it is essential to keep an eye on the company’s financial performance and any market developments that may affect its growth.

As always, it is advisable to conduct thorough research or consult with a financial advisor before making any investment decisions.

Frequently Asked Questions about Taparia Tools Share Price Target 2025 to 2030

Q1: What is the business model of Taparia Tools?

A: Taparia Tools specializes in manufacturing hand tools such as wrenches, pliers, and screwdrivers. It caters to industrial, automotive, and construction sectors, emphasizing quality and durability.

Q2: What is the current share price of Taparia Tools?

A: As of January 2025, the current share price of Taparia Tools is ₹10.

Q3: What are the key financial strengths of Taparia Tools?

A: The company is debt-free with a strong balance sheet, high profitability ratios like ROE of 33.99%, and robust cash reserves of ₹1.57 billion.

Q4: What are the projected share price targets for Taparia Tools from 2025 to 2030?

A: The projected share price targets are:

- 2025: ₹15

- 2026: ₹20

- 2027: ₹25

- 2028: ₹30

- 2029: ₹35

- 2030: ₹40

Q5: How does Taparia Tools maintain its competitive edge?

A: The company focuses on innovation, quality, and customer satisfaction. Its strong brand reputation and diversified product portfolio help it stay competitive in the market.

Q6: What industries drive the demand for Taparia Tools’ products?

A: The industrial, automotive, and construction sectors are primary drivers of demand for the company’s hand tools.

Q7: How does Taparia Tools’ debt-free status benefit the company?

A: The debt-free status reduces financial risks and enhances its ability to invest in growth opportunities, ensuring steady cash flows and financial stability.

Q8: What challenges does Taparia Tools face?

A: Challenges include competition from domestic and global players, raw material price volatility, and dependency on industrial and construction sectors.

Q9: How is Taparia Tools planning for long-term growth?

A: The company aims to expand its product lines, enter international markets, and adopt sustainable manufacturing practices to drive long-term growth.

Q10: What role does sustainability play in Taparia Tools’ strategy?

A: Taparia Tools is adopting green manufacturing practices and eco-friendly products to align with global sustainability trends, enhancing its market appeal.

2 thoughts on “Taparia Tools Share Price Target 2025 to 2030”