Subex Ltd Share Price Target 2025 to 2030: A Detailed Analysis of Subex Ltd

Introduction

Subex Ltd is a leading provider of digital trust solutions, including fraud management, revenue assurance, and AI-driven analytics for telecom and enterprise businesses. With its continued focus on innovation and technological advancement, investors are keen to understand its future share price trajectory.

This article provides a detailed analysis of Subex Ltd’s share price target from 2025 to 2030, considering market trends, financials, and strategic initiatives.

Key Metrics of Subex Ltd Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹1,534 Cr |

| Face Value | ₹5 |

| Book Value | ₹5.92 |

| PE Ratio | – |

| ROCE | -5.48% |

| ROE | -12.2% |

| Dividend Yield | 0% |

| 52-Week High | ₹45.8 |

| 52-Week Low | ₹22.4 |

Shareholding Pattern

| Category | Percentage |

|---|---|

| Promoters | 0% |

| FIIs | 1.08% |

| DIIs | 0.01% |

| Public | 97.53% |

| Others | 1.78% |

Subex Ltd Share Price Chart of Last 5years

Peers & Comparison

Income Statement

Overview

Industry refers to the sub-sector this company belongs to. A higher-than-industry revenue growth indicates increased potential for the company to expand its market share.

Over the last five years, Subex Ltd’s revenue has declined at a yearly rate of -2.04%, in contrast to the industry average growth rate of 14.27%. This indicates that while the broader industry has been experiencing significant growth, Subex has faced challenges in maintaining its revenue momentum.

Market Share Analysis

Market share represents the percentage of an industry’s total sales that a particular company captures. It provides a perspective on a company’s relative size compared to its competitors.

Over the last five years, Subex Ltd’s market share has decreased from 1.07% to 0.48%, highlighting a loss of competitive positioning within its sector. This decline suggests that the company may need to focus on strategic initiatives such as product innovation, customer acquisition, and operational efficiency to regain market strength.

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

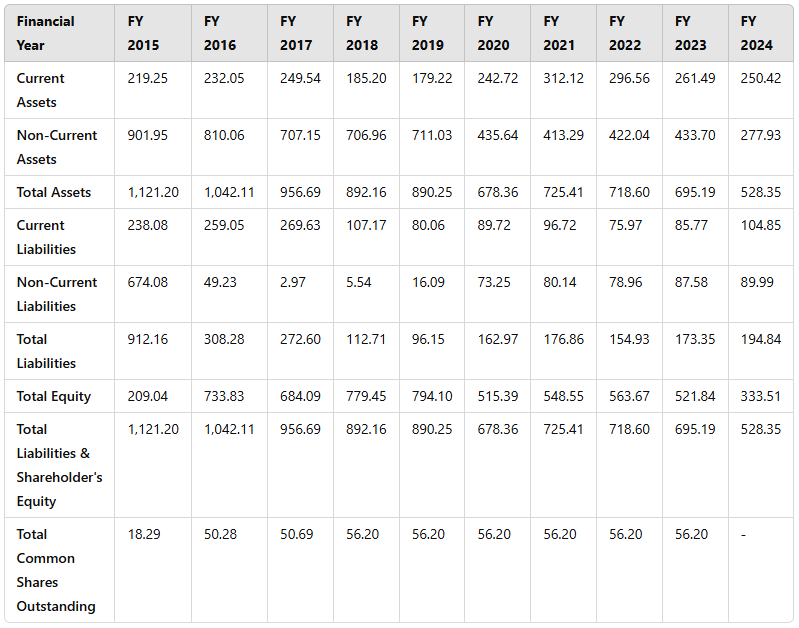

Balance Sheet Analysis

Industry Overview

The industry refers to the sub-sector in which Subex Ltd operates. Analyzing financial metrics in comparison to industry averages provides insights into the company’s financial health and competitiveness.

Debt to Equity Ratio

The Debt to Equity Ratio is a key financial metric that measures a company’s total liabilities relative to its shareholder equity. It indicates the extent to which a company is financing its operations through debt versus wholly owned funds.

- Over the last 5 years, Subex Ltd’s debt-to-equity ratio has averaged 6.32%, compared to the industry average of 13.52%.

- This suggests that Subex has maintained a lower reliance on debt financing than the industry average, which may indicate conservative financial management.

Current Ratio

The Current Ratio measures a company’s ability to meet its short-term obligations using its short-term assets. A higher ratio generally indicates better liquidity and financial stability.

- Over the last 5 years, Subex Ltd’s current ratio has averaged 305.46%, surpassing the industry average of 230.26%.

- This indicates that the company has strong short-term liquidity and is well-positioned to cover its current liabilities without financial strain.

Shares outstanding numbers in cr. Other numbers in ₹ cr

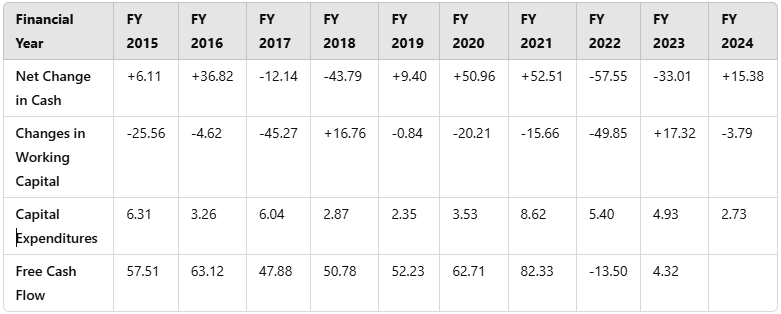

Cash Flow Statement

Fundamental Analysis

- Company Overview : Subex Ltd. is a leading global provider of digital trust solutions, specializing in analytics, artificial intelligence (AI), and Internet of Things (IoT) security. Established in 1992, the company has evolved from offering telecom fraud management solutions to a comprehensive suite of services that address modern digital challenges. Subex’s flagship platform, HyperSense, empowers organizations with augmented analytics capabilities, facilitating data-driven decision-making. The company’s clientele spans across telecommunications, finance, and other sectors, underscoring its versatility and industry relevance.

- Financial Health

- Debt Analysis: Subex has made significant strides in reducing its debt over the years, currently positioning itself as an almost debt-free company. This reduction enhances its financial stability and reduces interest obligations.

- Cash Flow: The company’s net cash flow has seen fluctuations, with figures around₹50 crores in 2020 and 2021, decreasing to approximately₹15 crores in recent years. This decline indicates potential challenges in cash generation, which may impact operational capabilities.

- Liquidity: Subex’s working capital requirements have improved, decreasing from 85.4 days to 58.8 days. This improvement suggests better efficiency in managing short-term assets and liabilities.

- Competitive Analysis : In the realm of digital trust and analytics, Subex faces competition from global entities such as TEOCO, WeDo Technologies, and Amdocs. While these competitors offer similar solutions, Subex differentiates itself through its HyperSense platform, which integrates AI-driven analytics with IoT security. The company’s focus on innovation and adaptability to emerging technologies provides a competitive edge.

- Growth Prospects

- Market Trends: The increasing adoption of AI and IoT across industries presents substantial growth opportunities for Subex. The global emphasis on digital transformation and cybersecurity further accentuates the demand for Subex’s solutions.

- Strategic Initiatives: Subex’s strategic initiatives include expanding its product line and global footprint, with a focus on IoT security and 5G analytics. These efforts are expected to boost sales and position the company for significant share price increases in the coming years.

- Dividend Policy : Currently, Subex does not offer dividends to its shareholders, as indicated by a dividend yield of 0%. The company appears to be reinvesting profits to fuel growth and strengthen its market position.

- ESG (Environmental, Social, and Governance) Factors : While specific ESG disclosures for Subex are limited, the company’s solutions contribute to social and governance aspects by enhancing digital trust and security. Implementing robust ESG practices could further enhance its reputation and appeal to socially conscious investors.

Key Factors Impacting Subex Ltd Share Price

- Technological Advancements: Subex’s ability to innovate and stay ahead in AI and IoT security will significantly influence its market valuation.

- Market Demand: Growing demand for digital trust solutions across sectors can drive revenue growth.

- Financial Performance: Sustained improvement in profitability and cash flow will bolster investor confidence.

- Competitive Landscape: The company’s performance relative to competitors will impact its market share and stock performance.

Subex Ltd Share Price Target 2025 to 2030 : Year by Year Analysis

Subex Ltd Share Price Target 2025

Target 1: ₹29 | Target 2: ₹35

In 2025, Subex Ltd is expected to benefit from increased demand for its AI-driven cybersecurity and fraud detection services. The company’s growing partnerships and customer base in the telecom industry will likely drive revenue growth.

Factors influencing the 2025 target:

- Expansion of AI-driven fraud detection solutions

- Strengthening digital trust platforms

- Positive global market conditions for cybersecurity solutions

Subex Ltd Share Price Target 2026

Target 1: ₹40 | Target 2: ₹55

By 2026, Subex’s growth trajectory is expected to accelerate as 5G adoption expands, increasing demand for advanced network security solutions. The company’s investment in AI analytics and machine learning is anticipated to enhance its service offerings.

Factors influencing the 2026 target:

- Wider adoption of 5G technology

- Increased market penetration in cybersecurity solutions

- Strategic acquisitions and partnerships

Subex Ltd Share Price Target 2027

Target 1: ₹60 | Target 2: ₹82

Subex is likely to witness substantial revenue growth by 2027 as its solutions gain greater market acceptance. AI-powered revenue assurance and fraud management will play a crucial role in telecom operations globally.

Factors influencing the 2027 target:

- Growth in digital trust solutions

- Expansion in international markets

- Stronger brand presence

Subex Ltd Share Price Target 2028

Target 1: ₹79 | Target 2: ₹91

The increasing importance of cybersecurity and the need for predictive analytics in telecom fraud prevention will likely drive Subex’s share price upwards.

Factors influencing the 2028 target:

- Increased demand for AI-powered security solutions

- Improved financial performance

- Consistent client acquisition in telecom and finance sectors

Subex Ltd Share Price Target 2029

Target 1: ₹100 | Target 2: ₹115

By 2029, Subex is expected to be a well-established name in digital trust solutions, with consistent revenue streams and a global presence. The company’s long-term investments will likely yield higher returns.

Factors influencing the 2029 target:

- Higher revenue from AI-powered analytics

- Strong financial stability and profitability

- Improved investor confidence

Subex Ltd Share Price Target 2030

Target 1: ₹125 | Target 2: ₹150

In 2030, Subex Ltd may become a major leader in AI-driven security and risk management solutions. If the company maintains its growth momentum, its share price could reach new highs.

Factors influencing the 2030 target:

- Sustained innovation and new product launches

- Expansion into new industry verticals

- Higher profitability and earnings per share (EPS) growth

Summary of Subex Ltd Share Price Target 2025 to 2030

| Year | Target 1 (₹) | Target 2 (₹) |

|---|---|---|

| 2025 | 29 | 35 |

| 2026 | 40 | 55 |

| 2027 | 60 | 82 |

| 2028 | 79 | 91 |

| 2029 | 100 | 115 |

| 2030 | 125 | 150 |

Conclusion

Subex Ltd has strong growth potential, driven by increasing demand for AI-powered digital trust solutions. While the company faces competition in the cybersecurity and telecom analytics space, its focus on innovation and expansion positions it well for long-term growth. Investors should consider market conditions, financial performance, and emerging technologies when making investment decisions.

By 2030, Subex Ltd could emerge as a key player in its industry, making it an attractive stock for long-term investors.

10 FAQs based on the article of Subex Ltd Share Price

- What is Subex Ltd?

Subex Ltd is a global provider of digital trust solutions, specializing in fraud management, revenue assurance, and AI-driven analytics for telecom and enterprise businesses. - What is Subex Ltd Share Price market capitalization?

Subex Ltd has a market capitalization of ₹1,534 Cr. - What is the current dividend yield for Subex Ltd Share Price ?

Subex Ltd currently has a dividend yield of 0%, indicating that it does not offer dividends to its shareholders. - What is Subex Ltd Share Price revenue growth over the past 5 years?

Over the last five years, Subex Ltd’s revenue has declined at an average annual rate of -2.04%. - How has Subex Ltd’s market share changed in the last 5 years?

Subex Ltd’s market share has decreased from 1.07% to 0.48% in the last five years. - What are the main factors influencing Subex Ltd Share Price Target 2025?

Factors for 2025 include the expansion of AI-driven fraud detection solutions, strengthening of digital trust platforms, and favorable global market conditions for cybersecurity solutions. - What is the Subex Ltd Share Price Target 2026?

The share price target for Subex Ltd in 2026 ranges from ₹40 to ₹55, driven by the wider adoption of 5G technology and increased market penetration in cybersecurity solutions. - What are the growth prospects for Subex Ltd by 2027?

By 2027, Subex is expected to see substantial revenue growth due to increasing market acceptance of its solutions and expansion into international markets, with a share price target range of ₹60 to ₹82. - What role does AI play in Subex Ltd’s future growth?

AI is central to Subex’s future growth, particularly in areas like AI-powered revenue assurance, fraud management, and cybersecurity solutions, which will drive revenue and market share. - What is Subex Ltd Share Price Target 2030?

Subex Ltd’s share price target for 2030 ranges from ₹125 to ₹150, with growth driven by sustained innovation, product launches, and expansion into new verticals.

2 thoughts on “Subex Ltd Share Price Target 2025 to 2030”