Prakash Steelage Share Price Target 2025 to 2030: A Detailed Analysis

The current share price of Prakash Steelage is ₹8, and it has captured significant attention among investors seeking long-term growth. This article delves deep into the potential share price target for Prakash Steelage from 2025 to 2030 while analyzing its business model, financial health, competitive standing, and market trends.

Understanding Business Model

Prakash Steelage Limited operates in the stainless steel industry, primarily manufacturing and exporting stainless steel tubes and pipes. Catering to sectors like oil and gas, power generation, pharmaceuticals, and construction, the company leverages its extensive product portfolio and robust distribution network. It emphasizes high-quality standards and innovation to meet diverse customer requirements, which could be pivotal in driving growth.

Key Metrics of Prakash Steelage Share

| Metric | Value |

|---|---|

| Market Cap | ₹145.25 Cr. |

| ROE | 0% |

| ROCE | 0% |

| P/E | 3.93 |

| P/B | 18.62 |

| Industry P/E | 19.32 |

| Debt to Equity | 0.04 |

| Div. Yield | 0% |

| Book Value | ₹0.45 |

| Face Value | ₹1 |

| EPS (TTM) | ₹2.11 |

| 52 Week High | ₹16.20 |

| 52 Week Low | ₹5.30 |

Prakash Steelage Share Price Chart of last 5 years

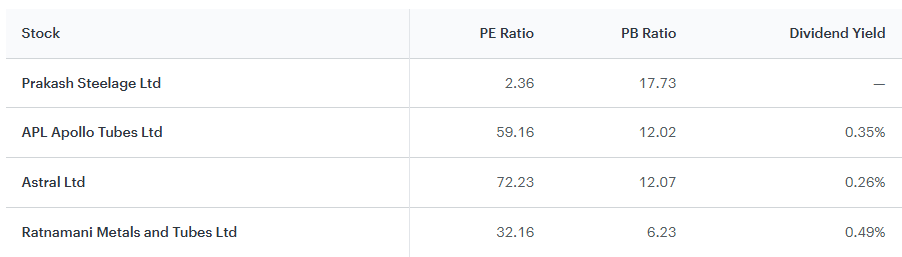

Peer Companies & Comparison

Shareholding Pattern

| Category | Holding (%) |

| Retail & Others | 66.45% |

| Promoters | 33.55% |

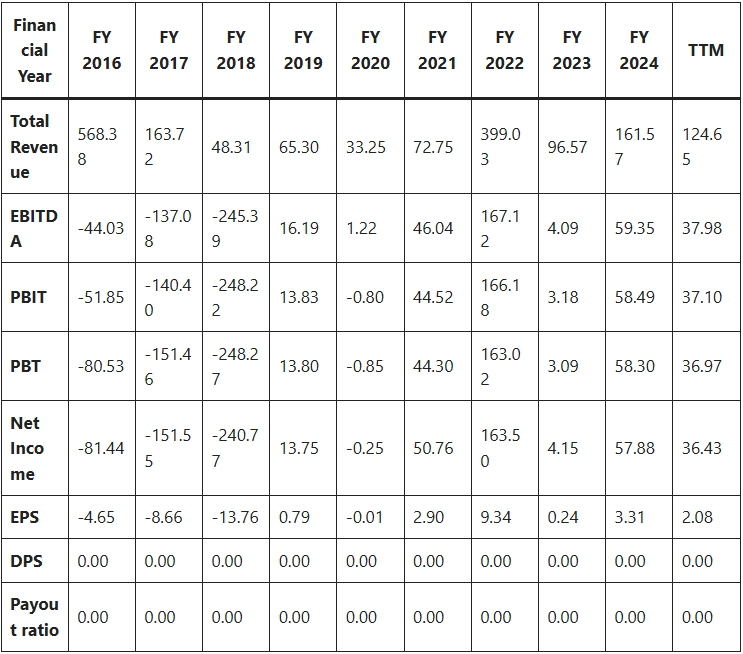

Income Statement

Revenue Growth:

- Over the last 5 years, the company’s revenue has grown at a yearly rate of 19.86%, which is higher than the industry average of 13.98%.

- This suggests that the company has the potential to increase its market share more rapidly than the industry as a whole.

Market Share:

- The company’s market share has increased from 0.13% to 0.17% over the last 5 years.

- This indicates that the company has gained a slightly larger portion of the market relative to its competitors.

Net Income Growth:

- The company’s net income has grown at a yearly rate of 33.3%, compared to the industry average of 21.77%.

- This strong net income growth suggests that the company is becoming more profitable at a faster rate than its competitors.

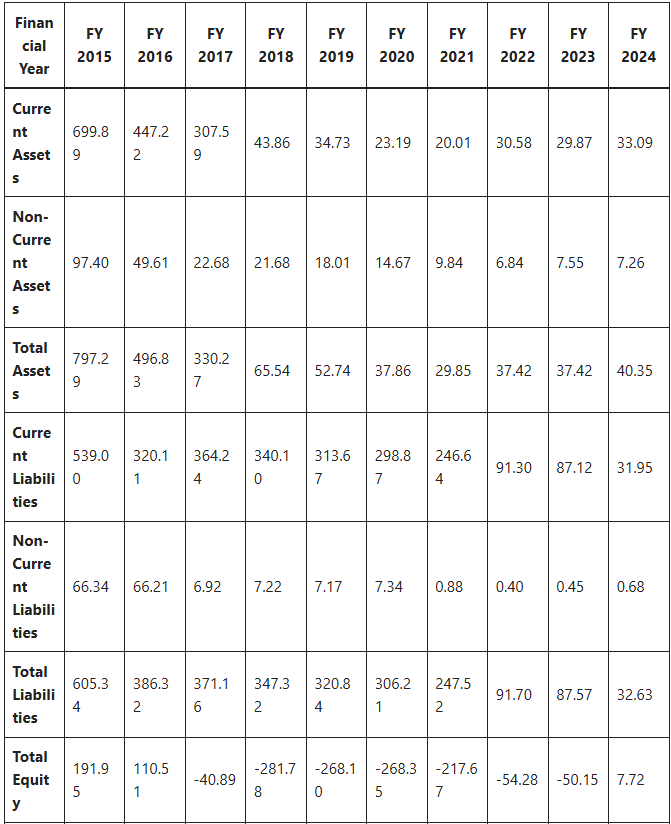

Balance Sheet

Lower than Industry Debt to Equity Ratio

The Debt to Equity Ratio is a company’s total liabilities divided by its shareholder equity. It’s the degree to which a company is financing its operations through debt v/s wholly owned funds

Over the last 5 years, debt to equity ratio has been -59.01%, vs industry avg of 40.79%

Lower than Industry Current Ratio

Current ratio measures a company’s ability to pay short-term obligations. Higher is better

Over the last 5 years, current ratio has been 37.44%, vs industry avg of 143.88%

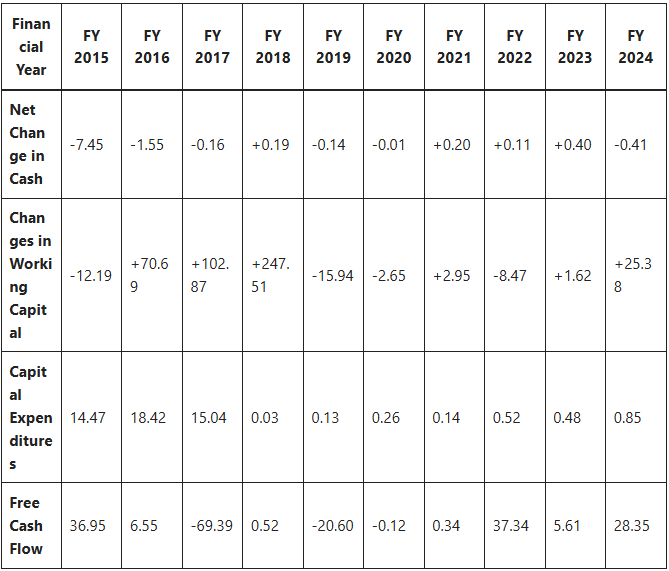

Cash Flow Statement

Fundamental Analysis

1. Company Overview

Prakash Steelage is a prominent player in the stainless steel sector, offering seamless and welded stainless steel pipes and tubes. Its customer base spans across domestic and international markets, with a focus on high-quality manufacturing to ensure industry compliance. Despite its niche positioning, the company faces challenges such as low return ratios (ROE and ROCE at 0%) and a modest market cap.

2. Financial Health

Debt Analysis

The company’s debt-to-equity ratio of 0.04 highlights a strong balance sheet with minimal leverage, indicating prudent financial management.

Cash Flow

With limited data on cash flow trends, investors should assess quarterly results and annual reports for insights into operational efficiency and cash reserves.

Liquidity

Prakash Steelage appears to have a stable liquidity position due to its low debt levels, but profitability metrics like ROE and ROCE suggest inefficiencies in utilizing its assets.

3. Competitive Analysis

The stainless steel industry is characterized by stiff competition, with players like Jindal Stainless and Ratnamani Metals dominating the market. Prakash Steelage’s small market share and lack of significant pricing power necessitate innovation and cost leadership to stay competitive.

4. Growth Prospects

Market Trends

The stainless steel sector is expected to grow at a CAGR of 5-7% over the next decade, driven by rising infrastructure projects, renewable energy investments, and urbanization. Prakash Steelage’s focus on export markets could be a significant growth driver.

Strategic Initiatives

To achieve consistent growth, the company needs to:

- Expand its product portfolio.

- Invest in R&D for advanced manufacturing techniques.

- Strengthen its export presence by targeting emerging markets.

5. Dividend Policy

The company currently does not offer dividends, reflecting its focus on reinvestment for growth. While this approach is favorable for long-term expansion, consistent profits are crucial to attract dividend-seeking investors.

6. ESG (Environmental, Social, and Governance) Factors

Sustainability is becoming a key consideration for investors. Prakash Steelage must adopt eco-friendly manufacturing processes and maintain transparency in its governance to enhance investor confidence.

Expanded Key Factors Impacting Prakash Steelage Share Price

Market Growth

The demand for stainless steel products is closely tied to the growth of end-user industries such as construction, energy, pharmaceuticals, and infrastructure. As governments globally prioritize infrastructure development and renewable energy projects, the stainless steel sector is poised for growth. Prakash Steelage can benefit significantly if it aligns its product portfolio with these expanding sectors. For instance, specialized stainless steel products for solar panels, wind turbines, or energy-efficient buildings could create niche opportunities. Furthermore, increasing urbanization in emerging economies can drive additional demand for high-quality steel products.

Profitability Metrics

Key profitability metrics such as Return on Equity (ROE) and Return on Capital Employed (ROCE) are critical indicators of financial health and operational efficiency. Currently, Prakash Steelage’s ROE and ROCE stand at 0%, reflecting inefficiencies in asset utilization and profit generation. To enhance these metrics, the company must:

- Focus on cost optimization through advanced manufacturing techniques.

- Explore value-added products with higher profit margins.

- Strengthen its distribution channels to reduce logistic costs. Improved profitability not only boosts investor confidence but also enhances the company’s ability to reinvest in growth initiatives.

Debt Management

A low debt-to-equity ratio of 0.04 indicates that Prakash Steelage has maintained a conservative approach to leveraging. This financial stability provides the company with the flexibility to raise funds for expansion without significantly increasing financial risk. However, underutilization of debt in a capital-intensive industry like steel manufacturing may limit growth potential. Prakash Steelage could consider:

- Strategic borrowing for capacity expansion or modernization.

- Leveraging low-interest-rate environments to finance R&D initiatives. Effective debt management will be crucial in balancing growth aspirations with financial prudence.

Market Sentiment

Investor perception and broader market trends play a significant role in determining share price movements. Factors such as macroeconomic conditions, geopolitical developments, and industry-specific trends influence market sentiment. Positive news such as securing large contracts, entering new markets, or partnerships with prominent players can create upward momentum in share prices. Conversely, adverse developments like regulatory issues or declining profits can dampen investor enthusiasm. Engaging in transparent communication and showcasing consistent performance will be vital for maintaining positive sentiment.

Regulatory Environment

Compliance with environmental, safety, and trade regulations is becoming increasingly important in the global market. The stainless steel industry, being energy-intensive, faces stringent environmental norms aimed at reducing carbon emissions. Prakash Steelage must:

- Invest in sustainable manufacturing processes to meet environmental standards.

- Stay informed about changes in trade policies to avoid disruptions in international operations. Failure to adhere to regulatory requirements can result in financial penalties, operational shutdowns, or reputational damage, thereby impacting share prices.

Expanded Prakash Steelage Share Price Target 2025 to 2030

Prakash Steelage Share Price Target 2025

Based on the company’s current financial performance and the anticipated growth in the stainless steel industry, Prakash Steelage could see its share price reach ₹11-14 by 2025. This projection assumes a modest improvement in profitability driven by:

- Stable demand for stainless steel products in core sectors like construction and energy.

- Effective cost management, which could lead to better margins.

- Incremental gains in market share supported by product innovation. While these factors support growth, external risks such as fluctuating raw material costs and economic slowdowns could temper the pace of progress.

Prakash Steelage Share Price Target 2026

If Prakash Steelage continues to enhance operational efficiency and consolidates its position in the market, the share price could rise to ₹14-17 by 2026. This growth hinges on:

- Strengthening relationships with key customers in both domestic and international markets.

- Improving utilization of existing assets to boost ROE and ROCE metrics.

- Capturing opportunities in emerging markets where stainless steel demand is growing. By 2026, strategic collaborations or joint ventures could further propel the company’s growth trajectory.

Prakash Steelage Share Price Target 2027

By 2027, Prakash Steelage’s share price could reach ₹17-20, assuming the following developments:

- Successful implementation of strategic initiatives such as diversifying its product range to include high-margin offerings.

- Enhanced export strategies that tap into underserved markets.

- Consistent improvements in financial metrics like earnings per share (EPS) and cash flow. This period could also witness greater investment in automation and technology, which would improve operational efficiency and attract investor interest.

Prakash Steelage Share Price Target 2028

Assuming continued market expansion and diversification, the share price could rise to ₹20-24 by 2028. Key drivers include:

- Expansion into niche applications of stainless steel in industries like renewable energy and advanced manufacturing.

- Robust export growth supported by favorable trade policies and competitive pricing.

- Strengthened brand reputation as a reliable supplier of high-quality stainless steel products. Moreover, maintaining a low debt-to-equity ratio will enable the company to finance growth initiatives without overleveraging.

Prakash Steelage Share Price Target 2029

By 2029, a solid presence in international markets and improved return ratios could push the share price to ₹24-28. This projection factors in:

- Achieving economies of scale through capacity expansion.

- Strengthening supply chain networks to ensure cost efficiencies.

- Capitalizing on industry trends such as increasing sustainability requirements and higher demand for eco-friendly products. Strategic marketing and partnerships with global players could further enhance its competitive position.

Prakash Steelage Share Price Target 2030

By 2030, Prakash Steelage’s share price could reach ₹28-35, provided it achieves sustainable growth and mitigates risks. Critical factors include:

- Sustained revenue growth fueled by innovation and market penetration.

- Enhanced profitability metrics through disciplined cost control and operational excellence.

- Adopting environmentally responsible practices to align with global ESG (Environmental, Social, and Governance) standards, which could attract socially responsible investors.

Summary of Prakash Steelage Share Price Target 2025 to 2030

| Year | Target Price (₹) |

|---|---|

| 2025 | 11-14 |

| 2026 | 14-17 |

| 2027 | 17-20 |

| 2028 | 20-24 |

| 2029 | 24-28 |

| 2030 | 28-35 |

Conclusion

Prakash Steelage’s growth potential lies in its ability to capitalize on market trends, improve financial metrics, and expand its presence in international markets. While its current performance metrics raise concerns, strategic initiatives and favorable market conditions could pave the way for significant share price appreciation by 2030. Investors should closely monitor its financial health, competitive positioning, and industry developments for informed decision-making.

Frequently Asked Questions (FAQs)

Q1: What is the current share price of Prakash Steelage? The current share price of Prakash Steelage is ₹8.

Q2: What is Prakash Steelage’s primary business? Prakash Steelage operates in the stainless steel industry, primarily manufacturing and exporting stainless steel tubes and pipes. Their products cater to sectors like oil and gas, power generation, pharmaceuticals, and construction.

Q3: What are the key financial metrics of Prakash Steelage Share Price ? Here are some key metrics:

- Market Cap: ₹145.25 Cr.

- ROE: 0%

- ROCE: 0%

- P/E: 3.93

- Debt to Equity: 0.04

- EPS (TTM): ₹2.11

Q4: How is the shareholding distributed in Prakash Steelage? The shareholding pattern is as follows:

- Retail & Others: 66.45%

- Promoters: 33.55%

Q5: What is the Prakash Steelage Share Price Target 2025 ? Based on current financial metrics and market conditions, the share price target for 2025 is projected to be between ₹11-14.

Q6: What factors are expected to drive the growth of Prakash Steelage Share Price ? Key factors include:

- Expansion in end-user industries like construction and energy.

- Improvement in profitability metrics such as ROE and ROCE.

- Maintaining a low debt-to-equity ratio.

- Strategic initiatives targeting market expansion and product innovation.

Q7: What challenges does Prakash Steelage face in the market? Challenges include:

- Stiff competition from larger players like Jindal Stainless.

- Low return ratios (ROE and ROCE at 0%).

- Limited pricing power and modest market share.

Q8: Does Prakash Steelage pay dividends? Currently, Prakash Steelage does not pay dividends, reflecting its focus on reinvestment for growth.

Q9: What is the projected Prakash Steelage Share Price Target 2030? By 2030, the share price is projected to reach ₹28-35, provided the company achieves sustainable growth and enhances profitability.

Q10: How does the regulatory environment impact Prakash Steelage Share Price ? The regulatory environment, particularly environmental and trade regulations, can significantly affect operations and costs. Compliance with these regulations is essential to avoid financial penalties and maintain smooth operations.

3 thoughts on “Prakash Steelage Share Price Target 2025 to 2030”