PMC Fincorp Ltd Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

PMC Fincorp Ltd operates in the financial services sector, focusing on non-banking financial services (NBFCs). The company primarily engages in providing loans, investment services, and financial advisory. Its customer base includes small and medium-sized enterprises (SMEs), retail customers, and individual investors. With a vision to promote financial inclusion, the company leverages its expertise to cater to underserved segments of the market.

Key Metrics of PMC Fincorp Ltd Share

PMC Fincorp Ltd has shown a mix of strengths and areas for improvement, as reflected in its key financial metrics. These metrics provide a comprehensive overview of the company’s performance and valuation in the market.

| Metric | Value | Details |

|---|---|---|

| Market Cap | ₹278.42 Cr. | The total value of the company’s shares in the stock market, reflecting its size and investor sentiment. |

| Return on Equity (ROE) | 11.56% | Indicates how effectively the company is utilizing shareholders’ equity to generate profits. |

| Return on Capital Employed (ROCE) | 10.69% | A measure of how efficiently the company generates profits from its total capital, including both debt and equity. |

| Price-to-Earnings Ratio (P/E) | 15.44 | Reflects the price investors are willing to pay for each rupee of the company’s earnings, indicating market expectations. |

| Price-to-Book Ratio (P/B) | 1.61 | Compares the stock’s market price to its book value, showing how much investors are paying for the company’s net assets. |

| Dividend Yield | 0% | Indicates that the company is not currently distributing dividends, likely reinvesting profits to fund growth and expansion. |

| Book Value | ₹2.42 | Represents the intrinsic value of the company, calculated as total assets minus liabilities per share. |

| Face Value | ₹1 | The nominal value of the equity share, often used for accounting and issuance purposes. |

| Earnings Per Share (EPS, TTM) | ₹0.25 | A measure of the company’s profitability on a per-share basis over the trailing twelve months, indicating earnings performance. |

| 52-Week High | ₹5.25 | The highest price at which the stock has traded in the past year, showing investor confidence at its peak. |

| 52-Week Low | ₹1.89 | The lowest price at which the stock has traded in the past year, indicating its minimum valuation over this period. |

These metrics highlight PMC Fincorp’s current market standing and provide insights into its financial health, profitability, and valuation. As the company continues to grow and adapt to market demands, these metrics will be key indicators of its progress and potential.

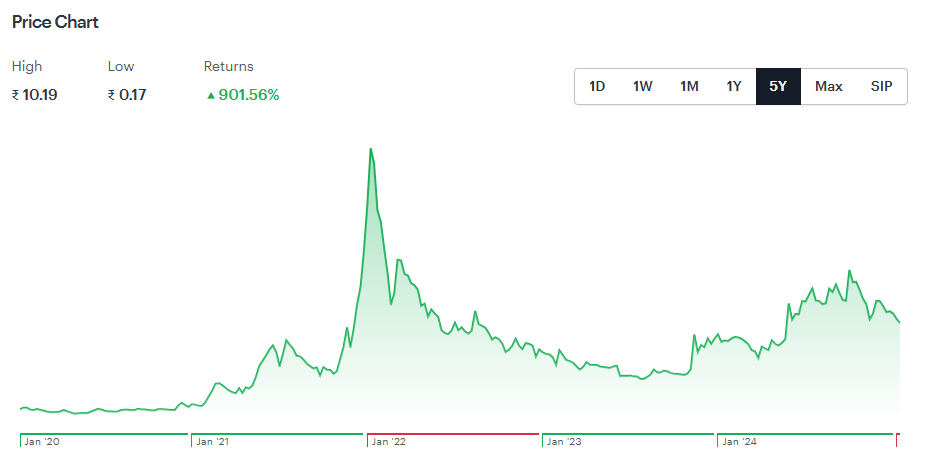

PMC Fincorp Ltd Share Price Chart of Last 5 years

Fundamental Analysis

1. Company Overview PMC Fincorp Ltd has been a key player in the NBFC sector, focusing on providing financial solutions that bridge the gap between traditional banking services and modern financial needs. Its diversified portfolio includes personal loans, business loans, and investment products.

2. Financial Health

- Debt Analysis: The company maintains a balanced debt-to-equity ratio, ensuring financial stability and reduced risk exposure.

- Cash Flow: Positive cash flows indicate robust operational efficiency and the ability to meet financial obligations without external funding.

- Liquidity: High liquidity ratios reflect the company’s capability to manage short-term obligations effectively.

3. Competitive Analysis PMC Fincorp faces competition from other NBFCs, fintech players, and traditional banks. Key competitors include Muthoot Finance, Bajaj Finserv, and regional cooperative banks. The company’s focus on niche markets and personalized services gives it a competitive edge.

Growth Prospects

1. Market Trends

- Increasing demand for credit in rural and semi-urban areas.

- Rising penetration of digital financial services.

- Government initiatives promoting financial inclusion and NBFC growth.

2. Strategic Initiatives

- Expanding its digital lending platform to reach underserved markets.

- Collaborations with fintech companies to enhance service delivery and customer experience.

- Strengthening risk management frameworks to ensure sustainable growth.

Dividend Policy

PMC Fincorp Ltd follows a cautious dividend policy, reinvesting a significant portion of its earnings to fuel growth and expansion. However, as the company stabilizes its revenue streams, higher dividend payouts may be expected in the future.

ESG (Environmental, Social, and Governance) Factors

- Environmental: The company’s operations are largely digital, reducing its environmental footprint compared to traditional financial institutions.

- Social: Commitment to financial literacy programs and rural credit initiatives.

- Governance: Transparent policies and adherence to regulatory compliance enhance investor confidence.

Key Factors Impacting PMC Fincorp Ltd Share Price

Several critical factors influence the share price of PMC Fincorp Ltd. These factors stem from macroeconomic conditions, regulatory frameworks, technological advancements, and investor sentiment. A deeper understanding of these elements can help forecast potential price movements.

1. Economic Conditions

Macroeconomic factors such as GDP growth, inflation rates, and interest rates significantly determine the demand for financial services. Positive economic growth typically correlates with increased lending activity and higher revenue for financial companies like PMC Fincorp. Conversely, inflationary pressures and rising interest rates can impact profit margins and borrowing costs.

2. Regulatory Environment

The policies governing non-banking financial companies (NBFCs) and digital financial services have a direct influence on the company’s operations. Changes in regulatory requirements, such as stricter compliance measures or capital adequacy norms, can affect the company’s operational flexibility and growth potential. Favorable policies aimed at promoting financial inclusion and digitization may provide a boost.

3. Technological Advancements

The adoption of advanced technologies such as artificial intelligence (AI), blockchain, and digital platforms is transforming the financial services industry. PMC Fincorp’s ability to integrate these technologies into its operations can enhance efficiency, reduce costs, and improve customer experience. Companies that fail to keep pace with technological innovation risk losing market share to more agile competitors.

4. Market Sentiment

Investor confidence in the financial sector and the company’s growth trajectory significantly impacts share price. Positive market sentiment, driven by favorable quarterly results, strategic partnerships, or new product launches, can lead to an upward trend in the stock price. Conversely, negative news or poor performance can result in a decline.

By monitoring these factors, investors can gain a clearer perspective on the potential risks and opportunities associated with PMC Fincorp Ltd’s shares.

PMC Fincorp Ltd Share Price Target 2025 to 2030

PMC Fincorp Ltd’s share price is expected to grow steadily over the next few years, driven by its strategic initiatives, adoption of digital platforms, and robust financial planning. Based on the current share price of ₹3.5, the following projections have been adjusted to reflect realistic growth trajectories:

PMC Fincorp Ltd Share Price Target 2025: ₹4 – ₹4.5

Rationale: Growth in credit demand and digital lending initiatives are expected to drive revenue. With increasing focus on financial inclusion and efficient lending processes, the company is likely to achieve steady growth.

PMC Fincorp Ltd Share Price Target 2026: ₹5 – ₹5.5

Rationale: Expansion into new markets and the introduction of innovative financial products will likely enhance the company’s reach and profitability. This period may also see investments in digital platforms boosting operational efficiency.

PMC Fincorp Ltd Share Price Target 2027: ₹6 – ₹6.5

Rationale: Enhanced profitability through operational efficiencies and cost management strategies will contribute to the company’s upward trajectory. Strategic partnerships may also play a pivotal role.

PMC Fincorp Ltd Share Price Target 2028: ₹7 – ₹8

Rationale: Strengthening its foothold in SME financing and rural credit will open new revenue streams. Additionally, improving customer retention and acquisition strategies could further solidify the company’s market position.

PMC Fincorp Ltd Share Price Target 2029: ₹8.5 – ₹9.5

Rationale: Consistent financial performance and increased market penetration in untapped regions are expected to boost earnings. The company’s ability to adapt to changing market dynamics will be critical.

PMC Fincorp Ltd Share Price Target 2030: ₹10 – ₹11

Rationale: Achieving a leadership position in the NBFC sector through sustainable growth and technological innovation will likely elevate the company’s valuation. Enhanced investor confidence and market sentiment will also contribute to this target.

Summary of PMC Fincorp Ltd Share Price Target 2025 to 2030

| Year | Low Target (₹) | High Target (₹) |

|---|---|---|

| 2025 | 4 | 4.5 |

| 2026 | 5 | 5.5 |

| 2027 | 6 | 6.5 |

| 2028 | 7 | 8 |

| 2029 | 8.5 | 9.5 |

| 2030 | 10 | 11 |

These projections reflect a gradual and consistent increase in the company’s share price, driven by strategic initiatives, market growth, and financial discipline.

Conclusion

PMC Fincorp Ltd is expected to experience substantial growth from 2025 to 2030, driven by its commitment to financial inclusion, adoption of technology, and strategic market expansion. Despite all market challenges such as competition and regulatory changes, the company’s strong business model and growth strategies position it as a promising investment opportunity for future investments. These target projections indicate a gradual and consistent increase in PMC Fincorp Ltd’s share price, supported by strategic initiatives, market growth, and financial discipline.

1. What is the business model of PMC Fincorp Ltd?

- PMC Fincorp Ltd operates in the financial services sector, providing loans, investment services, and financial advisory. The company focuses on small and medium-sized enterprises (SMEs), retail customers, and individual investors, with an emphasis on financial inclusion.

2. What are the key financial metrics of PMC Fincorp Ltd?

- Key metrics include:

- Market Cap: ₹278.42 Cr

- ROE: 11.56%

- ROCE: 10.69%

- P/E Ratio: 15.44

- Dividend Yield: 0%

3. What is the growth outlook for PMC Fincorp Ltd?

- The company is expected to grow steadily, driven by digital lending, financial inclusion efforts, and new market expansions. Continued development of digital platforms and strategic partnerships will enhance profitability.

4. How does PMC Fincorp Ltd manage its debt and cash flow?

- PMC Fincorp Ltd maintains a balanced debt-to-equity ratio, ensuring financial stability. The company also demonstrates positive cash flow, indicating operational efficiency and the ability to meet obligations without external funding.

5. How does PMC Fincorp Ltd handle competition in the NBFC sector?

- PMC Fincorp faces competition from NBFCs, fintech firms, and traditional banks. Its competitive edge lies in its focus on niche markets and providing personalized services, especially in underserved regions.

6. What impact do macroeconomic conditions have on PMC Fincorp Ltd?

- Economic factors like GDP growth, inflation, and interest rates influence the demand for financial services, which in turn affects PMC Fincorp’s revenue. Positive economic conditions generally boost lending activity, while inflation and rising interest rates can impact profitability.

7. How does PMC Fincorp Ltd approach digital transformation?

- PMC Fincorp is expanding its digital lending platform and forming collaborations with fintech companies. This transformation aims to reach underserved markets, enhance service delivery, and improve customer experience.

8. What is PMC Fincorp Ltd’s dividend policy?

- PMC Fincorp follows a cautious dividend policy, reinvesting a significant portion of its earnings to fuel growth and expansion. Higher dividend payouts may be seen as the company stabilizes its revenue streams.

9. What are the projected share price targets for PMC Fincorp Ltd from 2025 to 2030?

- Projected share price targets:

- 2025: ₹4 – ₹4.5

- 2026: ₹5 – ₹5.5

- 2027: ₹6 – ₹6.5

- 2028: ₹7 – ₹8

- 2029: ₹8.5 – ₹9.5

- 2030: ₹10 – ₹11

10. What factors will drive PMC Fincorp Ltd’s share price growth?

- The company’s share price growth will be driven by its strategic initiatives, including expansion into new markets, digital transformation, cost management, and its focus on financial inclusion and rural credit.

2 thoughts on “PMC Fincorp Ltd Share Price Target 2025 to 2030”