HUDCO Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

HUDCO (Housing and Urban Development Corporation) is a public sector enterprise under the Ministry of Housing and Urban Affairs. Established in 1970, its primary objective is to provide long-term finance for housing and urban infrastructure projects across India. HUDCO plays a crucial role in advancing social housing initiatives and urban development, focusing on affordable housing, slum rehabilitation, and sustainable infrastructure projects.

The company generates revenue primarily through interest income from loans offered to state governments, urban local bodies, and private sector entities. It also invests in capacity-building programs and provides consultancy services for project planning and implementation.

Key Metrics of HUDCO Share

| Metric | Value |

|---|---|

| Market Cap | ₹ 46,035 Cr |

| Face Value | ₹ 10 |

| Book Value | ₹ 85.5 |

| PE Ratio | 18.7 |

| ROCE Ratio | 9.23% |

| ROE Ratio | 13.2% |

| Dividend Yield | 1.81% |

| 52-Week High | ₹ 354 |

| 52-Week Low | ₹ 78.2 |

HUDCO Share Price Chart of Last 5years

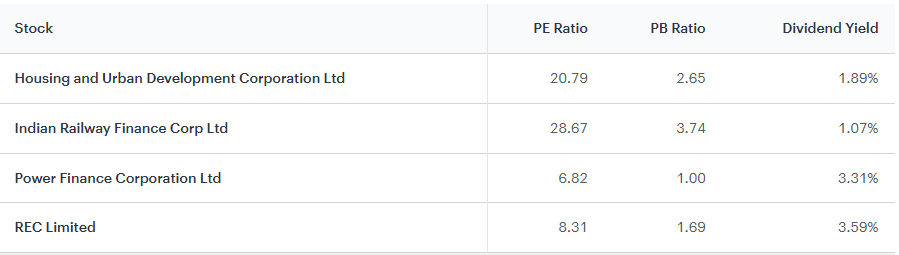

Peers & Comparison

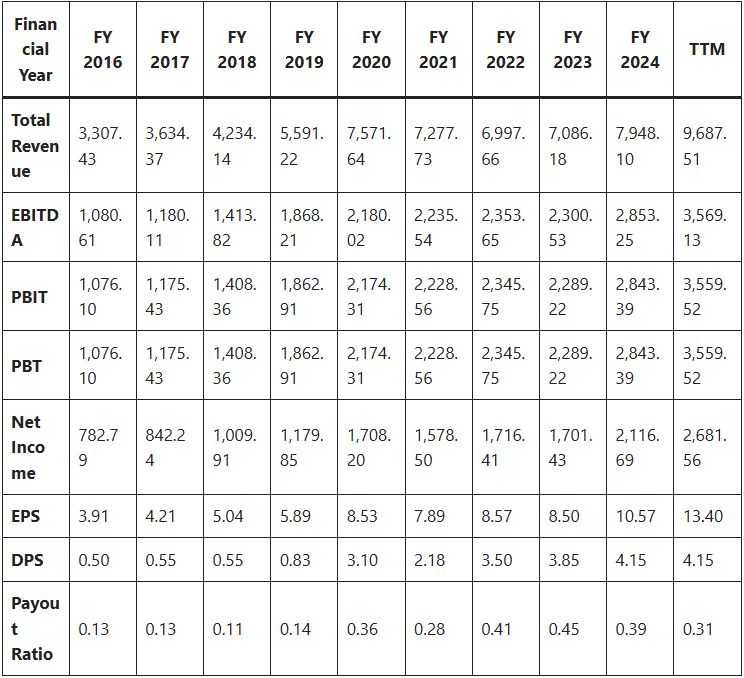

Income Statement Analysis

Industry Context:

The Income Statement highlights the company’s performance within its sub-sector. Revenue growth exceeding the industry average signals potential for increasing market share, while profitability metrics offer insights into financial health.

- Revenue Growth:

Over the past five years, the company has achieved a compound annual growth rate (CAGR) of 7.29%, which is below the industry average of 12.69%. This indicates a slower pace of expansion compared to peers. - Market Share:

Market share, the percentage of an industry’s total sales captured by the company, has declined from 4.59% to 3.64% over the last five years. This reflects a reduction in competitive standing within the industry. - Net Income Growth:

Net income, which represents the company’s profitability after expenses, has grown at a CAGR of 12.4% over the past five years, lagging behind the industry average growth rate of 18.31%. This indicates room for enhancing profitability relative to competitors.

Income Statement Data (₹ cr)

- EPS (Earnings Per Share) and DPS (Dividends Per Share) are in ₹.

- All other financial figures, except the payout ratio, are expressed in ₹ cr.

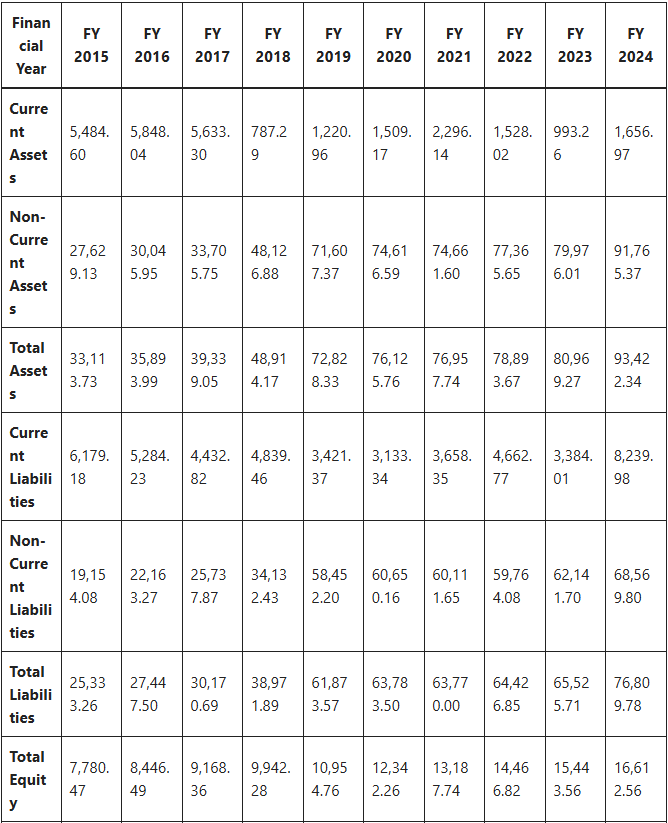

Balance Sheet Analysis

Industry Context:

The Balance Sheet provides insights into the company’s financial position, including how it funds operations and manages liabilities. Key indicators like the Debt-to-Equity Ratio and Current Ratio are essential for evaluating financial health relative to industry benchmarks.

- Debt-to-Equity Ratio:

Over the past five years, the company’s average Debt-to-Equity Ratio has been 447.61%, significantly lower than the industry average of 698.97%. This suggests a more conservative approach to leveraging debt compared to competitors. - Current Ratio:

The average Current Ratio over the last five years stands at 38.63%, far below the industry average of 207.28%. This indicates limited short-term liquidity to cover immediate liabilities, a potential area of concern.

Balance Sheet Data (₹ cr)

- Figures, except for shares outstanding, are in ₹ cr.

- The Debt-to-Equity Ratio and Current Ratio are calculated from these data points.

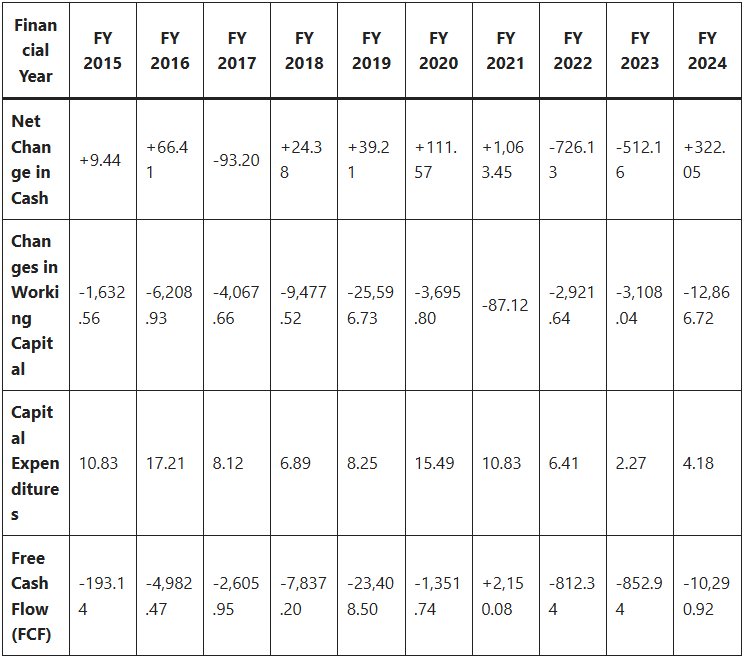

Cash Flow Statement Analysis

The Cash Flow Statement helps assess the company’s cash generation ability and financial flexibility by analyzing changes in cash, working capital, capital expenditures, and free cash flow.

Key Observations:

- Net Change in Cash:

- The company has shown fluctuating cash flow over the years, with significant increases in FY 2021 (+₹1,063.45 cr) and FY 2024 (+₹322.05 cr) but large declines in FY 2022 (-₹726.13 cr) and FY 2023 (-₹512.16 cr).

- These variations indicate irregular cash management, potentially linked to operational or financing decisions.

- Changes in Working Capital:

- The company has consistently experienced negative working capital changes, with a significant outflow in FY 2019 (-₹25,596.73 cr) and FY 2024 (-₹12,866.72 cr).

- Such trends might reflect high inventory levels, increased receivables, or other inefficiencies in managing short-term assets and liabilities.

- Capital Expenditures:

- The company’s capital spending has remained relatively modest over the years, peaking at ₹17.21 cr in FY 2016 and reducing significantly to ₹4.18 cr in FY 2024.

- This suggests limited investments in asset expansion or modernization.

- Free Cash Flow (FCF):

- The company has struggled with negative free cash flow in most years, notably FY 2019 (-₹23,408.50 cr) and FY 2024 (-₹10,290.92 cr).

- FY 2021 stands out with a positive FCF of ₹2,150.08 cr, likely due to improved cash from operations or reduced capital expenditures.

- Persistent negative FCF is a red flag for long-term sustainability, indicating the company may rely heavily on external funding.

Cash Flow Statement Data (₹ cr)

Summary:

- Strengths: Positive FCF in FY 2021 and controlled capital expenditures.

- Weaknesses: Persistent negative FCF, significant working capital outflows, and fluctuating cash balances.

Fundamental Analysis

1. Company Overview

HUDCO has carved a niche as a premier financial institution supporting housing and urban development. Its extensive portfolio includes financing rural and urban housing projects, urban water supply, roads, sanitation, and commercial infrastructure. The company’s involvement in sustainable development ensures its strategic alignment with government schemes such as Pradhan Mantri Awas Yojana (PMAY).

2. Financial Health

HUDCO’s financial performance reflects its operational efficiency and robust revenue streams. Key financial aspects include:

Debt Analysis

HUDCO’s debt levels are carefully managed, with a significant portion of its funding derived from government-backed schemes. Its debt-to-equity ratio remains within acceptable limits, ensuring financial stability.

Cash Flow

The company’s cash flow is steady due to consistent repayments from borrowers and interest income. Positive cash flows enhance its ability to disburse loans and pay dividends.

Liquidity

HUDCO maintains strong liquidity, supported by diversified funding sources and prudent financial management. Its ability to meet short-term obligations underscores its resilience.

3. Competitive Analysis

As a public sector entity, HUDCO enjoys competitive advantages such as access to low-cost funding, government support, and a reputation for reliability. Key competitors include:

- Housing Finance Companies (HFCs)

- Banks providing housing and infrastructure loans

Despite competition, HUDCO’s focus on underserved segments and government-backed projects ensures steady demand for its services.

4. Growth Prospects

Market Trends

India’s housing and infrastructure sectors are poised for significant growth, driven by urbanization, population growth, and government initiatives. HUDCO is well-positioned to benefit from these trends, given its expertise and strong relationships with stakeholders.

Strategic Initiatives

HUDCO’s strategic initiatives include enhancing digital capabilities, diversifying its portfolio, and increasing focus on sustainable projects. These efforts are expected to drive growth and improve operational efficiency.

Expanded Key Factors Impacting HUDCO Share Price

HUDCO’s share price is influenced by a combination of internal and external factors. Below is a detailed analysis of these key drivers:

1. Government Policies

Government initiatives play a pivotal role in shaping HUDCO’s business environment and, consequently, its share price. Key policies impacting HUDCO include:

- Pradhan Mantri Awas Yojana (PMAY): This flagship housing program aims to provide affordable housing to all. HUDCO, as a leading financer for such projects, benefits significantly from increased demand for financing under this scheme.

- Smart Cities Mission: By funding urban infrastructure projects under the Smart Cities initiative, HUDCO taps into opportunities created by the government’s push for modernization and sustainability.

- Affordable Housing Policies: Tax incentives and subsidies for affordable housing projects indirectly increase HUDCO’s business volume, driving growth.

2. Economic Growth

The growth trajectory of India’s economy has a direct bearing on HUDCO’s performance. A robust economy leads to:

- Increased infrastructure spending, driving higher demand for housing and urban development projects.

3. Interest Rate Changes

Interest rate fluctuations significantly impact HUDCO’s operations and profitability:

- Rising Interest Rates: Higher borrowing costs for the company can compress margins, while increased loan rates may deter demand from borrowers.

HUDCO’s ability to manage its interest rate exposure effectively is crucial for maintaining profitability and stability in share prices.

4. Market Sentiment

Investor perceptions of public sector enterprises (PSEs) and the housing sector influence HUDCO’s share price. Positive sentiment can stem from:

- Favorable government announcements or budget allocations for housing and urban development.

Conversely, negative sentiment due to macroeconomic challenges or perceived inefficiencies in PSEs could adversely affect the stock.

HUDCO Share Price Target 2025 to 2030: Detailed Analysis

HUDCO Share Price Target 2025

By 2025, HUDCO’s share price is projected to benefit significantly from increased government expenditure on housing and infrastructure. Several government initiatives, such as Pradhan Mantri Awas Yojana (PMAY) and the Smart Cities Mission, are expected to drive substantial demand for HUDCO’s financing services. Additionally, a continued emphasis on affordable housing could bolster the company’s loan disbursement and revenue growth.

Estimated Target Price: ₹ 300

This projection assumes a growth rate of 12-15%, supported by consistent financial performance and favorable policy frameworks.

HUDCO Share Price Target 2026

In 2026, the momentum from the housing sector is expected to continue, further supported by HUDCO’s strategic initiatives to diversify its portfolio and enhance operational efficiency. Key factors contributing to the projected growth include:

- Expansion in rural housing finance programs.

- Improved digital capabilities for faster loan approvals and disbursements.

- Strengthened partnerships with state governments and private developers.

Estimated Target Price: ₹ 340

This estimate reflects HUDCO’s adaptability to market demands and its ability to capitalize on infrastructure growth opportunities.

HUDCO Share Price Target 2027

By 2027, HUDCO’s focus on digital transformation and sustainability initiatives could yield substantial benefits. The company’s increased investment in green housing projects and its alignment with ESG (Environmental, Social, and Governance) principles are expected to attract socially responsible investors. Furthermore, a favorable economic climate and reduced non-performing assets (NPAs) could enhance profitability.

Estimated Target Price: ₹ 380

This projection underscores the company’s strategic shift towards innovation and sustainable development.

HUDCO Share Price Target 2028

In 2028, HUDCO’s expansion into emerging markets and increased lending activity in underdeveloped regions could drive its growth. Key drivers for the year include:

- Higher allocation of funds toward urban infrastructure projects.

- Strengthened presence in tier-2 and tier-3 cities.

- Improved revenue streams from consultancy and capacity-building services.

Estimated Target Price: ₹ 420

These factors, combined with a stable economic environment, position HUDCO for continued growth.

HUDCO Share Price Target 2029

By 2029, HUDCO’s consistent growth trajectory could be further reinforced by:

- Technological advancements in project monitoring and loan recovery.

- Expansion of its portfolio to include innovative financing options, such as green bonds.

- Strong support from government policies aimed at achieving housing for all.

Estimated Target Price: ₹ 460

This growth is expected to be accompanied by an increase in investor confidence and market capitalization.

HUDCO Share Price Target 2030

Looking ahead to 2030, HUDCO’s share price is anticipated to reach ₹ 500. This projection is based on:

- Sustained demand for housing and infrastructure financing.

- Strategic investments in technology and sustainable projects.

- Increased profitability driven by efficient operations and reduced costs.

Estimated Target Price: ₹ 500

This target reflects HUDCO’s resilience, adaptability, and ability to align with long-term growth trends.

Summary of HUDCO Share Price Target 2025 to 2030

| Year | Target Price (₹) |

|---|---|

| 2025 | 300 |

| 2026 | 340 |

| 2027 | 380 |

| 2028 | 420 |

| 2029 | 460 |

| 2030 | 500 |

Conclusion

HUDCO’s strong fundamentals, government backing, and strategic focus on housing and infrastructure position it as a promising investment for the long term. While market volatility and economic factors may pose challenges, the company’s resilience and growth potential make it an attractive choice for investors seeking stable returns. The share price targets for 2025 to 2030 underscore the company’s potential to deliver sustained growth and value creation.

Frequently Asked Questions (FAQs) on HUDCO Share Price Target 2025 to 2030

1. What is HUDCO, and what does it do?

HUDCO (Housing and Urban Development Corporation) is a public sector enterprise under the Ministry of Housing and Urban Affairs. It provides long-term finance for housing and urban infrastructure projects, focusing on affordable housing, slum rehabilitation, and sustainable infrastructure development.

2. What are the key metrics of HUDCO’s financial performance?

Key metrics include:

- Market Cap: ₹46,035 Cr

- Face Value: ₹10

- Book Value: ₹85.5

- PE Ratio: 18.7

- ROCE Ratio: 9.23%

- ROE Ratio: 13.2%

- Dividend Yield: 1.81%

- 52-Week High: ₹354

- 52-Week Low: ₹78.2

3. What is HUDCO Share Price Target 2025?

By 2025, HUDCO’s share price is projected to reach ₹300, driven by increased government spending on housing and infrastructure, along with favorable policies like PMAY and the Smart Cities Mission.

4. How does HUDCO’s business model generate revenue?

HUDCO generates revenue primarily through:

- Interest income from loans to state governments, urban local bodies, and private entities.

- Consultancy services for project planning and implementation.

- Investments in capacity-building programs.

5. What are the growth prospects for HUDCO Share Price 2025 to 2030?

Growth prospects are driven by:

- Government initiatives like PMAY and Smart Cities Mission.

- Expansion into emerging markets.

- Increased focus on sustainable projects and digital transformation.

- Rising demand for affordable housing and urban infrastructure.

6. What role does ESG (Environmental, Social, and Governance) play in HUDCO’s strategy?

HUDCO prioritizes ESG principles by:

- Promoting affordable housing and slum rehabilitation.

- Supporting sustainable infrastructure projects.

- Adhering to ethical governance standards, enhancing its appeal to socially responsible investors.

7. How does economic growth impact HUDCO Share Price?

A growing economy boosts:

- Demand for housing and urban development projects.

- Borrowers’ financial stability, reducing non-performing assets (NPAs).

- Investor confidence, positively influencing HUDCO’s valuation.

8. What are the risks to HUDCO’s growth trajectory?

Potential risks include:

- Economic slowdown or policy changes.

- Interest rate fluctuations affecting borrowing costs.

- Increased competition from private sector housing finance companies.

9. What are HUDCO Share Price Target for 2026 and 2027?

- 2026: Projected to reach ₹340, supported by strategic initiatives and rural housing finance expansion.

- 2027: Estimated at ₹380, driven by digital transformation, sustainability initiatives, and reduced NPAs.

10. What is the long-term share price target for 2030?

By 2030, HUDCO’s share price is anticipated to reach ₹500, supported by:

- Sustained demand for infrastructure financing.

- Strategic investments in technology and sustainability.

- Enhanced profitability through efficient operations and cost management.

3 thoughts on “HUDCO Share Price Target 2025 to 2030”