Heritage Foods Share Price Target 2025 to 2030: A Detailed Analysis

Heritage Foods has been a prominent player in India’s dairy and food product sector, renowned for its commitment to quality and innovation. With the current share price standing at ₹436, investors are keenly observing its growth trajectory for the coming years. This detailed analysis aims to provide a comprehensive outlook on Heritage Foods’ share price targets from 2025 to 2030, supported by an understanding of the business model, fundamental analysis, and market trends.

Understanding Business Model

Heritage Foods operates primarily in the dairy sector, focusing on milk, curd, butter, ghee, and other value-added products. The company has also diversified into renewable energy and organic products, enhancing its sustainability efforts. It employs a farm-to-table model, ensuring product quality and supply chain efficiency, which has significantly contributed to its market reputation.

Key Metrics of Heritage Foods Share

| Metric | Value |

|---|---|

| Market Cap | ₹4,626.34 Cr |

| ROE | 11.87% |

| ROCE | 15.48% |

| P/E | 29.52 |

| P/B | 5.22 |

| Dividend Yield | 0.5% |

| Book Value | ₹95.48 |

| Face Value | ₹5 |

| EPS (TTM) | ₹16.89 |

| 52 Week High | ₹727.90 |

| 52 Week Low | ₹232.50 |

Heritage Foods Share Price Chart of Last 5 years

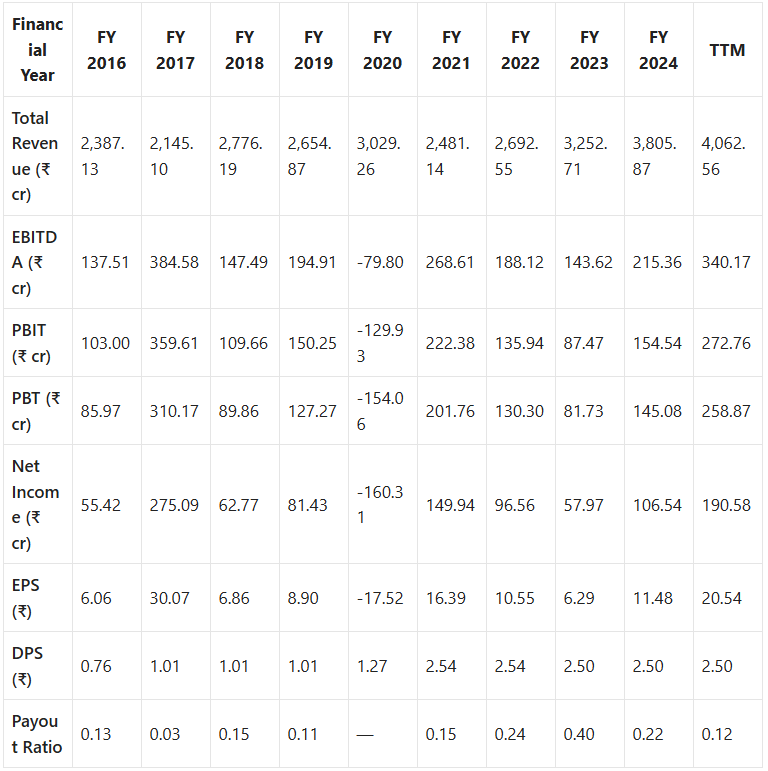

Income Statement

1. Revenue Growth

- Revenue Growth (Last 5 years): The company has grown its revenue at a rate of 7.47% per year, which is below the industry average of 10.65%. This suggests that while the company is growing, it is trailing behind its competitors in terms of revenue expansion.

2. Market Share

- Market Share Change (Last 5 years): The company’s market share has decreased from 3.06% to 2.66% over the past five years. This indicates that although the company’s revenue has grown, it has been losing ground relative to its competitors, possibly due to stronger industry growth or better performance by other companies.

3. Net Income Growth

- Net Income Growth (Last 5 years): The company’s net income has grown at 5.52% annually, which is significantly below the industry average of 12.3%. This slower net income growth could be a concern, as it suggests the company may not be effectively translating its revenue increases into profitability.

4. Income Statement Breakdown

Here are some key items from the income statement for the given financial years:

- Total Revenue: The revenue has been increasing steadily, from ₹2,387.13 crore in FY 2016 to ₹4,062.56 crore in TTM (Trailing Twelve Months).

- EBITDA: EBITDA is fluctuating, with a significant dip in FY 2020 (₹-79.80 crore) but recovering in recent years, reaching ₹340.17 crore in TTM.

- PBIT: Profit Before Interest and Taxes (PBIT) shows fluctuations, with losses in FY 2020, but it has been recovering since then.

- PBT: Profit Before Tax (PBT) also reflects fluctuations, with a loss in FY 2020 but a recovery in subsequent years.

- Net Income: Net income has been volatile, with a loss in FY 2020 and recovery in later years. In FY 2024 (TTM), net income has increased to ₹190.58 crore.

5. EPS and DPS

- Earnings Per Share (EPS): The EPS has shown volatility, with a significant drop to ₹-17.52 in FY 2020, followed by a recovery to ₹20.54 in TTM.

- Dividend Per Share (DPS): The company has consistently paid dividends, with an increase in DPS over the years (from ₹0.76 in FY 2016 to ₹2.50 in TTM).

6. Payout Ratio

- The payout ratio indicates the proportion of earnings paid out as dividends. It has varied significantly, from 0.13 in FY 2016 to 0.12 in TTM, suggesting a relatively low payout compared to earnings in recent years.

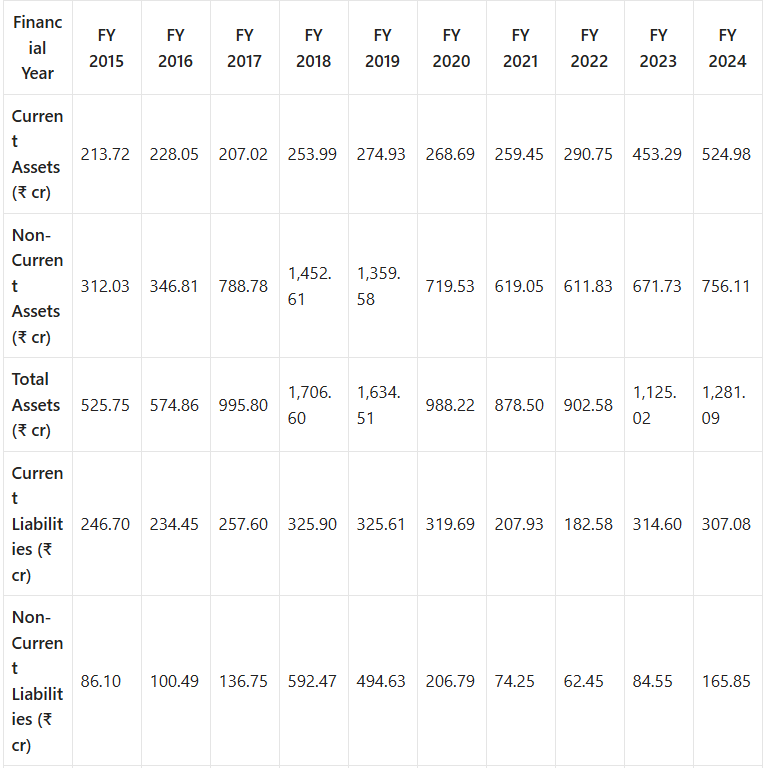

Balance Sheet

Yearly Performance Insights:

- Current Assets: Show a steady increase, particularly in FY 2023 and FY 2024, reflecting growth in short-term assets.

- Non-Current Assets: Significant growth between FY 2017 and FY 2018, with a slight decrease in FY 2020 but recovery in subsequent years.

- Total Assets: Growth over the years, with particularly large increases from FY 2017 to FY 2018 and a further rise in FY 2023 and FY 2024.

- Current Liabilities: Increase from FY 2015 to FY 2019, followed by a decrease in FY 2020 and a moderate rise in FY 2023 and FY 2024.

- Non-Current Liabilities: Significant increase in FY 2018, then a reduction starting in FY 2020, with a rise again in FY 2024.

- Total Liabilities: A sharp rise in FY 2018, followed by a decrease in FY 2020, and then an upward trend in FY 2024.

- Total Equity: Steady growth, with a notable jump from FY 2017 to FY 2018 and continued increase over subsequent years.

- Total Liabilities & Equity: The total of liabilities and equity tracks the growth in assets, with a steady increase over the years.

- Shares Outstanding: Remained constant at 9.15 crore shares until FY 2023, when it increased slightly to 9.28 crore shares.

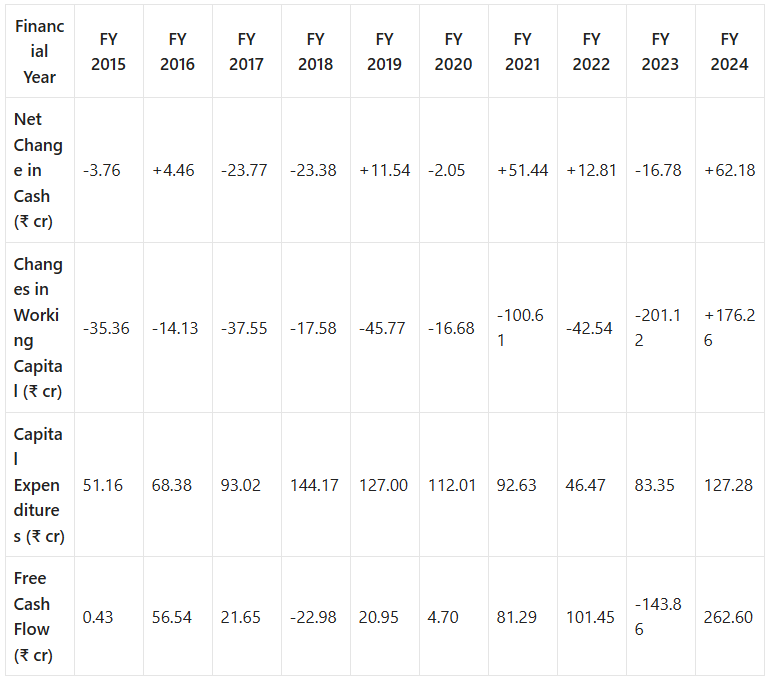

Cash Flow Statement

Yearly Performance Insights:

- Net Change in Cash: The cash position of the company shows fluctuations with negative changes in FY 2015, FY 2017, FY 2018, and FY 2023, and positive changes in other years, particularly in FY 2024.

- Changes in Working Capital: This has been mostly negative, indicating that working capital has been consumed for most of the years, except in FY 2024, where there was a significant positive change.

- Capital Expenditures: Capital expenditures show a trend of investing in the company’s growth, with the highest investments in FY 2018 and steady investments in most other years.

- Free Cash Flow: Free cash flow fluctuates, with a positive peak in FY 2024 at ₹262.60 crore, suggesting the company is generating strong excess cash in that year. Free cash flow was negative in FY 2018 and FY 2023, which could indicate higher capital expenditures or changes in working capital in those years.

Fundamental Analysis

1. Company Overview

Established in 1992, Heritage Foods has evolved into a diversified conglomerate, focusing on dairy, renewable energy, and organic farming. Its robust distribution network spans rural and urban markets, helping it cater to a wide demographic. The company’s strategic initiatives and consistent performance have made it a key player in the Indian dairy industry.

2. Financial Health

- Debt Analysis: Heritage Foods maintains a manageable debt-to-equity ratio, reflecting prudent financial management. The company uses its cash reserves effectively for expansion and diversification.

- Cash Flow: Strong cash flow from operating activities ensures the company’s ability to invest in growth-oriented projects.

- Liquidity: With a healthy current ratio, Heritage Foods is well-positioned to meet its short-term obligations, highlighting its sound liquidity position.

3. Competitive Analysis

Heritage Foods faces competition from major players like Amul, Mother Dairy, and Nestle in the dairy sector. However, its focus on regional markets, quality assurance, and value-added products gives it a competitive edge. The company’s ventures into renewable energy and organic food further diversify its revenue streams.

4. Growth Prospects

- Market Trends: The increasing demand for dairy and organic products, coupled with health-conscious consumer behavior, presents significant growth opportunities.

- Strategic Initiatives: Heritage Foods’ investment in technology, expansion of distribution networks, and focus on sustainability position it for long-term growth.

5. Dividend Policy

Heritage Foods has a consistent dividend payout history, reflecting its commitment to sharing profits with shareholders. The current dividend yield of 0.5% is modest but underscores the company’s financial stability.

6. ESG (Environmental, Social, and Governance) Factors

Heritage Foods is actively involved in sustainable practices, including renewable energy initiatives and water conservation. These efforts align with global ESG standards, enhancing its reputation among environmentally conscious investors.

Expanded Analysis of Key Factors Impacting Heritage Foods Share Price

1. Demand for Dairy Products

The rising demand for milk and value-added dairy products is a cornerstone of Heritage Foods’ revenue growth. With increasing health consciousness among consumers, products such as probiotic yogurt, low-fat milk, and fortified dairy items are witnessing significant uptake. Additionally, the urbanization of rural areas and changing dietary preferences are further fueling this demand. Heritage Foods is strategically positioned to capitalize on this trend with its broad product portfolio and strong distribution network, ensuring that it meets both urban and rural market needs.

Key Drivers:

- Health Awareness: Increasing awareness about the nutritional benefits of dairy products.

- Population Growth: India’s growing population continues to create a steady demand for dairy.

- E-commerce Growth: Online grocery platforms provide new avenues for distributing dairy products efficiently.

2. Expansion and Diversification

Heritage Foods’ strategic diversification into organic foods and renewable energy marks a significant shift in reducing dependency on its core dairy business. By entering the organic food market, the company aligns itself with growing consumer trends favoring sustainable and chemical-free products. Similarly, investments in renewable energy not only reduce operational costs but also improve the company’s sustainability profile.

Key Areas of Focus:

- Renewable Energy: Solar and wind energy initiatives reduce reliance on conventional power sources, lowering costs.

- Organic Foods: Expansion into pesticide-free and natural food products appeals to a niche yet growing market segment.

- Geographic Reach: Strengthening presence in tier-2 and tier-3 cities to tap into emerging markets.

3. Technological Advancements

Investment in technology and digital platforms is a critical factor in enhancing Heritage Foods’ operational efficiency. From automated milk processing plants to advanced supply chain management systems, technology enables the company to reduce costs, improve quality, and ensure timely delivery of products.

Innovations Driving Efficiency:

- AI and IoT: Utilization of artificial intelligence and Internet of Things (IoT) for inventory and logistics management.

- E-commerce Integration: A robust digital presence allows the company to reach tech-savvy consumers.

- Quality Control: Technology-driven quality checks ensure adherence to high standards, enhancing consumer trust.

4. Economic Indicators

Macroeconomic factors such as inflation, rural income levels, and government policies play a pivotal role in shaping Heritage Foods’ growth trajectory. The affordability of dairy products is closely linked to income levels, especially in rural areas where a significant portion of the company’s market lies.

Economic Factors at Play:

- Inflation: Changes in raw material costs, particularly fodder and fuel, impact production expenses.

- Rural Development: Government schemes aimed at rural development and agricultural growth indirectly benefit the company.

- Subsidies and Incentives: Policies promoting renewable energy and dairy farming provide financial advantages.

Heritage Foods Share Price Target 2025 to 2030

Heritage Foods Share Price Target 2025: ₹623

By 2025, Heritage Foods plans to solidify its market position through strategic expansion and diversification. The company’s initiatives to broaden its product portfolio, including organic and fortified dairy products, are expected to attract a wider customer base. Moreover, its investment in expanding distribution channels, both offline and online, will enhance its reach across urban and rural markets. Analysts forecast a share price of ₹623, supported by steady revenue growth, operational efficiency improvements, and a focus on sustainability initiatives.

Heritage Foods Share Price Target 2026: ₹754

In 2026, Heritage Foods’ focus on digital platforms and technological advancements will likely propel its growth. The company’s investments in data-driven supply chain management and customer engagement platforms are expected to enhance operational efficiency and customer satisfaction. Additionally, targeted marketing campaigns and collaborations with retail giants could further boost sales. With increasing penetration into tier-2 and tier-3 cities, the share price is projected to climb to ₹754, reflecting the positive outcomes of these strategies.

Heritage Foods Share Price Target 2027: ₹870

By 2027, Heritage Foods aims to strengthen its position as an industry innovator. The launch of new, health-oriented products and the expansion of its organic food segment will likely enhance its market share. The company’s streamlined operations and robust business model will ensure stable profitability. Furthermore, its sustained efforts in renewable energy projects, such as solar-powered milk chilling units, will not only reduce costs but also align with its sustainability goals. Analysts predict the share price could reach ₹870, driven by these combined efforts.

Heritage Foods Share Price Target 2028: ₹998

The year 2028 is expected to mark a significant milestone for Heritage Foods, as its strategic initiatives begin to yield substantial returns. The company’s diversification into renewable energy and organic food markets will likely bolster its revenue streams. Increased demand for high-quality, natural, and sustainable food products will further enhance its growth. Heritage Foods’ ability to innovate and adapt to market trends will play a crucial role in achieving a projected share price of ₹998.

Heritage Foods Share Price Target 2029: ₹1156

By 2029, Heritage Foods’ emphasis on expanding its market presence in tier-2 and tier-3 cities will likely result in a stronger consumer base. Its diversified revenue streams, including organic foods, dairy products, and renewable energy ventures, will provide financial stability and resilience against market fluctuations. The company’s consistent financial performance and strategic positioning in emerging markets are expected to drive the share price to ₹1156.

Heritage Foods Share Price Target 2030: ₹1420

By 2030, analysts anticipate that Heritage Foods will reach new heights, with a projected share price of ₹1420. The company’s long-term growth strategy, centered on innovation, diversification, and sustainability, will likely solidify its position as a market leader. Leveraging global dairy trends and strengthening its foothold in both domestic and international markets will contribute to this remarkable growth. Heritage Foods’ commitment to quality, coupled with its ability to adapt to changing consumer preferences, ensures its continued success.

Summary of Heritage Foods Share Price Target 2025 to 2030

| Year | Share Price Target (₹) |

|---|---|

| 2025 | 623 |

| 2026 | 754 |

| 2027 | 870 |

| 2028 | 998 |

| 2029 | 1156 |

| 2030 | 1420 |

Conclusion

Heritage Foods is well-positioned for sustainable growth, with a strategic focus on diversification, market expansion, and innovation. The projected share price targets from 2025 to 2030 reflect the company’s potential to capitalize on market trends and operational efficiencies. Investors seeking long-term growth opportunities may find Heritage Foods an attractive option in the Indian stock market.

Frequently Asked Questions (FAQs)

- What is Heritage Foods Share Price core business?

- Heritage Foods primarily operates in the dairy sector, offering milk, curd, butter, ghee, and value-added products. The company has also diversified into renewable energy and organic foods.

- What is the current Heritage Foods Share Price ?

- As of now, the share price of Heritage Foods stands at ₹436.

- What is the projected Heritage Foods Share Price Target in 2025?

- Analysts predict that the share price of Heritage Foods could reach ₹623 by 2025.

- What factors are driving the growth of Heritage Foods Share Price ?

- Key growth drivers include rising demand for dairy products, diversification into organic foods and renewable energy, technological advancements, and strategic market expansion.

- How does Heritage Foods Share Price stand out in the competitive market?

- Heritage Foods distinguishes itself with its focus on quality assurance, a strong presence in regional markets, and diversification into high-growth segments like organic foods and renewable energy.

- What are the key financial metrics of Heritage Foods Share Price ?

- Important metrics include a market cap of ₹4,626.34 Cr, ROE of 11.87%, ROCE of 15.48%, and a P/E ratio of 29.52. The dividend yield is 0.5%.

- How is Heritage Foods addressing sustainability?

- The company actively engages in renewable energy initiatives, such as solar and wind energy projects, and promotes sustainable farming practices.

- What is the projected Heritage Foods Share Price Target 2030?

- By 2030, the share price of Heritage Foods is anticipated to reach ₹1420.

- What are Heritage Foods’ strategic initiatives for growth?

- The company is focusing on expanding its distribution network, leveraging digital platforms, and introducing innovative, health-oriented products.

- Is Heritage Foods Share Price a good investment for long-term growth?

- Heritage Foods demonstrates strong growth potential through diversification, market expansion, and a focus on sustainability, making it an attractive option for long-term investors.

4 thoughts on “Heritage Foods Share Price Target 2025 to 2030”