Happiest Minds Share Price Target 2025 to 2030 : A Detailed Analysis

Understanding Business Model

Happiest Minds Technologies Limited is a digital transformation and IT solutions company that focuses on delivering next-generation services in areas such as cloud computing, artificial intelligence (AI), Internet of Things (IoT), and digital process automation. The company’s business model is centered around providing end-to-end digital solutions to its clients, enabling them to stay competitive in an increasingly digital world. By leveraging emerging technologies, Happiest Minds aims to drive innovation and efficiency for its clients across various industries.

Key Metrics of Happiest Minds Share

| Metric | Value |

|---|---|

| Market Cap | ₹11,024.70 Cr. |

| Return on Equity (ROE) | 21.41% |

| Return on Capital Employed (ROCE) | 22.82% |

| Price-to-Earnings (P/E) Ratio | 51.07 |

| Price-to-Book (P/B) Ratio | 7.34 |

| Dividend Yield | 0.79% |

| Book Value | ₹98.69 |

| Face Value | ₹2 |

| Earnings Per Share (EPS) (TTM) | ₹14.18 |

| 52-Week High | ₹959.95 |

| 52-Week Low | ₹716.25 |

Shareholding Pattern

| Category | Percentage |

|---|---|

| Retail & Other | 46.26% |

| Promoters | 44.22% |

| Foreign Institutions | 5.33% |

| Mutual Funds | 2.66% |

| Other Domestic Institutions | 1.52% |

Happiest Minds Share Price Chart of Last 5 years

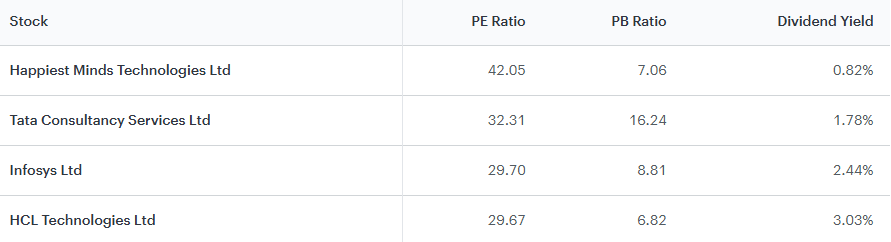

Peers & Comparison

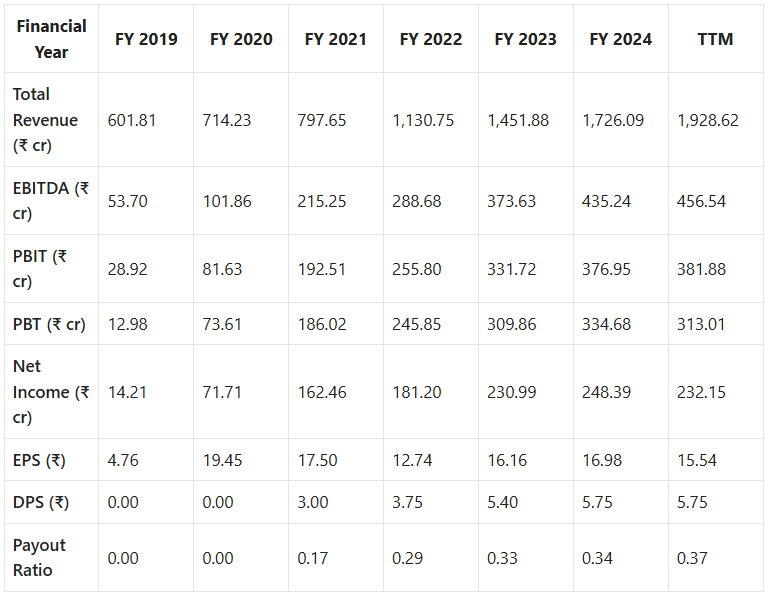

Income Statement

Over the last five years, Happiest Minds has demonstrated impressive financial performance:

- Revenue Growth: The company’s revenue has grown at a yearly rate of 23.46%, significantly outperforming the industry average of 11.42%. This higher-than-industry revenue growth indicates the company’s increasing market share and its ability to attract and retain clients.

- Market Share: Happiest Minds’ market share has increased from 0.13% to 0.22% over the last five years, reflecting its expanding presence in the IT services sector.

- Net Income Growth: The company’s net income has grown at a remarkable yearly rate of 77.22%, compared to the industry average of 9.24%. This substantial growth in net income underscores the company’s operational efficiency and profitability.

- EPS (Earnings Per Share) and DPS (Dividend Per Share) are in ₹.

- All other financial figures except the Payout Ratio are in ₹ crores.

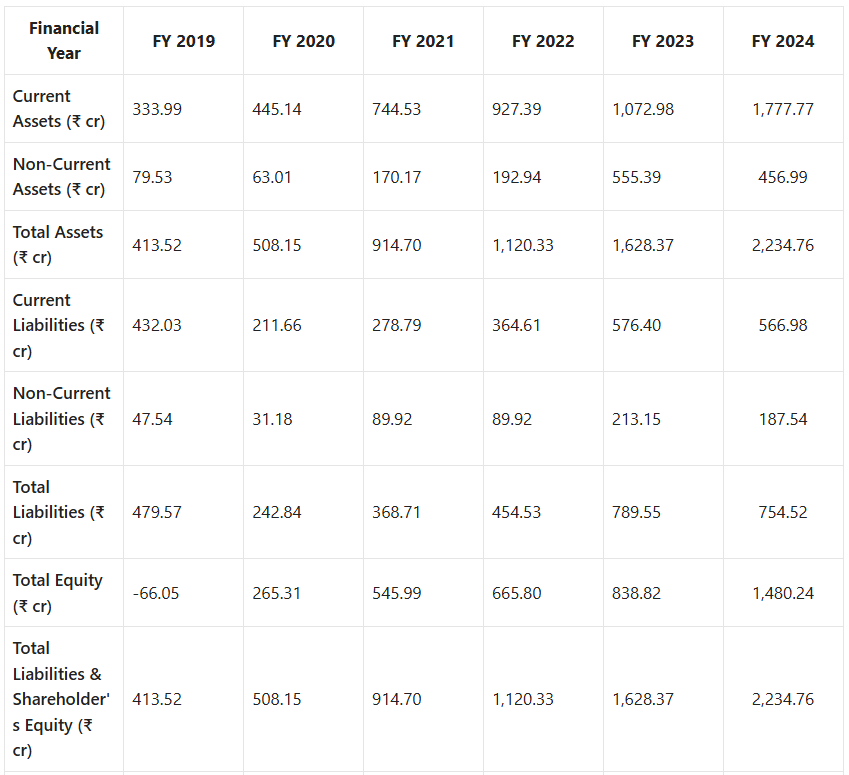

Balance Sheet

An analysis of Happiest Minds’ balance sheet reveals the following insights:

- Debt-to-Equity Ratio: Over the last five years, the company’s debt-to-equity ratio has been 42.8%, higher than the industry average of 14.83%. A higher ratio indicates a greater reliance on debt financing, which could pose risks if not managed prudently.

- Current Ratio: The company’s current ratio has been 246.28%, compared to the industry average of 221.24%. A higher current ratio suggests a strong liquidity position, indicating the company’s ability to meet its short-term obligations.

- Shares Outstanding Numbers in crores.

- Other Numbers are in ₹ crores.

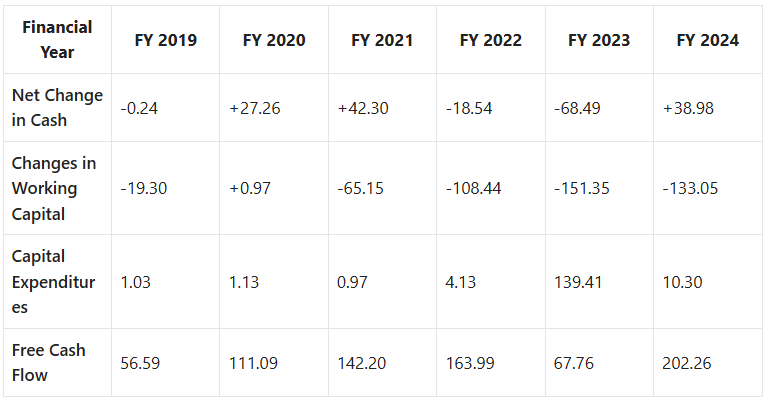

Cash Flow Statement

Happiest Minds has demonstrated strong cash flow management:

- Free Cash Flow Growth: Over the last five years, the company’s free cash flow has grown by 29.01%, surpassing the industry average of 13.86%. This growth indicates the company’s ability to generate cash after accounting for capital expenditures, which is crucial for funding expansion and returning value to shareholders.

All numbers are in ₹ crore.

Fundamental Analysis

- Company OverviewHappiest Minds Technologies Limited, founded in 2011, has established itself as a prominent player in the digital transformation space. The company’s services encompass digital business solutions, product engineering, infrastructure management, and security services. With a focus on emerging technologies, Happiest Minds caters to a diverse clientele across industries such as retail, manufacturing, banking, and healthcare.

- Financial Health

- Debt Analysis: While the company’s debt-to-equity ratio is higher than the industry average, it is essential to assess the nature and terms of the debt. If the debt is being utilized for strategic investments that yield higher returns, it could be beneficial for the company’s growth.

- Cash Flow: The positive growth in free cash flow indicates that the company generates sufficient cash to fund its operations and investments without relying heavily on external financing.

- Liquidity: A current ratio above the industry average suggests that Happiest Minds maintains a healthy liquidity position, ensuring it can meet its short-term liabilities.

- Competitive AnalysisIn the competitive landscape of IT services, Happiest Minds differentiates itself through its focus on digital transformation and emerging technologies. The company’s agility and specialized expertise enable it to compete effectively with larger firms. Its commitment to innovation and customer-centric approach has resulted in high client satisfaction and retention rates.

- Growth Prospects

- Market Trends: The global demand for digital transformation services is on the rise, driven by advancements in technology and the need for businesses to stay competitive. Happiest Minds is well-positioned to capitalize on these trends, given its expertise in areas like AI, cloud computing, and IoT.

- Strategic Initiatives: The company’s vision to achieve $1 billion in revenues by 2031 reflects its ambitious growth plans. Initiatives such as the creation of a Generative AI business unit and the establishment of new industry groups demonstrate its proactive approach to capturing emerging opportunities.

Key Factors Impacting Share Price

- Financial Performance: Happiest Minds Technologies has demonstrated robust financial growth, with a year-over-year revenue increase of 34.4%, reporting revenues of ₹356 crores, and maintaining a superior EBITDA margin of 26.3% . Consistent revenue growth and strong profitability metrics are pivotal in enhancing investor confidence and driving share price appreciation.

- Industry Positioning: Specializing in digital transformation services, Happiest Minds is well-positioned to capitalize on the increasing global demand for digital solutions. The company’s focus on emerging technologies such as AI, cloud computing, and IoT aligns with market trends, potentially leading to sustained growth.

- Market Sentiment and Analyst Projections: Analyst consensus indicates a positive outlook for Happiest Minds, with a target average share price of ₹1,116.50, representing an anticipated uptick from current levels . Such projections can influence investor sentiment and impact share price movements.

- Macroeconomic Factors: Global economic conditions, currency fluctuations, and policy changes can affect the IT sector. Happiest Minds’ ability to navigate these macroeconomic variables will play a crucial role in its share price trajectory.

- Technological Advancements: The rapid evolution of technology necessitates continuous innovation. Happiest Minds’ commitment to staying at the forefront of technological developments will be instrumental in maintaining its competitive edge and supporting share price growth.

Happiest Minds Share Price Target 2025 to 2030 : Detailed Yearly Analysis

Happiest Minds Share Price Target 2025

Target 1: ₹750

This target is based on the company’s expansion into high-demand sectors like IoT and cloud solutions. With a projected P/E ratio exceeding 50 and an ROE of 24%, Happiest Minds is expected to experience steady growth, positioning it as a strong long-term investment

Target 2: ₹850

Analyst consensus maintains a price target of ₹816, reflecting a stable outlook despite minor downgrades in earnings per share forecasts

Happiest Minds Share Price Target 2026

Target 1: ₹900

Building on its previous successes, Happiest Minds is anticipated to continue its upward trajectory, driven by sustained demand for digital transformation services.

Target 2: ₹1,000

Optimistic projections suggest the company could reach the ₹1,000 mark, assuming continued innovation and market expansion.

Happiest Minds Share Price Target 2027

Target 1: ₹1,100

As the digital landscape evolves, Happiest Minds’ investments in emerging technologies are expected to yield significant returns, pushing the share price to ₹1,100.

Target 2: ₹1,200

In a more bullish scenario, the share price could climb to ₹1,200, reflecting strong market positioning and financial performance.

Happiest Minds Share Price Target 2028

Target 1: ₹1,300

The company’s strategic initiatives and expanding client base are projected to drive the share price to ₹1,300.

Target 2: ₹1,400

With favorable market conditions, the share price could reach ₹1,400, indicating robust growth prospects.

Happiest Minds Share Price Target 2029

Target 1: ₹1,500

Continued success in delivering innovative solutions is expected to result in a share price of ₹1,500.

Target 2: ₹1,600

Aggressive growth strategies may propel the share price to ₹1,600.

Happiest Minds Share Price Target 2030

Target 1: ₹1,700

By 2030, Happiest Minds is anticipated to reach new heights, with a share price target of ₹1,750.99. As the demand for digital transformation accelerates globally, the company’s deep focus on AI, digital services, and cloud computing will drive substantial growth

Target 2: ₹1800

Alternative forecasts predict a share price of ₹1,253.14 by January 25, 2030, based on technical market analysis.

Summary of Happiest Minds Share Price Target 2025 to 2030

| Year | Target 1 (₹) | Target 2 (₹) |

|---|---|---|

| 2025 | 750 | 850 |

| 2026 | 900 | 1,000 |

| 2027 | 1,100 | 1,200 |

| 2028 | 1,300 | 1,400 |

| 2029 | 1,500 | 1,600 |

| 2030 | 1,700 | 1,800 |

Conclusion

Happiest Minds Technologies is poised for significant growth between 2025 and 2030, driven by its strategic focus on digital transformation and emerging technologies. While projections vary, the overall outlook remains positive. Investors should monitor the company’s financial performance, industry developments, and macroeconomic factors to make informed decisions.

FAQs on Happiest Minds Share Price Target 2025 to 2030

1. What is Happiest Minds Technologies Limited?

Happiest Minds Technologies Limited is an IT services company that specializes in digital transformation, cloud computing, artificial intelligence (AI), the Internet of Things (IoT), and other emerging technologies.

2. What factors influence Happiest Minds’ share price?

Key factors affecting the share price include financial performance, industry positioning, market sentiment, macroeconomic conditions, and technological advancements.

3. What is the expected share price of Happiest Minds in 2025?

The projected share price for 2025 ranges from ₹750 to ₹850, depending on market conditions and company performance.

4. Will Happiest Minds’ share price grow in the coming years?

Analyst projections suggest a steady increase, with potential share price targets reaching ₹1,800 by 2030.

5. What are the revenue growth trends of Happiest Minds?

The company has demonstrated an annual revenue growth rate of 23.46%, significantly outperforming the industry average of 11.42%.

6. How does Happiest Minds compare to its competitors?

Happiest Minds differentiates itself with a strong focus on digital transformation services and emerging technologies, allowing it to compete effectively with larger IT firms.

7. What are the major risks associated with investing in Happiest Minds?

Potential risks include a high debt-to-equity ratio, industry competition, macroeconomic uncertainties, and evolving technology trends.

8. What is Happiest Minds’ market capitalization?

As of the latest data, Happiest Minds has a market cap of approximately ₹11,024.70 crore.

9. How is Happiest Minds’ financial health?

The company has shown strong financial performance, with consistent revenue and net income growth, a healthy free cash flow, and an above-average current ratio.

10. Is Happiest Minds a good long-term investment?

Given its strong market positioning, innovation-driven approach, and financial growth, Happiest Minds is considered a promising long-term investment, though investors should assess risks and market conditions regularly.

4 thoughts on “Happiest Minds Share Price Target 2025 to 2030”