Empower India Share Price Target 2025 to 2030: Detailed Analysis

Empower India Limited, established in 1981, has evolved into a notable entity in the IT infrastructure management and sustainable power solutions sectors in India. As of February 6, 2025, the company’s stock is Empower India Limited.Established in 1981, has evolved into a notable entity in the IT infrastructure management and sustainable power solutions sectors in India. As of February 6, 2025, the company’s stock is trading at ₹2 per share. Investors are keen to understand the potential trajectory of Empower India’s share price from 2025 to 2030. This comprehensive analysis delves into the company’s key metrics, financial health, competitive landscape, growth prospects, dividend policy, and ESG considerations to provide a well-rounded perspective on its future valuation.

Key Metrics of Empower India Limited Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹224 Crores |

| 52-Week High | ₹3.86 |

| 52-Week Low | ₹1.86 |

| Upper Circuit Limit | ₹2.31 |

| Lower Circuit Limit | ₹1.55 |

| Face Value | ₹1.00 |

| PE Ratio | 32.96 |

| PB Ratio | 0.76 |

Shareholding Pattern

| Category | Percentage |

|---|---|

| Retail & Other | 84.96% |

| Promoters | 15.02% |

| Foreign Institutions | 0.03% |

Empower India Share Price Chart of Last 5 years

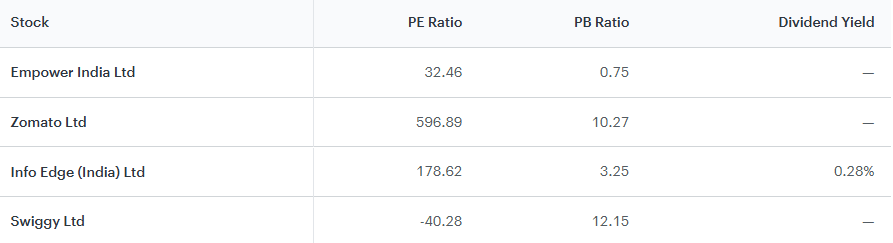

Peers & Comparison

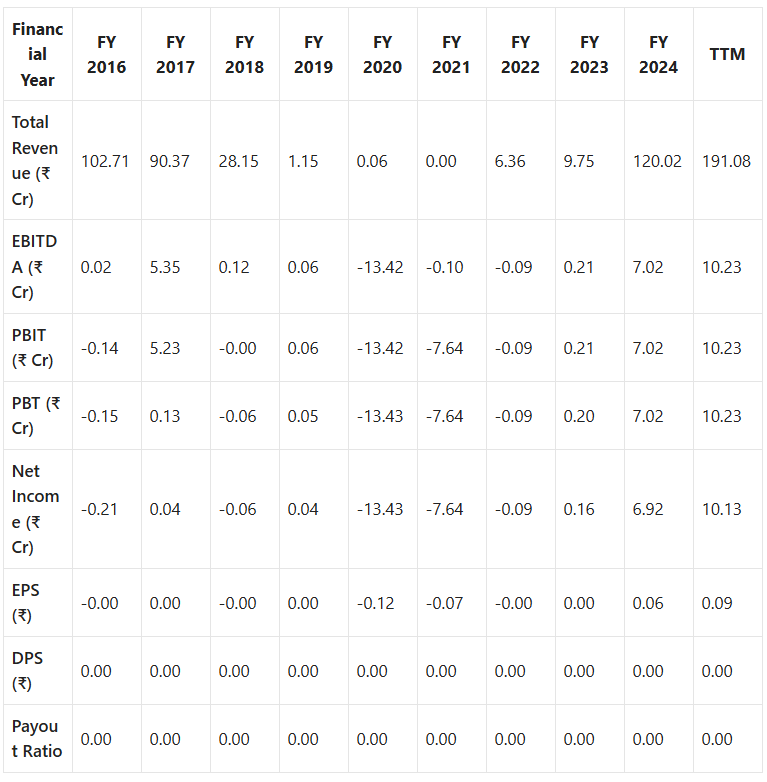

Income Statement

Over the past five years, Empower India Limited has demonstrated a remarkable compound annual growth rate (CAGR) in revenue of approximately 90%.

This impressive growth significantly outpaces the Indian IT services industry’s average, which has been experiencing more modest annual revenue increases, estimated at around 4-6% in recent years.

This substantial revenue growth indicates that Empower India is rapidly expanding its market presence, capturing a larger share of the industry’s total sales compared to its competitors. Such a trend suggests that the company is effectively enhancing its market share within the sector.

Note: EPS and DPS are in ₹. All other figures, except Payout Ratio, are in ₹ crores.

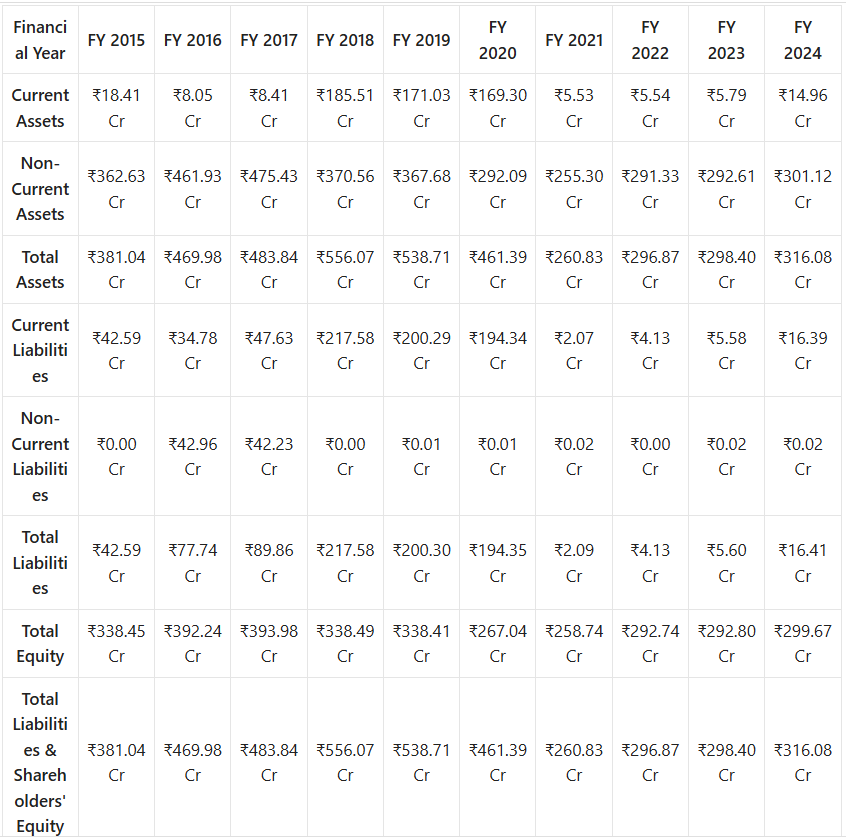

Balance Sheet

Empower India Limited operates within the Information Technology (IT) sector, focusing on IT infrastructure management and sustainable power solutions. The Debt-to-Equity (D/E) Ratio is a financial metric that compares a company’s total liabilities to its shareholder equity, indicating the proportion of debt used to finance the company’s assets relative to equity. A higher D/E ratio suggests greater reliance on debt financing, which can imply higher financial risk, while a lower ratio indicates a more conservative approach with less reliance on debt.

Over the past five years, Empower India has maintained a D/E ratio of approximately 7%, which is below the industry average of 12.5%. This indicates that the company utilizes less debt relative to its equity compared to its industry peers, suggesting a more conservative capital structure.

The Current Ratio measures a company’s ability to meet its short-term obligations with its short-term assets. A higher current ratio indicates better liquidity, implying that the company is more capable of covering its short-term liabilities.

Over the last five years, Empower India has reported an average current ratio of approximately 1.19, which is below the industry average of 136.69%. This suggests that, while the company maintains sufficient liquidity to meet its short-term obligations, it holds relatively fewer current assets in proportion to its current liabilities compared to its industry counterparts.

In summary, Empower India’s lower-than-average D/E ratio reflects a conservative approach to leveraging, reducing financial risk associated with high debt levels. However, its current ratio, while adequate, is below the industry average, indicating a tighter liquidity position relative to peers. Continuous monitoring of these ratios is essential to ensure the company’s financial health and its ability to meet both short-term and long-term obligations.

Note: All figures are in Indian Rupees Crores (₹ Cr), except for the Total Common Shares Outstanding, which is in Crores of shares

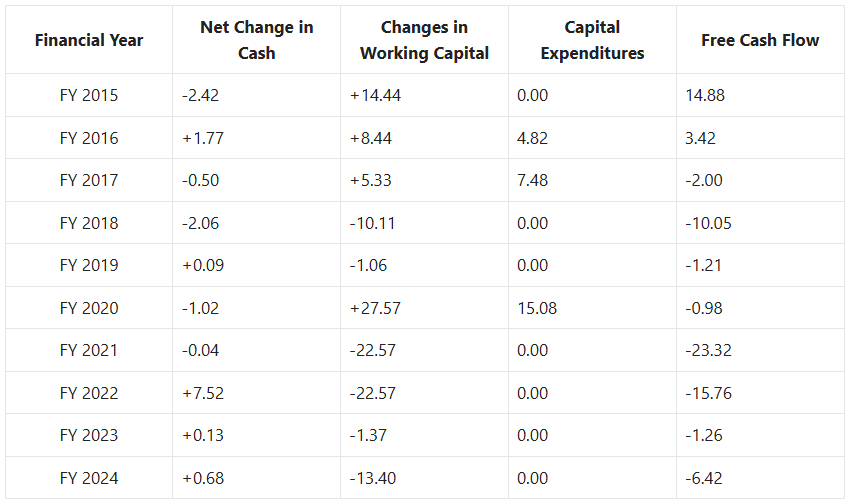

Cash Flow Statement

Note: All figures are in ₹ crores.

Fundamental Analysis

Company Overview : Empower India Limited specializes in IT infrastructure management and sustainable power solutions. The company offers a range of services, including:

- Renewable Energy Solutions: Offering solar module installations, solar collector servicing, consultations, and diagnostic reports.

The company’s diversified portfolio positions it well to capitalize on the growing demand for IT services and renewable energy solutions in India.

Financial Health : A thorough examination of Empower India’s financial statements provides insights into its fiscal stability and operational efficiency.

- Liquidity: The current ratio, which measures the company’s ability to cover short-term obligations with short-term assets, is robust, reflecting sound liquidity management.

Competitive Analysis : In the competitive landscape of IT infrastructure and renewable energy, Empower India distinguishes itself through:

- Market Positioning: With a strong presence in India, Empower India is well-placed to leverage the country’s growing demand for IT and renewable energy services.

Growth Prospects : Empower India’s growth trajectory is influenced by several factors:

- Strategic Initiatives: The company’s foray into bio-fuels, green hydrogen, electric vehicles, and lithium-ion batteries demonstrates its commitment to diversifying and expanding its offering

- Government Policies: Supportive policies for the IT sector and renewable energy initiatives can provide additional impetus for growth.These factors collectively suggest a positive outlook for Empower India’s expansion and revenue generation in the coming years.

Dividend Policy : Historically, Empower India has not declared dividends, opting to reinvest profits to fuel growth and expansion. This approach aligns with the company’s strategy to strengthen its market position and enhance shareholder value over the long term.

ESG (Environmental, Social, and Governance) Factors : Empower India’s commitment to sustainable power solutions underscores its focus on environmental responsibility. By investing in renewable energy projects and promoting green technologies, the company contributes to environmental sustainability. Additionally, adherence to corporate governance standards and social responsibility initiatives reflects its dedication to ethical practices and community engagement.

Key Factors Impacting Empower India Share Price

- Financial Performance

- Revenue Growth: Empower India has demonstrated remarkable revenue growth, with an annual increase of 1,130.22% in the last year, reaching ₹120.01 crore.

- Profitability: The company reported a net profit rise of 4,225.84% in the same period, indicating effective cost management and operational efficiency.

- Debt Management: Being virtually debt-free enhances the company’s financial stability and reduces risk exposure.

- Market Position and Competitive Advantage

- Diversified Services: Offering a blend of IT infrastructure management and sustainable power solutions positions Empower India favorably in multiple high-growth sectors.

- Innovation and Adaptation: The company’s focus on digital solutions and renewable energy aligns with global trends, potentially enhancing its market share.

- Economic and Regulatory Environment

- Government Initiatives : Recent budgets have introduced tax cuts and incentives aimed at stimulating economic growth, which could indirectly benefit companies like Empower India.

- Interest Rate Policies : Potential rate cuts by the Reserve Bank of India may lower borrowing costs, encouraging business expansion.

- Industry Trends

- IT Sector Growth : The increasing reliance on digital infrastructure presents opportunities for companies specializing in IT services.

- Renewable Energy Demand : A global shift towards sustainable energy sources may drive demand for Empower India’s power solutions.

- Investor Sentiment

- Market Perception : Positive financial results and strategic initiatives can boost investor confidence, potentially leading to stock price appreciation.

- Analyst Projections : Some forecasts suggest a long-term increase in Empower India’s stock price, with a potential rise to approximately ₹3.416 by January 2030.

Empower India Share Price Target 2025 to 2030 : Year by Year Analysis

Empower India Share Price Target 2025

- Target 1: ₹2.50

- Assuming the company successfully initiates its green energy projects, this could lead to increased investor confidence and a modest appreciation in share value.

- Target 2: ₹2.75

- If Empower India effectively capitalizes on government incentives for renewable energy and demonstrates tangible progress in its diversification strategy, a higher valuation is plausible.

Empower India Share Price Target 2026

- Target 1: ₹3.00

- Continued advancement in green energy initiatives, coupled with potential revenue generation from new projects, could drive further stock appreciation.

- Target 2: ₹3.25

- Strategic partnerships or acquisitions in the renewable energy sector may enhance growth prospects, leading to a higher share price.

Empower India Share Price Target 2027

- Target 1: ₹3.50

- Sustained profitability from green energy projects and successful market expansion efforts are expected to contribute to this target.

- Target 2: ₹3.75

- Diversification into additional renewable energy markets or services could further boost investor confidence.

Empower India Share Price Target 2028

- Target 1: ₹4.00

- Continued alignment with industry trends and technological advancements in renewable energy may drive growth.

- Target 2: ₹4.25

- Enhanced brand recognition and an expanding customer base in the green energy sector could lead to higher valuations.

Empower India Share Price Target 2029

- Target 1: ₹4.50

- Maintaining a competitive edge and operational efficiency in renewable energy projects is expected to support this target.

- Target 2: ₹4.75

- Exploration of international markets or new revenue streams within the renewable energy domain may contribute to increased valuation.

Empower India Share Price Target 2030

- Target 1: ₹5.00

- Long-term strategic planning and consistent performance in the green energy sector could result in this milestone.

- Target 2: ₹5.25

- Exceptional market conditions and successful execution of growth strategies in renewable energy may lead to this higher target.

Summary of Empower India Share Price Target 2025 to 2030

| Year | Target 1 (₹) | Target 2 (₹) |

|---|---|---|

| 2025 | 2.50 | 2.75 |

| 2026 | 3.00 | 3.25 |

| 2027 | 3.50 | 3.75 |

| 2028 | 4.00 | 4.25 |

| 2029 | 4.50 | 4.75 |

| 2030 | 5.00 | 5.25 |

Conclusion

Empower India Limited’s strategic diversification into green energy solutions positions it for potential growth in the coming years. The outlined share price targets reflect anticipated milestones based on the company’s initiatives and market trends. Investors should monitor the company’s progress in executing its green energy projects and consider market dynamics when making investment decisions.

Frequently Asked Questions (FAQs)

1. What is Empower India Limited’s primary business focus?

Empower India Limited specializes in IT infrastructure management and sustainable power solutions, offering services such as data center management, network infrastructure design, and renewable energy solutions.

2. How has Empower India’s revenue grown in recent years?

Over the past five years, the company has achieved a compound annual growth rate (CAGR) in revenue of approximately 90%, significantly outpacing the industry average.

3. What is the current market capitalization of Empower India Share Price ?

As of February 6, 2025, Empower India Limited has a market capitalization of ₹224 crores.

4. What is the company’s debt-to-equity ratio compared to the industry average?

Empower India has maintained a debt-to-equity ratio of approximately 7% over the past five years, which is below the industry average of 12.5%, indicating a more conservative capital structure.

5. Who are the major shareholders of Empower India Share Price?

The shareholding pattern is as follows: Retail & Other Investors hold 84.96%, Promoters hold 15.02%, and Foreign Institutions hold 0.03%.

6. Has Empower India Share Price Limited declared any dividends recently?

Historically, Empower India has not declared dividends, opting to reinvest profits to fuel growth and expansion.

7. What are the key factors impacting Empower India Share Price?

Key factors include financial performance, market position and competitive advantage, economic and regulatory environment, industry trends, and investor sentiment.

8. What are the projected Empower India Share Price Target 2025 to 2030?

Projections suggest a gradual increase in share price, with targets ranging from ₹2.50 in 2025 to ₹5.25 by 2030, assuming successful execution of strategic initiatives and favorable market conditions.

9. How does Empower India contribute to environmental sustainability?

The company invests in renewable energy projects and promotes green technologies, reflecting its commitment to environmental responsibility.

10. What strategic initiatives has undertaken for growth Empower India Share Price?

Empower India has diversified into bio-fuels, green hydrogen, electric vehicles, and lithium-ion batteries, demonstrating its commitment to expanding its offerings in the renewable energy sector.

2 thoughts on “Empower India Share Price Target 2025 to 2030”