Comfort Intech Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

Comfort Intech is a diversified financial and investment services company engaged in activities such as trading, commodity services, and investment advisory. The company focuses on offering financial solutions across various segments, including retail and corporate clients. Through its strong market presence and strategic alliances, Comfort Intech aims to create value for stakeholders by leveraging its expertise in financial services, risk management, and investment strategies.

The company generates revenue primarily through:

- Trading Operations: Revenue from trading in securities and commodities.

- Investment Income: Returns from long-term investments in equity and debt markets.

- Advisory Services: Revenue from financial and investment consulting.

Key Metrics of Comfort Intech Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹278 Crore |

| Book Value | ₹5.19 |

| PE Ratio | 16.3 |

| Dividend Yield | 0.70% |

| ROCE | 6.51% |

| ROE | 11.9% |

| 52-Week High | ₹12.28 |

| 52-Week Low | ₹4.25 |

Comfort Intech Share PriceChart of Last 5 years

Peers & Comparison

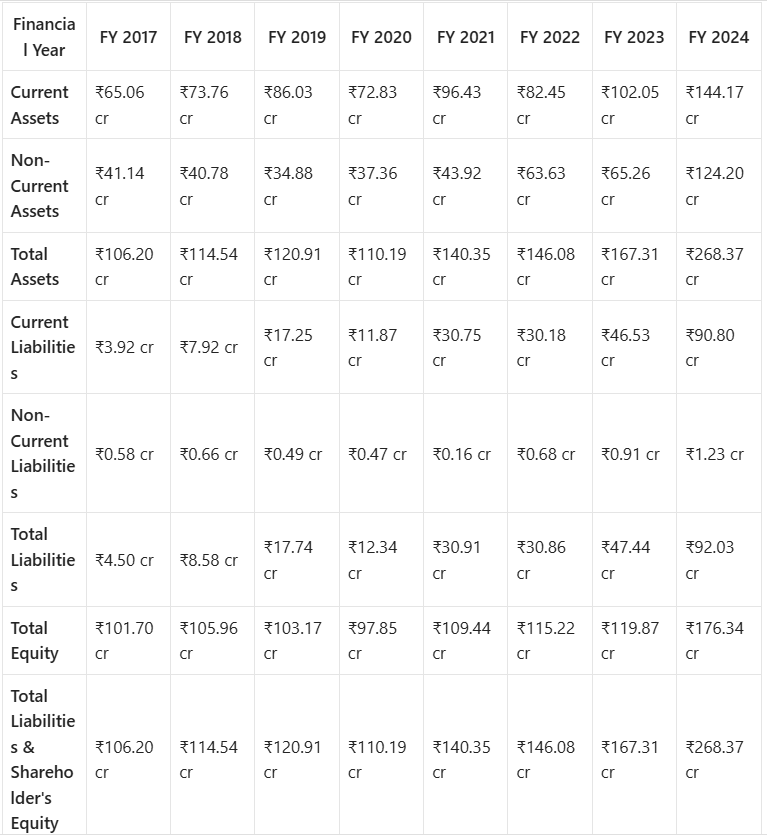

Balance Sheet

Debt to Equity Ratio

The Debt to Equity Ratio indicates the proportion of a company’s total liabilities to its shareholders’ equity, reflecting the extent to which a company relies on debt for financing its operations versus using its own funds.

Over the past 5 years, the company’s debt to equity ratio has been 7.89%, significantly lower than the industry average of 347.88%.

Here is the financial data in column format:

Cash Flow Statement

Current Ratio

The Current Ratio measures a company’s ability to cover its short-term liabilities with its short-term assets. A higher ratio is generally better, indicating stronger liquidity.

Over the past 5 years, the company’s current ratio has been 315.69%, well above the industry average of 65.46%.

Fundamental Analysis

1. Company Overview

Comfort Intech has established itself in India’s financial services sector with a focus on delivering sustainable growth and shareholder value. The company’s diversified portfolio and strategic investments have contributed to its steady performance. Its strong network, risk management framework, and customer-centric approach have made it a reliable player in its segment.

2. Financial Health

Debt Analysis

Comfort Intech maintains a conservative approach to debt. Its debt-to-equity ratio remains low, indicating prudent financial management. This ensures the company’s ability to meet obligations while minimizing financial risks.

Cash Flow

The company’s cash flow statements reflect steady operational inflows. Positive cash flows from operations highlight its efficiency in generating revenue and managing expenses, enabling reinvestment for growth.

Liquidity

Comfort Intech has a robust liquidity position supported by a healthy cash reserve and liquid assets. This enhances its ability to navigate market uncertainties and seize growth opportunities.

3. Competitive Analysis

Comfort Intech competes with established financial firms and newer fintech companies. Its key competitors include:

- Traditional Financial Institutions: Competing in investment and advisory services.

- Fintech Startups: Challenging with innovative digital solutions.

Despite competition, Comfort Intech’s focus on a balanced portfolio and strategic investments gives it an edge in delivering consistent performance.

4. Growth Prospects

Market Trends

- Rising Demand for Financial Services: With increasing financial literacy and digital penetration, the demand for investment and advisory services is expected to grow.

- Digital Transformation: Integration of technology in operations offers scalability and efficiency.

Strategic Initiatives

- Portfolio Diversification: Comfort Intech is focusing on expanding its portfolio to include emerging asset classes.

- Customer-Centric Approach: Enhanced focus on customer satisfaction through personalized services.

- Technology Integration: Adopting advanced analytics and AI-driven tools to improve decision-making and operations.

5. Dividend Policy

Comfort Intech’s dividend policy reflects its commitment to rewarding shareholders while maintaining reserves for future growth. With a current dividend yield of 0.70%, the company balances investor returns with sustainable business expansion.

6. ESG (Environmental, Social, and Governance) Factors

Comfort Intech’s commitment to ESG principles is evident in its ethical governance and sustainable investment practices. The company’s focus on transparency, employee welfare, and community initiatives enhances its appeal to socially responsible investors.

Key Factors Impacting Comfort Intech Share Price

1. Economic Growth

The financial services sector—a key domain of Comfort Intech—is inherently tied to the health of the broader economy. Strong GDP growth fosters increased consumer spending and higher disposable incomes, leading to greater demand for investment and financial advisory services. Comfort Intech, with its diversified portfolio, stands to benefit from such economic expansion. Conversely, economic slowdowns or recessions could adversely impact its growth trajectory, as reduced investor confidence and spending tighten the market.

2. Market Sentiment

Investor sentiment plays a pivotal role in shaping the share price of companies in the financial services sector. Positive market conditions, coupled with favorable government policies, often result in increased investments in equity markets and related financial products. Comfort Intech’s share price is likely to rise during such times. However, negative sentiment driven by global events, market volatility, or financial crises could lead to a temporary dip in the company’s valuation.

3. Technological Advancements

The adoption of innovative technologies is becoming increasingly critical for financial service providers to stay competitive. Comfort Intech’s ability to integrate advanced analytics, AI-driven decision-making tools, and secure digital platforms can significantly enhance its operational efficiency and customer experience. Such advancements not only reduce operational costs but also attract a tech-savvy clientele, bolstering the company’s share price. Companies that lag in technological adoption risk losing market share to more innovative competitors.

4. Regulatory Environment

The financial services industry operates within a framework of stringent regulations, and any changes in these laws can directly impact Comfort Intech’s operations. For example, tax incentives for investments can encourage more individuals to engage with financial advisory services, boosting the company’s revenue. Conversely, stricter compliance requirements or unfavorable regulatory changes could increase operational costs and limit profitability. Comfort Intech’s ability to navigate this regulatory landscape efficiently will be a determining factor in maintaining investor confidence.

5. Competitive Landscape

Comfort Intech operates in a highly competitive market, with established financial institutions and innovative fintech startups vying for market share. Its ability to differentiate through superior customer service, cost-effective solutions, and strategic partnerships will significantly influence its market position. Developing a robust competitive edge through innovation and diversification will be critical for sustaining long-term growth and ensuring positive share price performance.

6. Global Economic Factors

As a company involved in financial and investment services, Comfort Intech’s performance is also influenced by global economic trends. Factors such as international trade policies, currency fluctuations, and global financial market conditions can have a direct or indirect impact on its operations and share price. For instance, a favorable global economic environment can enhance cross-border investments and revenue opportunities, while global recessions or geopolitical tensions can pose risks.

7. Consumer Behavior and Financial Literacy

The increasing awareness and adoption of financial planning and investment among consumers contribute to the growth of companies like Comfort Intech. Higher financial literacy rates lead to a broader client base and increased demand for advisory and investment services. Educating and engaging with this growing audience can significantly enhance the company’s market presence and drive its share price upward.

Comfort Intech Share Price Target 2025 to 2030: Expanded Analysis

Comfort Intech Share Price Target 2025

By 2025, Comfort Intech’s focus on portfolio diversification and digital transformation is likely to play a pivotal role in its growth. The company’s strategic initiatives in streamlining operations and adopting advanced technologies will enhance productivity and cost efficiency. Additionally, the rising demand for financial services across India, coupled with increased investor confidence, could drive the share price to approximately ₹16. This target reflects a combination of steady revenue growth, controlled operational costs, and favorable macroeconomic conditions.

Comfort Intech Share Price Target 2026

Moving into 2026, Comfort Intech is expected to leverage its market position further by diversifying into high-growth segments and strengthening its digital capabilities. This year may witness a significant focus on customer acquisition and retention through personalized financial services. The company’s ability to capitalize on emerging market trends—such as an increasing preference for digital investment platforms—may propel its share price to around ₹18. Enhanced operational efficiency and strategic alliances will likely support this upward trajectory.

Comfort Intech Share Price Target 2027

By 2027, Comfort Intech’s investments in emerging asset classes such as fintech integration, alternative investments, and structured financial products are anticipated to yield substantial returns. The company’s growing customer base and improved service offerings will create a competitive edge in the market. Efforts to penetrate untapped regions and expand its client portfolio could contribute significantly to revenue growth. The share price for this period is projected to reach ₹20, reflecting the cumulative benefits of strategic execution and market expansion.

Comfort Intech Share Price Target 2028

The year 2028 is expected to mark a period of consolidation and growth for Comfort Intech as it strengthens its foothold in the industry. Strategic partnerships with leading financial institutions and technology providers may enhance its service portfolio and operational scalability. Furthermore, a stronger market presence, bolstered by a reputation for reliability and innovation, could elevate the share price to ₹22. This projection considers potential macroeconomic stability and the company’s consistent focus on growth-oriented strategies.

Comfort Intech Share Price Target 2029

As Comfort Intech continues to grow its revenue streams and improve profitability, 2029 could see a significant boost in shareholder value. The company’s focus on sustainability, governance, and long-term customer relationships will likely solidify its standing in the financial services sector. By maintaining a robust balance sheet and delivering value to stakeholders, the share price could rise to ₹24, supported by an expanding market for financial advisory and investment services.

Comfort Intech Share Price Target 2030

By 2030, Comfort Intech is poised to achieve sustained growth through continued innovation, market expansion, and strategic investments. The company’s ability to adapt to evolving market dynamics and regulatory changes will be crucial in maintaining its competitive advantage. With steady gains in market share and enhanced profitability, the share price is expected to reach approximately ₹26. This target reflects the cumulative impact of a decade of strategic focus on innovation, customer satisfaction, and financial performance.

Summary of Comfort Intech Share Price Target (2025 to 2030)

| Year | Target Price (₹) |

|---|---|

| 2025 | 16 |

| 2026 | 18 |

| 2027 | 20 |

| 2028 | 22 |

| 2029 | 24 |

| 2030 | 26 |

Conclusion

Comfort Intech’s steady growth trajectory, supported by its diversified portfolio, strategic initiatives, and market trends, positions it as a promising investment in the financial services sector. While its performance is influenced by economic and regulatory factors, the company’s focus on innovation and operational efficiency ensures long-term value creation for shareholders. Investors should consider Comfort Intech’s fundamentals and growth prospects while evaluating its potential as a part of their portfolio.

FAQs on Comfort Intech Share Price Target 2025 to 2030

1. What is the business model of Comfort Intech Share ?

Comfort Intech operates in the financial and investment services sector. It generates revenue through trading operations, investment income, and advisory services. The company serves both retail and corporate clients, focusing on portfolio diversification and leveraging its market expertise.

2. What are the key financial metrics of Comfort Intech?

Key metrics include:

- Market Capitalization: ₹278 Crore

- Book Value: ₹5.19

- PE Ratio: 16.3

- Dividend Yield: 0.70%

- ROCE: 6.51%

- ROE: 11.9%

- 52-Week High: ₹12.28

- 52-Week Low: ₹4.25

3. What is the projected Comfort Intech Share Price Target 2025 ?

By 2025, Comfort Intech’s share price is projected to reach approximately ₹16, driven by portfolio diversification, digital transformation, and favorable market conditions.

4. How does Comfort Intech plan to achieve growth by 2030?

Comfort Intech aims to grow through:

- Strategic partnerships

- Technological integration

- Diversified revenue streams

- Customer-centric approaches

- Expanding into high-growth financial segments

5. What are the growth drivers for Comfort Intech Share Price?

Key drivers include economic growth, rising demand for financial services, digital transformation, strategic partnerships, and increased financial literacy among consumers.

6. How does Comfort Intech’s dividend policy impact investors?

Comfort Intech’s dividend yield is 0.70%, reflecting its strategy to reward shareholders while maintaining reserves for sustainable business growth. This balance appeals to long-term investors seeking stability.

7. What are the main risks impacting Comfort Intech’s share price?

Risks include:

- Economic slowdowns

- Adverse regulatory changes

- High competition from fintech startups and traditional institutions

- Global market volatility

8. How does Comfort Intech leverage technological advancements?

The company integrates advanced analytics, AI-driven tools, and secure digital platforms to enhance operational efficiency, customer experience, and scalability. This technology adoption provides a competitive edge in the financial services sector.

9. What role do ESG factors play in Comfort Intech’s strategy?

Comfort Intech’s commitment to ethical governance, sustainability, and social responsibility enhances its reputation and attracts ESG-focused investors, contributing to long-term share price stability.

10. What are the projected share prices for Comfort Intech from 2025 to 2030?

The projected share prices are:

- 2025: ₹16

- 2026: ₹18

- 2027: ₹20

- 2028: ₹22

- 2029: ₹24

- 2030: ₹26 These targets are based on market trends, strategic initiatives, and financial performance.

1 thought on “Comfort Intech Share Price Target 2025 to 2030”