Berger Paints Share Price Target 2025 to 2030 : Detailed Analysis

Introduction

Berger Paints India Limited is one of the leading players in the Indian paint industry, offering a broad range of decorative and industrial paints. Over the years, the company has grown due to its diverse product portfolio, strong brand recognition, and robust distribution channels. With a share price of ₹475 as of January 31, 2025, the stock presents a compelling investment opportunity for many. This article delves into the future prospects of Berger Paints, analyzing the Berger Paints Share Price Target 2025 to 2030 based on various factors such as industry trends, company performance, and market conditions.

Key Financial Metrics of Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹51,593.86 Crore |

| Return on Equity (ROE) | 21.85% |

| Return on Capital Employed (ROCE) | 28.53% |

| Price-to-Earnings (P/E) Ratio | 52.68 |

| Price-to-Book (P/B) Ratio | 10.05 |

| Dividend Yield | 0.79% |

| Book Value per Share | ₹44.04 |

| Face Value | ₹1 |

| Earnings Per Share (EPS) (TTM) | ₹8.40 |

| 52-Week High | ₹629.60 |

| 52-Week Low | ₹438 |

Shareholding Pattern

| Category | Percentage |

|---|---|

| Promoters | 74.99% |

| Retail & Other Investors | 9.24% |

| Foreign Institutional Investors (FIIs) | 6.98% |

| Mutual Funds | 3.82% |

| Other Domestic Institutions | 4.97% |

Berger Paints Share Price Chart Of Last 5 years

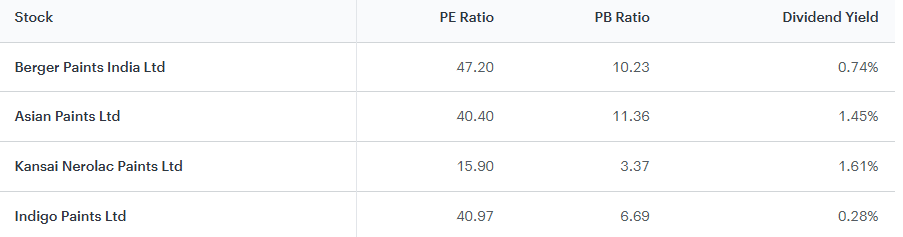

Peers & Comparison

Income Statement Analysis

Industry Comparison:

- The revenue growth of Berger Paints has outpaced the industry average, growing at a rate of 13.05% per year over the last 5 years, compared to the industry’s average of 12.54%. This indicates that Berger Paints has been more successful in driving sales growth relative to its peers in the paint industry. Higher-than-industry revenue growth represents the company’s ability to increase market share, capitalize on opportunities, and differentiate itself with products, pricing strategies, and customer acquisition tactics.

- Market Share: Despite the impressive revenue growth, Berger Paints has seen a slight decline in market share, decreasing from 19.67% to 19.55% over the past five years. While the overall revenue growth rate remains above the industry average, the company has not been able to maintain its share of the market relative to competitors. This could signal a potential risk if competitors are aggressively expanding their market share or if Berger Paints is struggling with market saturation or internal challenges.

- Net Income: Over the last five years, Berger Paints’ net income has grown at a rate of 18.76% annually, which is lower than the industry average of 20.29%. While the company has managed to increase profitability, it has underperformed relative to its peers. This may be due to higher operational costs, pricing pressures, or insufficient operational efficiency compared to industry leaders.

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

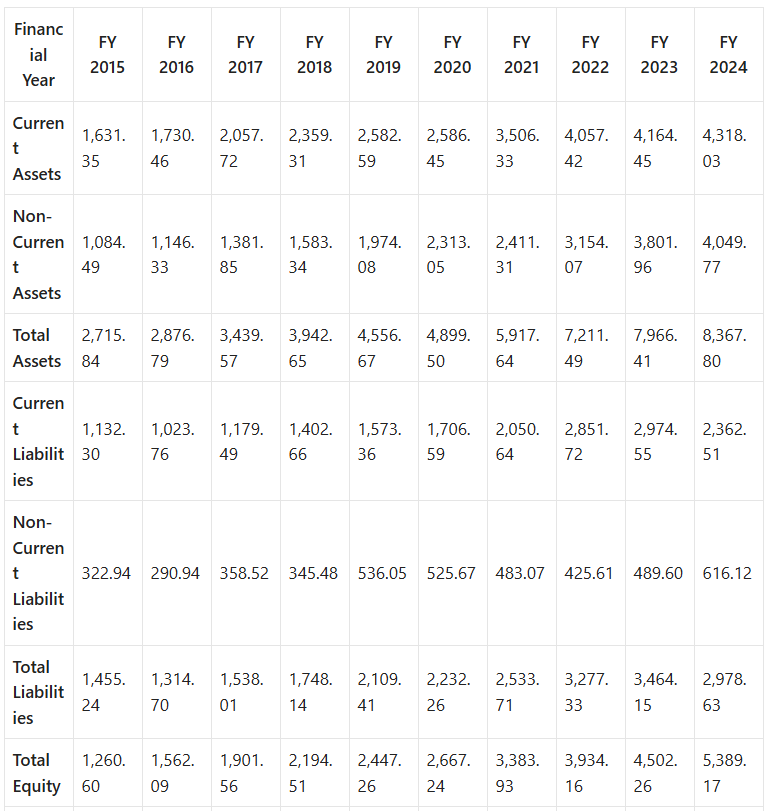

Balance Sheet Analysis

Industry Comparison:

- Debt to Equity Ratio: Berger Paints has a debt-to-equity ratio of 22.73%, which is considerably higher than the industry average of 11.53%. This suggests that the company relies more on debt financing relative to its equity base compared to its competitors. While a modest amount of debt can leverage growth, this higher ratio could raise concerns regarding financial risk, especially if the company faces challenges in maintaining stable earnings or if interest rates increase.

- Current Ratio: The current ratio for Berger Paints stands at 157.52%, which is lower than the industry’s average of 198.81%. The current ratio measures a company’s ability to cover its short-term liabilities with its short-term assets. While Berger Paints is still in a strong liquidity position, the ratio is below the industry average, which could suggest that competitors are better positioned to handle short-term financial obligations or might be more efficient in managing their working capital.

- Shares outstanding numbers are in crores (cr).

- Other numbers are in ₹ crores (cr).

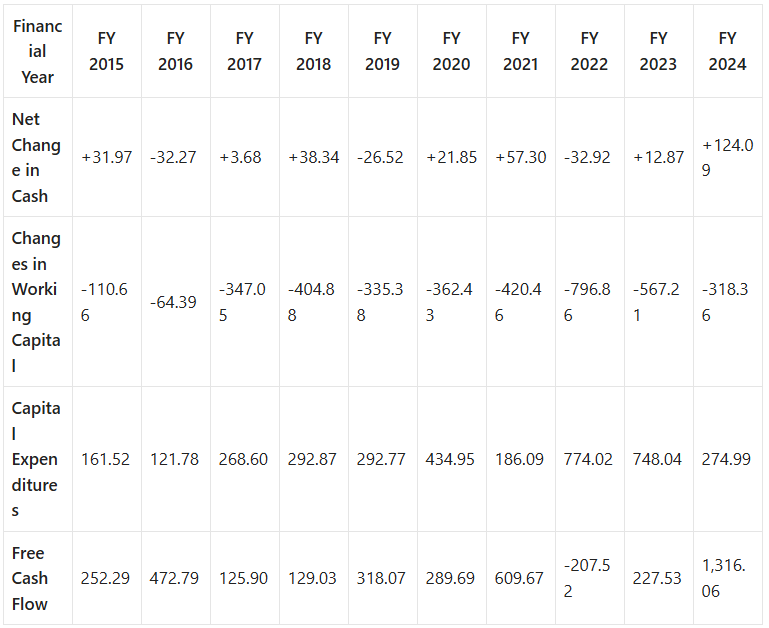

Cash Flow Statement Analysis

Industry Comparison:

- Free Cash Flow: Berger Paints has achieved a 32.85% annual growth in free cash flow over the last five years, although this is slightly below the industry average of 36.14%. Free cash flow represents the cash a company generates after accounting for capital expenditures, and an increase in free cash flow reflects strong operational efficiency and the ability to invest in future growth or return capital to shareholders. While Berger Paints is generating healthy free cash flow, its rate of growth lags behind industry peers, which may indicate missed opportunities in capital allocation or less efficient use of capital.

All numbers in ₹ cr.

Factors Influencing Berger Paints Share Price

The share price of Berger Paints, like any publicly traded company, is influenced by a variety of external and internal factors. These factors affect the company’s performance and market sentiment, which ultimately impacts its stock price. Below, we analyze in detail the key factors that could influence the share price of Berger Paints in the coming years.

1. Market Demand

As India’s economy continues to grow and urbanize, the demand for paints is expected to increase significantly. The growth in the residential, commercial, and infrastructure sectors is particularly noteworthy.

- Residential Sector: With the rise in disposable incomes, more people are investing in home improvements and new constructions. This trend drives the demand for both decorative and functional paints, such as wall paints, exterior coatings, and finishes. As the middle class expands and urbanization accelerates, more people are likely to adopt modern, aesthetically pleasing homes, further boosting the market for paints.

- Commercial Sector: The commercial real estate sector is another area where paint demand is seeing growth. New office buildings, retail spaces, and other commercial properties require high-quality paint solutions. As the Indian economy continues to expand and urban centers grow, the demand for paints in commercial spaces is expected to grow in tandem.

- Infrastructure Sector: The government’s focus on infrastructure development—including highways, bridges, ports, and urban development projects—is expected to create a strong demand for industrial coatings. Berger Paints, with its industrial segment, will benefit from these developments. As the government pushes for smart cities and urban infrastructure projects, the need for durable, weather-resistant, and eco-friendly coatings will rise.

Given these factors, market demand is likely to remain strong, which will positively impact Berger Paints’ revenue growth and share price. The company’s ability to meet this demand through consistent product innovation and efficient supply chain management will be critical.

2. Raw Material Prices

Raw material costs are a significant determinant of Berger Paints’ profitability. Paints are primarily made from chemicals, pigments, resins, and solvents, many of which are derived from crude oil or other petrochemical products. As such, fluctuations in the price of crude oil directly affect paint manufacturing costs.

- Crude Oil Prices: Given the high dependency on crude oil for the production of solvents, resins, and other chemicals, any increase in crude oil prices could lead to an increase in the cost of these raw materials. This could result in higher production costs for Berger Paints, potentially squeezing profit margins if the company is unable to pass these costs onto consumers.

- Supply Chain Disruptions: Global supply chain disruptions, especially those affecting key raw materials, can further complicate cost structures. The company will need to maintain strong supplier relationships and manage its raw material procurement strategically to mitigate the impact of price volatility.

- Pricing Power: Berger Paints’ ability to increase the prices of its products without significantly affecting demand will depend on its brand strength and market position. While the company has significant market power in India, it must balance price increases with maintaining consumer loyalty and competitive pricing against other major players like Asian Paints.

Overall, fluctuations in raw material prices are an important risk factor for Berger Paints. However, its historical ability to pass on cost increases to customers through price hikes and product differentiation will likely help the company manage these risks.

3. Competitor Strategies

Berger Paints operates in a highly competitive market dominated by key players such as Asian Paints, Kansai Nerolac, and AkzoNobel. The strategies adopted by these competitors play a significant role in shaping Berger Paints’ market share, pricing power, and overall growth.

- Market Share and Pricing Power: Asian Paints, the market leader, has a stronghold in the Indian market. Its ability to innovate, expand distribution channels, and offer a wide range of products at different price points impacts Berger Paints’ share of the market. Any shift in pricing or promotional strategies by competitors can affect Berger Paints’ competitive positioning.

- Innovation and Product Diversification: Competitors like Kansai Nerolac and Asian Paints have strong R&D divisions that work on product innovation. If these competitors introduce superior products, such as eco-friendly paints, innovative finishes, or smart coatings, it could put pressure on Berger Paints to respond with similar or better products to maintain consumer interest.

- Aggressive Marketing: Marketing plays a crucial role in the paint industry. Aggressive advertising campaigns, celebrity endorsements, and innovative marketing strategies can shift consumer preferences. Berger Paints will need to keep up with such marketing strategies to retain customer loyalty and increase brand awareness.

- Global Expansion: The international presence of competitors like AkzoNobel could pose a challenge to Berger Paints’ efforts to expand globally. Competing with international players in emerging markets could impact its growth potential and market valuation.

While Berger Paints holds a strong position in the Indian market, it must continue to innovate, offer competitive pricing, and monitor the strategies of its competitors to maintain its market share and ensure sustainable growth.

5. Technological Advancements

Technological advancements are increasingly influencing the paint industry, with innovation playing a key role in product development, manufacturing processes, and customer experience. Berger Paints’ ability to adapt to technological changes will be critical for its long-term success.

- Product Innovation: The development of new, specialized paint products—such as anti-microbial, UV-resistant, or energy-efficient paints—could open new avenues for growth. Technologies that improve the durability, aesthetic appeal, and sustainability of paints can differentiate Berger Paints from its competitors and attract premium customers.

- Smart Coatings: The adoption of smart coatings, which can change color, resist dirt, or offer other advanced features, is becoming more common in the construction industry. Berger Paints can tap into this growing trend to stay ahead of the competition.

- Automation and Manufacturing Efficiency: Technological advancements in production processes, such as automation and digitalization, can help Berger Paints reduce production costs, increase efficiency, and maintain high product quality. Investing in state-of-the-art manufacturing facilities could lead to improved margins and stronger financial performance.

- E-commerce and Digital Transformation: As e-commerce becomes increasingly popular, Berger Paints can leverage online platforms for direct consumer sales, DIY solutions, and product guidance. Investing in digital platforms for customer engagement and sales could boost the company’s overall reach and revenue generation.

6. Economic Factors

The overall economic environment plays a significant role in the performance of Berger Paints’ stock. Economic conditions, such as inflation, GDP growth, and consumer sentiment, directly impact consumer spending and business investments.

Consumer Confidence: In times of high consumer confidence, people are more likely to invest in home improvements, new constructions, and commercial properties. This would lead to higher demand for Berger Paints’ products. Conversely, during periods of economic uncertainty, consumer confidence may drop, resulting in reduced demand for paints.

Inflation: High inflation can erode consumer purchasing power, making it difficult for consumers to spend on discretionary items like home improvement products. As a result, a high inflationary environment could potentially reduce demand for paints, especially in the premium product segments.

GDP Growth: A strong GDP growth rate often correlates with increased demand for construction and home improvement, driving up the demand for paints. Conversely, in times of economic downturn, paint sales might be adversely affected as both consumers and businesses may delay spending on renovations and new projects.

Berger Paints Share Price Target 2025 to 2030 : Year by Year Analysis

Berger Paints Share Price Target 2025

For 2025, the share price target for Berger Paints is projected to be influenced by the company’s strong brand presence, expanding product range, and overall market conditions.

Target 1: ₹550 – ₹600

- Reasoning: By 2025, the Indian paint industry is expected to grow due to rising disposable incomes and an expanding real estate sector. Berger Paints is well-positioned to benefit from these trends with its extensive distribution network and consistent product innovations. The target of ₹550 to ₹600 reflects a moderate growth rate from the current price of ₹475, factoring in industry growth and the company’s own strategies.

Target 2: ₹600 – ₹650

- Reasoning: If Berger Paints successfully capitalizes on new market opportunities, such as expanding into the construction chemicals market, the share price could see a more aggressive growth trajectory. Moreover, if macroeconomic conditions remain favorable, the company could exceed the moderate growth expectations, pushing the price closer to ₹650.

Berger Paints Share Price Target 2026

In 2026, the company’s growth will likely be propelled by increased demand for its products and an expansion in the commercial and industrial sectors.

Target 1: ₹650 – ₹700

- Reasoning: With sustained demand for decorative and industrial paints, Berger Paints could reach a valuation closer to ₹650 to ₹700, supported by market stability and solid financial performance. The rise in infrastructure projects across India is expected to boost demand, contributing to higher revenues for the company.

Target 2: ₹700 – ₹750

- Reasoning: If the Indian economy experiences rapid growth, especially in construction and infrastructure, Berger Paints could outperform its expectations. This would lead to an accelerated rise in the stock price to ₹750, driven by strong earnings growth and robust demand.

Berger Paints Share Price Target 2027

By 2027, Berger Paints will likely be a market leader, with increased penetration into rural and semi-urban markets, along with new product lines.

Target 1: ₹750 – ₹800

- Reasoning: Given its strong brand and dominance in the Indian market, Berger Paints could see its stock price appreciate to ₹750 to ₹800, underpinned by its continuous market expansion and improved margins.

Target 2: ₹800 – ₹850

- Reasoning: If the company’s international business also experiences growth, alongside domestic expansion, the share price could rise more sharply, reaching ₹850, driven by increased investor confidence and higher profit margins.

Berger Paints Share Price Target 2028

By 2028, Berger Paints could significantly benefit from its foray into international markets and innovations in eco-friendly paint products.

Target 1: ₹850 – ₹900

- Reasoning: The growing demand for eco-friendly paints and coatings, coupled with new initiatives in water-based and low-VOC products, could further drive the company’s growth. The stock price could rise to ₹900 with a strong global presence and sustained domestic leadership.

Target 2: ₹900 – ₹950

- Reasoning: A combination of sustained product innovation and leadership in the premium paints segment could drive Berger Paints’ stock price to ₹950. Positive market sentiment and expanding international operations will fuel this growth.

Berger Paints Share Price Target 2029

As Berger Paints moves closer to 2030, it will benefit from its extensive market reach and premium offerings.

Target 1: ₹950 – ₹1000

- Reasoning: With the growing penetration into untapped markets and a stronghold in urban and semi-urban areas, Berger Paints’ share price could reach ₹1000, supported by a larger product portfolio, including premium segments.

Target 2: ₹1000 – ₹1100

- Reasoning: With potential global expansion and deeper market penetration in niche product categories, such as specialized coatings and eco-friendly solutions, Berger Paints could push its share price to ₹1100.

Berger Paints Share Price Target 2030

By 2030, Berger Paints’ comprehensive growth strategy, including expansion into construction chemicals, and its innovative product offerings will likely pay dividends.

Target 1: ₹1100 – ₹1200

- Reasoning: By this time, the company is expected to have a diversified revenue stream, with increased presence in international markets and a strong portfolio of innovative products. The stock price could cross ₹1200 if the company remains at the forefront of the Indian paint industry and its international ventures.

Target 2: ₹1200 – ₹1300

- Reasoning: Berger Paints could achieve a valuation of ₹1300 by 2030, if global expansion and the growing popularity of sustainable, high-performance paints help the company achieve strong growth, making it a dominant player in the global paints and coatings market.

Summary of Berger Paints Share Price Target 2025 to 2030

| Year | Target 1 | Target 2 |

|---|---|---|

| 2025 | ₹550 – ₹600 | ₹600 – ₹650 |

| 2026 | ₹650 – ₹700 | ₹700 – ₹750 |

| 2027 | ₹750 – ₹800 | ₹800 – ₹850 |

| 2028 | ₹850 – ₹900 | ₹900 – ₹950 |

| 2029 | ₹950 – ₹1000 | ₹1000 – ₹1100 |

| 2030 | ₹1100 – ₹1200 | ₹1200 – ₹1300 |

Conclusion

Berger Paints stands as a prominent player in India’s rapidly growing paint industry. The company’s robust financials, coupled with its expansion into new markets and product lines, position it well for strong growth in the coming years. The stock price of Berger Paints is expected to rise consistently from ₹475 in 2025 to ₹1300 by 2030, driven by a combination of domestic and international growth, along with its continued commitment to innovation and sustainability.

While market fluctuations and raw material costs may present short-term challenges, the long-term outlook for Berger Paints remains highly positive, and it is likely to deliver strong returns for investors over the next decade.

Frequently Asked Questions (FAQs)

1. What is Berger Paints Share Price known for?

Berger Paints is one of the leading players in the Indian paint industry, known for offering a broad range of decorative and industrial paints. The company has a strong brand presence and a robust distribution network across urban and rural markets in India.

2. What is the current Berger Paints Share Price as of January 31, 2025?

The share price of Berger Paints is ₹475 as of January 31, 2025.

3. What is the market capitalization of Berger Paints Share Price?

As of the latest data, the market capitalization of Berger Paints is ₹51,593.86 crore.

4. What is Berger Paints Share Price dividend yield?

Berger Paints offers a dividend yield of 0.79%.

5. How has Berger Paints Share Price performed in terms of revenue growth?

Berger Paints has outpaced the industry in terms of revenue growth, achieving a 13.05% annual growth rate over the last 5 years, which is higher than the industry average of 12.54%.

6. How has the net income of Berger Paints Share Price in the past five years?

Over the last five years, Berger Paints’ net income has grown at an annual rate of 18.76%, although this is slightly lower than the industry average of 20.29%.

7. What is Berger Paints Share Price debt-to-equity ratio?

The debt-to-equity ratio of Berger Paints is 22.73%, which is higher than the industry average of 11.53%.

8. What are some of the key factors influencing Berger Paints Share Price ?

Key factors influencing Berger Paints’ share price include market demand, raw material prices, competitor strategies, regulatory changes, technological advancements, and economic factors.

9. What is the projected Berger Paints Share Price Target 2025?

The projected share price target for Berger Paints by 2025 is between ₹550 to ₹600, depending on market conditions and the company’s growth strategies.

10. How does growth outlook Berger Paints Share Price looks ?

The Berger Paints Share Price is expected to rise consistently from ₹475 in 2025 to ₹1300 by 2030, driven by growth in both domestic and international markets, product innovations, and sustainability initiatives.

5 thoughts on “Berger Paints Share Price Target 2025 to 2030”