BEML Ltd Share Price Target 2025 to 2030: A Detailed Analysis of BEML Ltd

Understanding BEML Ltd’s Business Model

BEML Ltd, formerly known as Bharat Earth Movers Limited, is a prominent Indian Public Sector Undertaking (PSU) operating under the Ministry of Defence. Established in 1964, the company has diversified its operations across various sectors:

- Defence and Aerospace: Manufacturing military equipment, including vehicles and aircraft components.

- Mining and Construction: Producing heavy machinery such as bulldozers, excavators, and dump trucks.

- Rail and Metro: Supplying rolling stock for railways and metro systems, including coaches and wagons.

BEML’s diversified portfolio enables it to mitigate risks associated with dependence on a single sector, positioning it to capitalize on India’s infrastructure development and defense modernization initiatives.

Key Financial Metrics BEML Ltd Share

As of January 30, 2025, BEML Ltd’s stock is trading at ₹3,550. Below is a detailed overview of the company’s key financial metrics:

| Metric | Value |

|---|---|

| Market Capitalization | ₹15,683 Cr |

| Book Value per Share | ₹641 |

| Face Value | ₹10 |

| Price-to-Earnings (P/E) Ratio | 54.8 |

| Return on Capital Employed (ROCE) | 15.2% |

| Return on Equity (ROE) | 11.1% |

| Dividend Yield | 0.13% |

| 52-Week High | ₹5,400 |

| 52-Week Low | ₹1,905 |

These metrics indicate a robust financial standing, with a notable ROCE suggesting efficient utilization of capital. The P/E ratio reflects market optimism about the company’s future earnings potential.

Shareholding Pattern

The distribution of BEML Ltd’s shareholding is as follows:

| Category | Percentage |

|---|---|

| Promoters | 54.03% |

| Retail and Others | 21.78% |

| Mutual Funds | 16.33% |

| Foreign Institutional Investors (FII) | 5.66% |

| Domestic Institutional Investors (DII) | 2.19% |

BEML Ltd Share Price Chart of last 5years

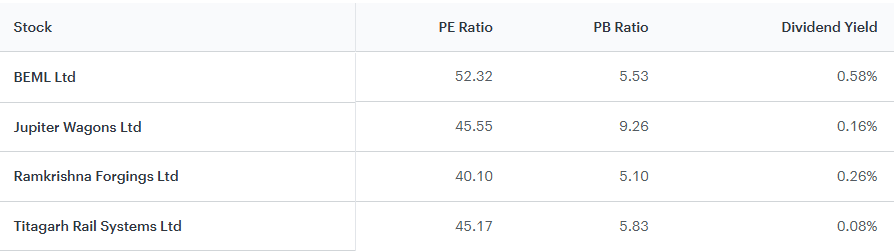

Peers & Comparison

Income Statement Analysis

Over the past five years, BEML Ltd has experienced the following financial trends:

- Revenue Growth: The company’s revenue has grown at an annual rate of 3.21%, compared to the industry average of 12.21%, indicating a slower expansion relative to peers.

- Market Share: There has been a decline in market share from 37.52% to 20.73%, suggesting increased competition or challenges in maintaining sales volumes.

- Net Income Growth: Despite slower revenue growth, net income has increased at an annual rate of 34.86%, surpassing the industry average of 34.1%, which points to improved profitability and cost management.

All other values are in ₹ crores, except for EPS and DPS, which are in ₹.

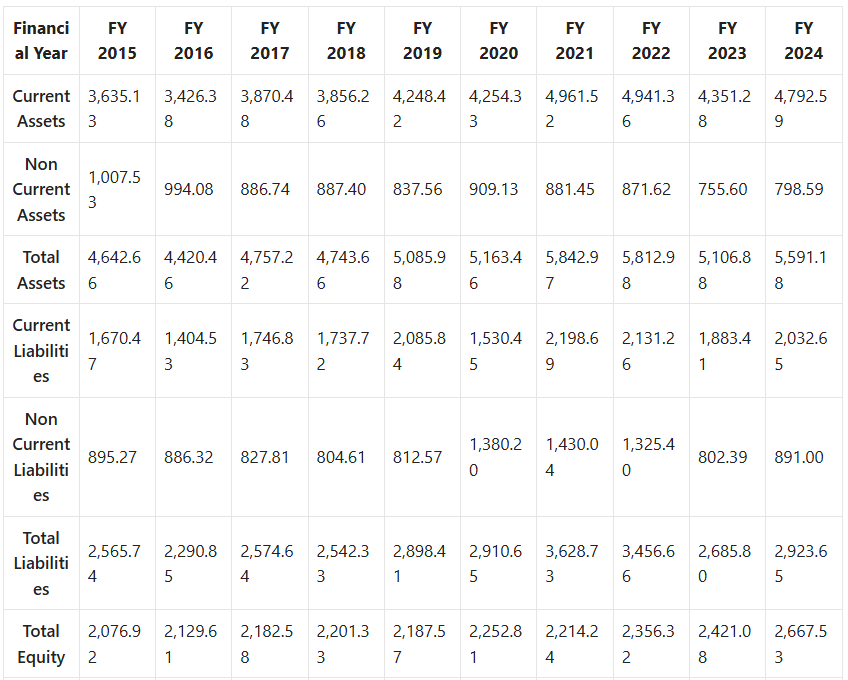

Balance Sheet Analysis

Key balance sheet metrics over the last five years include:

- Debt-to-Equity Ratio: BEML Ltd has maintained a ratio of 20.56%, lower than the industry average of 54.03%, indicating prudent financial leverage and a conservative approach to debt.

- Current Ratio: The company’s current ratio stands at 240.46%, higher than the industry average of 180.91%, reflecting strong liquidity and the ability to meet short-term obligations.

Shares outstanding numbers in crores. Other numbers are in ₹ crore.

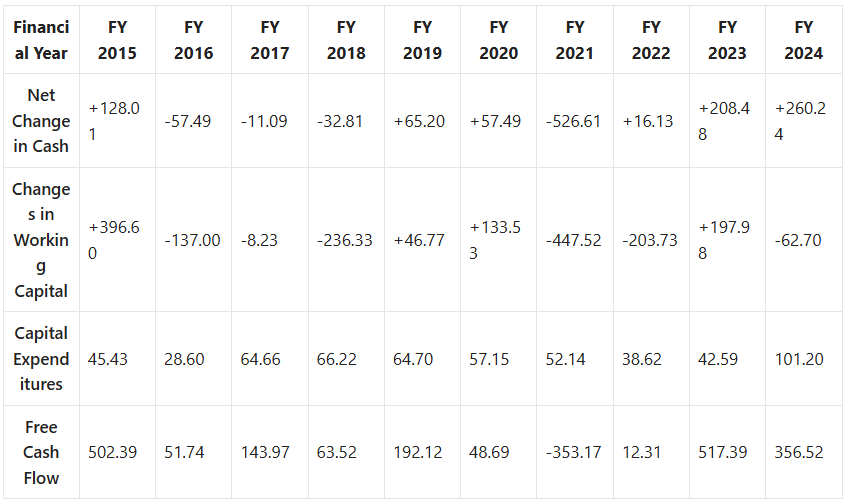

Cash Flow Statement

All numbers are in ₹ crore.

Fundamental Analysis

- Company Overview : BEML Limited, formerly known as Bharat Earth Movers Limited, is a prominent Indian public sector undertaking established in 1964. The company operates in three main segments: Mining & Construction, Defence, and Rail & Metro. BEML is renowned for manufacturing a diverse range of heavy equipment, including bulldozers, excavators, rail coaches, and metro cars, catering to both domestic and international markets. Over the years, BEML has played a pivotal role in India’s infrastructure development and defense production.

- Financial Health

- Debt Analysis : As of the fiscal year ending March 31, 2023, BEML’s total debt stood at ₹6.4 billion, resulting in a debt-to-equity ratio of 23.6%. This indicates a moderate level of leverage, suggesting that the company has been prudent in managing its debt obligations.

- Cash Flow : In FY23, BEML reported a significant improvement in its cash flow from operating activities, which stood at ₹5,634 million, a substantial increase from ₹509 million in FY22. This surge reflects enhanced operational efficiency and better working capital management. However, cash flow from financing activities was negative at ₹3,348 million, primarily due to debt repayments and dividend distributions.

- Liquidity : The company’s current ratio, a measure of its ability to cover short-term obligations, remained stable at 2.4x in FY23, consistent with the previous year. This ratio indicates a healthy liquidity position, ensuring that BEML can meet its short-term liabilities without financial strain.

- Competitive Analysis : BEML operates in a competitive landscape alongside companies like Larsen & Toubro, Tata Motors, and Caterpillar. Its diversified product portfolio across sectors such as mining, construction, defense, and railways provides a competitive edge. The company’s strong association with government projects and its established reputation for quality and reliability further bolster its market position. However, challenges persist in the form of technological advancements by competitors and the need for continuous innovation to maintain market share.

- Growth Prospects

- Market Trends : The Indian government’s focus on infrastructure development, urbanization, and modernization of the defense sector presents significant growth opportunities for BEML. Initiatives like the ‘Make in India’ campaign and increased budget allocations for infrastructure are expected to drive demand for heavy machinery and equipment. Additionally, the expansion of metro rail projects across various cities augments the demand for BEML’s rail and metro products.

- Strategic Initiatives : BEML has been actively pursuing strategic initiatives to enhance its growth trajectory. The company is focusing on research and development to introduce technologically advanced products, expanding its export markets, and exploring collaborations to diversify its product offerings. Furthermore, BEML’s efforts towards indigenization align with government policies, potentially leading to increased orders from defense and other sectors.

- Dividend Policy : BEML has maintained a consistent dividend payout policy, reflecting its commitment to shareholder returns. In FY23, the company declared a dividend payout ratio of 14.71%, indicating a balanced approach between rewarding shareholders and retaining earnings for future growth.

- ESG (Environmental, Social, and Governance) Factors : BEML is committed to sustainable practices across its operations. The company emphasizes environmental stewardship by implementing eco-friendly manufacturing processes and developing energy-efficient products. Socially, BEML engages in various corporate social responsibility initiatives, focusing on community development, education, and healthcare. On the governance front, as a public sector enterprise, BEML adheres to stringent corporate governance norms, ensuring transparency, accountability, and ethical business practices.

Key Factors Impacting BEML Ltd Share Price

Several factors are poised to influence BEML’s share price between 2025 and 2030:

- Government Policies: Changes in government spending on infrastructure and defense can significantly impact BEML’s order book and revenue.

- Economic Conditions: Economic growth, industrial activity, and investment in infrastructure projects will drive demand for BEML’s products.

- Technological Advancements: Adoption of new technologies and innovation in product offerings can enhance competitiveness and market share.

- Competitive Landscape: Actions by competitors, including pricing strategies and product development, can affect BEML’s market position.

- Regulatory Environment: Compliance with environmental and safety regulations may influence operational costs and product development.

BEML Ltd Share Price Target 2025 to 2030: Detailed Analysis

BEML Ltd Share Price Target 2025: ₹4,500 – ₹6,600

- Factors Influencing 2025 Target:

- Increased government investment in defense and infrastructure.

- Rising demand for BEML’s mining and construction equipment.

- Metro rail expansion projects in key cities like Mumbai, Bengaluru, and Hyderabad.

- Stable financial performance and expected revenue growth of 15-20% YoY.

- Challenges:

- Global economic slowdown may affect exports.

- Higher raw material costs impacting profit margins.

- Verdict: With strong government backing, improving financials, and increasing order book, BEML is expected to reach ₹4,500 (conservative) and ₹6,600 (optimistic) by the end of 2025.

BEML Ltd Share Price Target 2026: ₹5,011 – ₹7,500

- Growth Catalysts:

- Execution of large defense contracts, including tank and missile carrier vehicle production.

- Expansion into international markets, especially in Africa and Southeast Asia.

- Higher budget allocation for railway modernization, benefiting BEML’s metro and rail segment.

- Challenges:

- Any delays in order execution could impact revenue realization.

- Fluctuating crude oil and steel prices may affect production costs.

- Verdict: With stable revenue streams and diversification into international markets, BEML’s share price could touch ₹5,011 (minimum) and ₹7,500 (maximum) in 2026.

BEML Ltd Share Price Target 2027: ₹7,870 – ₹11,403

- Key Growth Drivers:

- Introduction of new technology-based heavy equipment.

- Expected privatization or partial disinvestment could increase market confidence.

- Increased metro rail projects leading to higher order inflows.

- New defense procurement policies favoring Indian manufacturers.

- Risks:

- Global recession or economic downturn.

- High competition from private players like L&T and Tata Advanced Systems.

- Verdict: If BEML capitalizes on its order book and sustains profitability, the stock could reach ₹7,870 (minimum) and ₹11,403 (maximum) by 2027.

BEML Ltd Share Price Target 2028: ₹11,443 – ₹16,580

- Market Trends:

- Large-scale urbanization in India driving demand for construction and mining equipment.

- Government initiatives like “Make in India” and “Atmanirbhar Bharat” boosting indigenous manufacturing.

- Expansion into electric and autonomous vehicles for defense.

- Concerns:

- Dependence on government contracts could slow growth if policies change.

- Technological advancements by global competitors may put pressure on margins.

- Verdict: BEML’s stock could trade between ₹11,443 (minimum) and ₹16,580 (maximum) by 2028, driven by government policies and product innovation.

BEML Ltd Share Price Target 2029: ₹16,639 – ₹24,107

- Factors Driving Growth:

- Stronger foothold in international markets.

- High demand for bullet train and high-speed railway projects.

- Diversification into electric heavy-duty vehicles.

- Challenges:

- Currency fluctuations affecting exports.

- Changes in government priorities post-elections.

- Verdict: If BEML sustains its growth and executes contracts efficiently, ₹16,639 (minimum) to ₹24,107 (maximum) is a realistic target for 2029.

BEML Ltd Share Price Target 2030: ₹24,194 – ₹35,053

- Long-Term Vision:

- Expansion into space and aerospace components.

- Potential listing on global stock exchanges.

- Strategic partnerships with foreign defense contractors.

- Challenges:

- Global economic and geopolitical uncertainties.

- Rapid technological disruptions.

- Verdict: ₹24,194 (minimum) and ₹35,053 (maximum) by 2030 is possible if BEML maintains a strong order book and capitalizes on defense and metro rail projects.

Summary Of BEML Ltd Share Price Target 2025 to 2030

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 4,500 | 6,600 |

| 2026 | 5,011 | 7,500 |

| 2027 | 7,870 | 11,403 |

| 2028 | 11,443 | 16,580 |

| 2029 | 16,639 | 24,107 |

| 2030 | 24,194 | 35,053 |

Conclusion

BEML Ltd’s diversified business model, strong financial metrics, and significant government backing position it well for future growth. However, investors should remain cognizant of the various risks and challenges that could influence the company’s performance. Continuous monitoring of industry trends, government policies, and the company’s strategic initiatives will be essential for making informed investment decisions.

10 FAQs on BEML Ltd Share Price Target 2025 to 2030

- What is BEML Ltd’s primary business model?

- BEML Ltd operates in three primary sectors: Defence and Aerospace, Mining and Construction, and Rail and Metro. It manufactures military equipment, heavy machinery, and rolling stock for railways and metro systems.

- What is BEML Ltd Share Price market capitalization?

- As of January 30, 2025, BEML Ltd’s market capitalization stands at ₹15,683 crore.

- How has BEML Ltd Share Price revenue growth been in recent years?

- BEML Ltd has experienced an annual revenue growth rate of 3.21%, which is slower than the industry average of 12.21%.

- What is the company’s debt-to-equity ratio?

- BEML Ltd has a debt-to-equity ratio of 20.56%, which is lower than the industry average of 54.03%, reflecting prudent financial management.

- How has BEML Ltd Share Price cash flow performance been in recent years?

- In FY23, BEML reported a significant improvement in its cash flow from operating activities, which increased to ₹5,634 million from ₹509 million in FY22.

- Who are the major shareholders ofBEML Ltd Share Price ?

- The shareholding pattern is as follows: Promoters hold 54.03%, Retail and Others hold 21.78%, Mutual Funds hold 16.33%, Foreign Institutional Investors (FII) hold 5.66%, and Domestic Institutional Investors (DII) hold 2.19%.

- What are some of the challenges BEML Ltd Share Price faces in its growth?

- BEML faces challenges like technological advancements by competitors, global economic slowdown, fluctuations in raw material costs, and potential changes in government policies.

- What is BEML Ltd Share Price dividend payout ratio?

- In FY23, BEML declared a dividend payout ratio of 14.71%, balancing shareholder returns and retaining earnings for future growth.

- What factors are expected to drive BEML Ltd Share Price Target 2025 to 2030?

- Key factors include increased government spending on infrastructure and defense, metro rail expansion, technology advancements, and BEML’s strong market position in defense and infrastructure projects.

- What is BEML Ltd Share Price Target 2030?

- The share price target for BEML Ltd in 2030 is expected to range between ₹24,194 and ₹35,053, driven by long-term growth in defense, infrastructure, and government initiatives like “Make in India.”