Bajaj Finance Share Price Target 2025 to 2030: What Investors Need to Know

As one of India’s premier non-banking financial companies (NBFCs), Bajaj Finance has been at the forefront of the consumer finance sector, consistently delivering impressive growth and returns to its investors. With the rapidly changing dynamics of the financial market, many investors are keen to understand the Bajaj Finance share price target for 2025 to 2030. This comprehensive article will explore the factors influencing the company’s performance, analyze its growth potential, and present expert predictions on its future share price.

Understanding Bajaj Finance Share

Company Overview

Founded in 1987, Bajaj Finance Limited is a part of the Bajaj Group, one of India’s largest and most diversified financial services conglomerates. Initially focused on consumer financing, the company has expanded its offerings to include personal loans, home loans, business loans, and a variety of financial products such as insurance and mutual funds.

With a customer-centric approach, Bajaj Finance has leveraged innovative technology to streamline its processes, improve customer experience, and enhance operational efficiency. This focus on technology has allowed the company to scale its operations significantly while maintaining a high level of service quality.

Current Market Position

As of October 2024, Bajaj Finance continues to hold a strong position in the Indian financial services market. The stock has witnessed fluctuations, like most equities, but has shown resilience, largely due to the robust demand for consumer loans and the company’s strategic focus on digital transformation.

Financial Performance and Growth Metrics

Revenue and Profitability

Bajaj Finance’s financial performance has consistently exceeded market expectations. The company reported a net profit of ₹3,500 crore in the last fiscal year, reflecting a growth of over 35% compared to the previous year. This impressive growth can be attributed to factors such as increased loan disbursements, a diversified product range, and effective cost management strategies.

Key Financial Ratios

How Key Ratios Impact Bajaj Finance Share Price Target 2025 to 2030:Bajaj Finance Share Price Target is heavily influenced by its key financial metrics, including net profit margin, return on equity (ROE), and debt-to-equity ratio. Strong net profit margins, high ROE, and lower debt levels typically support higher share price projections. These financial indicators are crucial for investors assessing the company’s growth prospects and long-term potential.

Return on Equity (ROE): Bajaj Finance boasts an ROE of approximately 18-20%, which is considerably higher than many competitors in the industry. A high ROE indicates effective management and profitable growth.

Net Interest Margin (NIM): The company’s NIM hovers around 8-10%, highlighting its efficiency in generating income from its lending operations.

Asset Quality: Bajaj Finance has consistently maintained a low Non-Performing Asset (NPA) ratio, generally below 1.5%. This low NPA ratio is a testament to the company’s stringent lending practices and credit risk management.

Growth in Loan Book: The company has been expanding its loan book at a CAGR of around 25-30% over the past few years, making it one of the fastest-growing NBFCs in India.

Market Capitalization and Stock Overview

With a market capitalization exceeding ₹4 lakh crore, Bajaj Finance is one of the largest NBFCs in India. The stock has delivered solid returns over the past decade, reflecting investor confidence in the company’s long-term growth prospects. With a share price hovering around ₹7,000 as of October 2023, many analysts speculate that a significant upside could be in store, given the projected growth of the company.

| Metric | Value |

|---|---|

| Market Capitalization | ₹4.44T INR |

| 52-Week High | ₹7,830.00 |

| 52-Week Low | ₹6,187.80 |

| Book Value | ₹1,234.23 |

| Face Value | ₹2 |

| P/E Ratio (TTM) | 28.87 |

| P/B Ratio | 5.34 |

| Industry P/E | 19.18 |

| Debt-to-Equity Ratio | 3.82 |

| Return on Equity (ROE) | 18.84% |

| Dividend Yield | 0.50% |

Bajaj Finance Share Price Chart of Last 5 years

Income Statement

A higher-than-average revenue growth relative to the industry indicates the company’s ability to potentially expand its market share. Over the past 5 years, the company’s revenue has grown at an annual rate of 24.34%, compared to the industry average of 15.2%.

Market share represents the portion of total sales within an industry captured by a particular company. It provides insight into the company’s size in comparison to its competitors. Over the past 5 years, the company’s market share has increased from 14.79% to 23.39%.

Net income refers to the company’s profit after deducting all expenses. It is a crucial metric for assessing the company’s overall profitability. Over the last 5 years, net income has grown at an annual rate of 29.32%, outpacing the industry average of 20.91%.

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

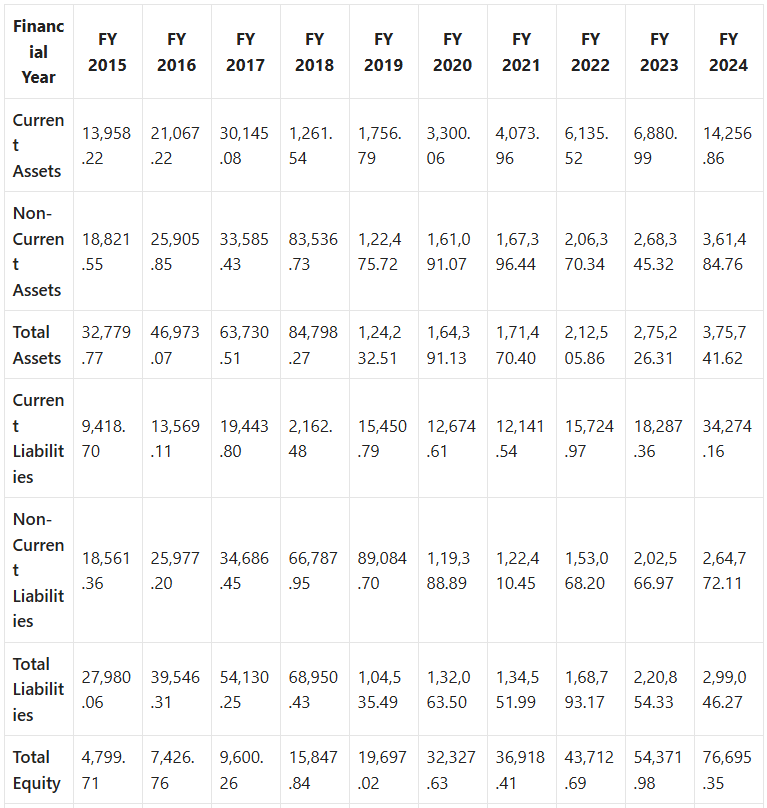

Balance Sheet

The Debt to Equity Ratio is a financial metric that compares a company’s total liabilities to its shareholder equity. It reflects the extent to which a company is financing its operations with debt as opposed to equity. Over the last 5 years, the company’s debt to equity ratio has been 383.42%, compared to the industry average of 348.03%.

The Current Ratio measures a company’s ability to meet short-term obligations with its short-term assets. A higher ratio indicates better liquidity and financial health. Over the past 5 years, the company’s current ratio has been 35.57%, whereas the industry average stands at 65.46%.

Shares outstanding numbers in cr. Other numbers in ₹ cr

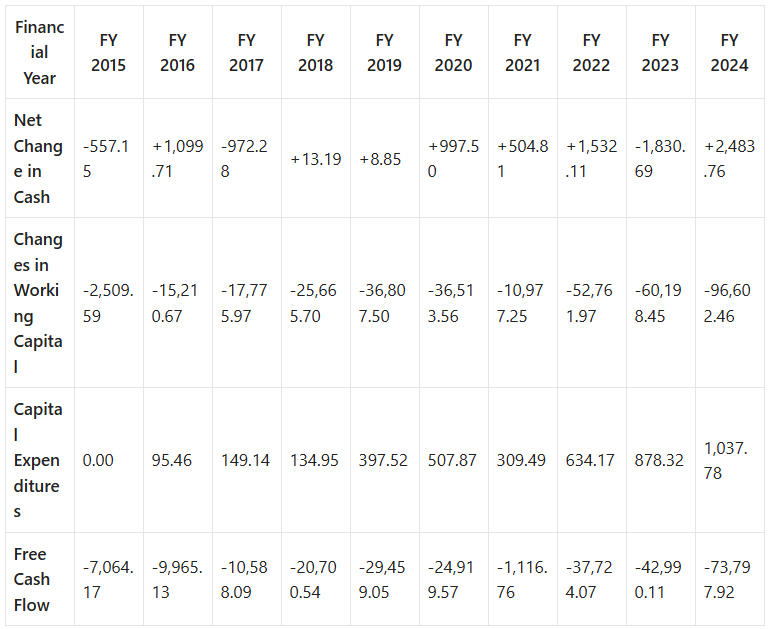

Cash Flow Statement

All numbers in ₹ cr.

Peers & Comparison

Key Factors Influencing Bajaj Finance Share Price Target 2025 to 2030

Economic Environment

The overall economic environment significantly impacts Bajaj Finance’s operations. Factors such as GDP growth, inflation rates, and consumer spending patterns play a pivotal role in determining the company’s performance. A thriving economy tends to increase loan demand, thereby boosting revenue for Bajaj Finance. Conversely, an economic downturn can lead to higher default rates, which may adversely affect profitability.

Regulatory Framework

The regulatory environment in India, particularly concerning NBFCs, is dynamic. The Reserve Bank of India (RBI) monitors the sector closely and may introduce changes that could impact operational practices. Compliance costs and regulatory changes must be accounted for in any investment analysis. Bajaj Finance has historically been proactive in aligning its operations with regulatory requirements, which could mitigate potential risks associated with regulatory changes.

Technological Advancements

The financial sector is undergoing a transformation driven by technology. Bajaj Finance’s investment in digital platforms and technology-driven solutions has enabled it to enhance customer experience and streamline operations. From digital loan applications to quick disbursements, technological advancements are likely to continue to shape the company’s growth trajectory.

Competitive Landscape

Bajaj Finance operates in a highly competitive environment, facing competition from both traditional banks and fintech companies. The rise of digital lending platforms poses a challenge, but Bajaj Finance has effectively countered this by leveraging its established brand reputation and extensive distribution network.

Consumer Behavior

Changing consumer behavior, especially among millennials and Gen Z, is influencing the financial services landscape. As younger consumers increasingly seek out digital solutions for their financial needs, Bajaj Finance’s focus on digital offerings positions it well to capture this market. The company’s ability to adapt to consumer preferences will be critical for future growth.

Bajaj Finance Share Price Target 2025 to 2030: Projections and Analysis

The following table summarizes projected price targets for Bajaj Finance over the coming years, illustrating both the expected price and the range of targets based on market analysis:

| Year | Expected Price Range |

|---|---|

| 2025 | ₹8,500 – ₹10,000 |

| 2026 | ₹10,500 – ₹12,000 |

| 2027 | ₹12,500 – ₹14,500 |

| 2028 | ₹14,000 – ₹16,000 |

| 2029 | ₹16,500 – ₹18,000 |

| 2030 | ₹20,000 – ₹22,000 |

Bajaj Finance Share Price Target 2025 to 2030 : Year-by-Year Analysis

Bajaj Finance Share Price Target 2025:

Analysts project the share price to reach INR 8,500 to INR 10,000, driven by robust business expansion and increased digital adoption.

Bajaj Finance Share Price Target 2026:

By 2026, the stock could climb to INR 10,500 to INR 12,000, supported by growing credit demand and a stable economic environment.

Bajaj Finance Share Price Target 2027:

For 2027, the share price is expected to range between INR 12,500 and INR 14,500, fueled by technological advancements and market penetration in rural areas.

Bajaj Finance Share Price Target 2028:

In 2028, the stock might touch INR 14,000 to INR 16,000, leveraging its diversified product portfolio and customer-centric strategies.

Bajaj Finance Share Price Target 2029:

Analysts estimate the share price to be around INR 16,500 to INR 18,000 in 2029, assuming continued earnings growth and favorable market conditions.

Bajaj Finance Share Price Target 2030:

By 2030, Bajaj Finance’s share price is anticipated to reach INR 20,000 to INR 22,000, reflecting its long-term growth potential and strategic execution.

Conclusion

The Bajaj Finance share price target for 2025 to 2030 underscores its potential as a long-term wealth creator. With estimated price targets ranging from INR 8,000 in 2025 to INR 20,000 in 2030, the stock offers promising opportunities for investors seeking exposure to India’s booming financial sector.

As always, while Bajaj Finance presents a compelling growth story, it is essential to monitor market conditions, company performance, and broader economic trends. By staying informed and adopting a disciplined investment approach, you can make the most of the opportunities that Bajaj Finance has to offer.

Frequently Asked Questions (FAQs)

1. What is the current share price of Bajaj Finance?

As of October 2023, the share price of Bajaj Finance is approximately ₹7,000. Please check updated market data for the latest information.

2. Is Bajaj Finance a good long-term investment?

Many analysts view Bajaj Finance as a solid long-term investment based on its strong growth potential, market position, and historical performance.

3. What are the main risks associated with investing in Bajaj Finance?

Key risks include economic downturns, increasing competition, and regulatory changes in the financial sector that could impact operations.

4. What are the projected share price targets for Bajaj Finance?

Projected price targets for Bajaj Finance are as follows:

- 2025: ₹8,500 – ₹10,000

- 2026: ₹10,500 – ₹12,000

- 2027: ₹12,500 – ₹14,500

- 2028: ₹14,000 – ₹16,000

- 2029: ₹16,500 – ₹18,000

- 2030: ₹20,000 – ₹22,000

5. How has Bajaj Finance performed in recent years?

Bajaj Finance has shown consistent growth with a net profit of ₹3,500 crore last fiscal year, reflecting a growth of over 35% due to increased loan disbursements and a diversified product portfolio.

6. What is Bajaj Finance’s strategy for growth?

Bajaj Finance focuses on expanding its digital offerings, enhancing customer experience, and entering underserved markets to sustain its growth trajectory.

7. How does Bajaj Finance manage credit risk?

Bajaj Finance maintains a low NPA ratio (typically below 1.5%) through stringent credit assessments and rigorous risk management practices.

8. What factors affect Bajaj Finance’s stock price?

Factors affecting Bajaj Finance’s stock price include economic conditions, regulatory changes, competitive landscape, and overall market sentiment.

9. What role does technology play in Bajaj Finance’s operations?

Technology plays a crucial role in Bajaj Finance’s operations by streamlining processes, enhancing customer service, and enabling quicker loan disbursements through digital platforms.

10. Can Bajaj Finance sustain its growth in a changing economic environment?

While the changing economic environment presents challenges, Bajaj Finance’s adaptability, robust business model, and customer-centric approach position it well for sustainable growth.

2 thoughts on “Bajaj Finance Share Price Target 2025 to 2030”