Avance Technologies Share Price Target 2025 to 2030: A Comprehensive Analysis

Avance Technologies Limited is a growing player in the technology sector. Investors are keen to understand the potential share price movements for the next few years, from 2025 to 2030. This article provides a detailed analysis based on financial performance, market trends, and other key factors affecting the stock.

Key Metrics of Avance Technologies Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹172.43 Crores |

| 52-Week High | ₹1.71 |

| 52-Week Low | ₹0.73 |

| Upper Circuit Limit | ₹0.84 |

| Lower Circuit Limit | ₹0.70 |

| Face Value | ₹1.00 |

| Price to Earnings (P/E) Ratio | 24.56 |

| Book Value | ₹1.00 |

| Face Value | ₹1.90 |

| Return on Equity (ROE) | 1.31% |

Avance Technologies Share Price Chart of Last 3 years

Income Statement

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

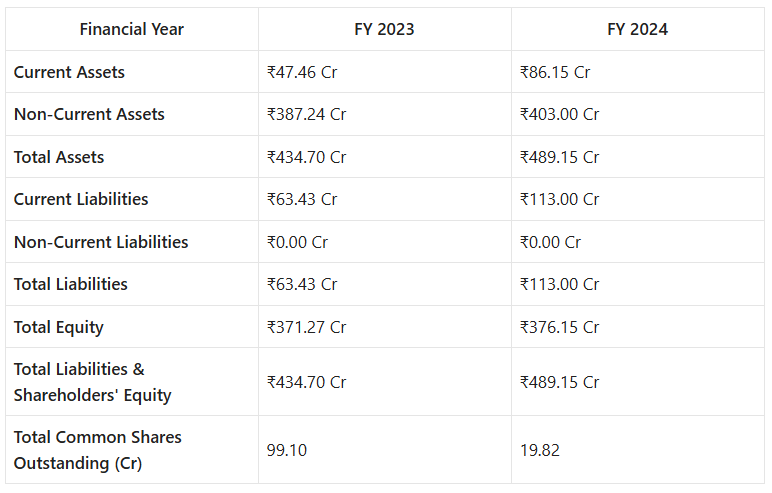

Balance Sheet

Note: All numbers are in ₹ crores except for shares outstanding, which is in crores.

Cash Flow Statement

(All numbers in ₹ crores)

Fundamental Analysis

1. Company Overview

Avance Technologies operates in the IT and digital services sector. The company focuses on software solutions, IT consulting, and digital transformation services. The business model is asset-light, and revenues are primarily driven by service contracts and technology solutions.

2. Financial Health

Debt Analysis

Avance Technologies maintains a low debt-to-equity ratio, reflecting a strong financial position. The company’s ability to manage debt effectively contributes to investor confidence.

Cash Flow Analysis

| Financial Year | FY 2023 | FY 2024 |

| Net Change in Cash | +0.01 | +14.75 |

| Changes in Working Capital | +5.67 | +25.45 |

| Capital Expenditures | 0.00 | 0.00 |

| Free Cash Flow | 6.16 | 30.50 |

The increase in cash flow indicates positive operational efficiency and financial management.

Liquidity

With a healthy liquidity position, Avance Technologies can meet its short-term obligations and invest in growth opportunities.

3. Competitive Analysis

Avance Technologies operates in a highly competitive market with players like Infosys, Wipro, and Tech Mahindra. However, its niche focus and agility give it a competitive edge.

4. Growth Prospects

Market Trends

- Digital transformation across industries is driving demand for IT solutions.

- Increasing investments in AI and cloud computing create opportunities.

- Government policies supporting IT sector growth add positive momentum.

Strategic Initiatives

- Expansion of service offerings in AI and cloud-based solutions.

- Strengthening partnerships with global tech firms.

- Investment in R&D to drive innovation.

5. Dividend Policy

Avance Technologies has historically not declared significant dividends, indicating a reinvestment strategy for expansion and growth.

6. ESG (Environmental, Social, and Governance) Factors

The company emphasizes responsible business practices, though it lacks a formal ESG disclosure framework.

Key Factors Impacting Share Price

1. Financial Performance

Sustained revenue growth and profitability play a crucial role in influencing Avance Technologies’ share price. Investors closely monitor financial statements, including revenue trends, profit margins, and net earnings. A steady increase in revenue indicates strong demand for the company’s services, while improved profit margins suggest better cost management. If Avance Technologies can maintain consistent profitability, investor confidence will strengthen, leading to potential stock appreciation.

2. Market Dynamics

The IT industry is highly dynamic, with rapid advancements in technology shaping market demand. The company’s ability to adapt to emerging trends such as artificial intelligence (AI), cloud computing, and cybersecurity solutions is essential. If Avance Technologies successfully integrates new technologies into its service offerings, it will remain competitive and attract more clients, positively impacting its share price. Additionally, global economic conditions, inflation rates, and currency fluctuations can influence investor sentiment towards the stock.

3. Strategic Decisions

Avance Technologies’ future growth largely depends on strategic decisions, including mergers, acquisitions, and partnerships. Collaborations with major tech firms can enhance brand value and expand market reach. Effective execution of expansion plans, entry into new markets, and diversification of service offerings will contribute to higher valuations. Conversely, poor strategic decisions or failed ventures may negatively affect the company’s stock performance.

4. Regulatory Environment

Compliance with government regulations and industry standards is crucial for business sustainability. Changes in data protection laws, cybersecurity regulations, and taxation policies can impact the company’s operations and financials. Any regulatory hurdles or legal issues could lead to penalties, affecting investor confidence and stock valuation. Conversely, government incentives for the IT sector can create growth opportunities, positively impacting the stock price.

5. Investor Sentiment

Market perception and investor confidence in the company’s leadership, vision, and performance significantly influence share price movements. Positive news such as new client acquisitions, contract wins, or strong quarterly results can drive demand for the stock. On the other hand, negative developments such as leadership changes, missed revenue targets, or market downturns may lead to stock volatility. The overall market sentiment, including trends in the broader stock market and investor risk appetite, also plays a role.

Avance Technologies Share Price Target 2025 to 2030 : Year By Year Analysis

Avance Technologies Share Price Target 2025

- First Target: ₹1.90

- Second Target: ₹2.30

These targets are based on the company’s efforts to expand its market presence and improve operational efficiency. Increased client acquisitions and technological advancements are expected to drive growth.

Avance Technologies Share Price Target 2026

- First Target: ₹2.85

- Second Target: ₹3.15

Anticipated growth reflects the company’s focus on innovative technological offerings and an improved financial position. Expansion into new markets and improved service efficiency will contribute to these projections.

Avance Technologies Share Price Target 2027

- First Target: ₹3.70

- Second Target: ₹4.50

Projections consider the company’s dedication to technological advancements and increased demand for its services. The rise in digital transformation efforts across industries will likely boost revenue streams.

Avance Technologies Share Price Target 2028

- First Target: ₹5.05

- Second Target: ₹5.95

Forecasts align with the company’s long-term strategic vision and its ability to adapt to market trends. The adoption of AI-driven solutions and automation is expected to play a key role in revenue growth.

Avance Technologies Share Price Target 2029

- First Target: ₹6.00

- Second Target: ₹6.30

Expectations are based on the company’s focus on enhancing operational excellence and exploring new business opportunities. Expansion into international markets and sustained profitability will support stock growth.

Avance Technologies Share Price Target 2030

- First Target: ₹7.10

- Second Target: ₹7.90

Projections reflect the company’s consistent efforts to innovate and expand its portfolio. A strong brand presence, strategic partnerships, and continued digital transformation efforts will be crucial factors.

Summary of Avance Technologies Share Price Target 2025 to 2030

| Year | First Target (₹) | Second Target (₹) |

|---|---|---|

| 2025 | 1.90 | 2.30 |

| 2026 | 2.85 | 3.15 |

| 2027 | 3.70 | 4.50 |

| 2028 | 5.05 | 5.95 |

| 2029 | 6.00 | 6.30 |

| 2030 | 7.10 | 7.90 |

Conclusion

Avance Technologies Ltd. presents a profile of cautious optimism. While the company has demonstrated financial stability and is positioned to benefit from favorable market trends, challenges such as intense competition and the need for continuous innovation persist. Investors should monitor the company’s strategic initiatives and market developments closely to make informed decisions.

Frequently Asked Questions (FAQs)

1. What is Avance Technologies’ current share price?

The current share price of Avance Technologies is ₹0.77.

2. What are the key factors influencing Avance Technologies’ share price?

Key factors include financial performance, market dynamics, strategic decisions, regulatory environment, and investor sentiment.

3. What are the expected share price targets for 2025?

The expected share price targets for 2025 are:

- First Target: ₹1.90

- Second Target: ₹2.30

4. How does financial performance impact the stock price?

Sustained revenue growth and profitability positively influence investor confidence, leading to potential stock appreciation.

5. What role do market trends play in determining the share price?

Emerging trends such as AI, cloud computing, and cybersecurity solutions impact demand, competitiveness, and revenue growth.

6. Does Avance Technologies have any strategic expansion plans?

Yes, the company plans to expand its service offerings, strengthen partnerships, and invest in R&D for technological advancements.

7. How do regulatory changes affect Avance Technologies?

Changes in data protection laws, cybersecurity regulations, and taxation policies can impact the company’s operations and profitability.

8. What are the share price projections for 2030?

The projected share price targets for 2030 are:

- First Target: ₹7.10

- Second Target: ₹7.90

9. How does investor sentiment affect the share price?

Positive investor perception, strong financial performance, and strategic partnerships drive stock demand, while negative news can cause volatility.

10. Is Avance Technologies a good long-term investment?

The company shows potential for growth due to industry trends, financial stability, and strategic initiatives, making it a promising long-term investment.

4 thoughts on “Avance Technologies Share Price Target 2025 to 2030”