Amara Raja Batteries Share Price Target 2025 to 2030 : Detailed Analysis

Amara Raja Energy & Mobility Ltd., formerly known as Amara Raja Batteries Ltd., is a prominent player in the Indian battery manufacturing industry. As of February 7, 2025, the company’s share price stands at ₹1,090. Investors are keen to understand the potential trajectory of this stock from 2025 to 2030. This comprehensive analysis delves into the company’s key metrics, shareholding pattern, fundamental aspects, and future prospects to provide a detailed outlook.

Key Metrics of Amara Raja Energy & Mobility Ltd Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹23,440.97 Cr |

| Return on Equity (ROE) | 14.97% |

| Return on Capital Employed (ROCE) | 19.23% |

| Price-to-Earnings (P/E) Ratio | 24.6 |

| Price-to-Book (P/B) Ratio | 3.24 |

| Dividend Yield | 0.77% |

| Book Value per Share | ₹395.39 |

| Face Value | ₹1 |

| Earnings Per Share (EPS) (TTM) | ₹52.07 |

| 52-Week High | ₹1,774.90 |

| 52-Week Low | ₹729.45 |

Shareholding Pattern

| Category | Percentage |

|---|---|

| Promoters | 32.86% |

| Foreign Institutions | 22.34% |

| Mutual Funds | 6.25% |

| Other Domestic Institutions | 9.11% |

| Retail and Others | 29.44% |

Amara Raja Batteries Share Price Chart Of Last 5 years

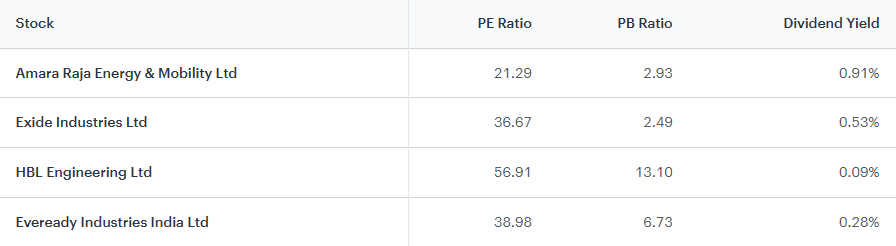

Peers & Comparison

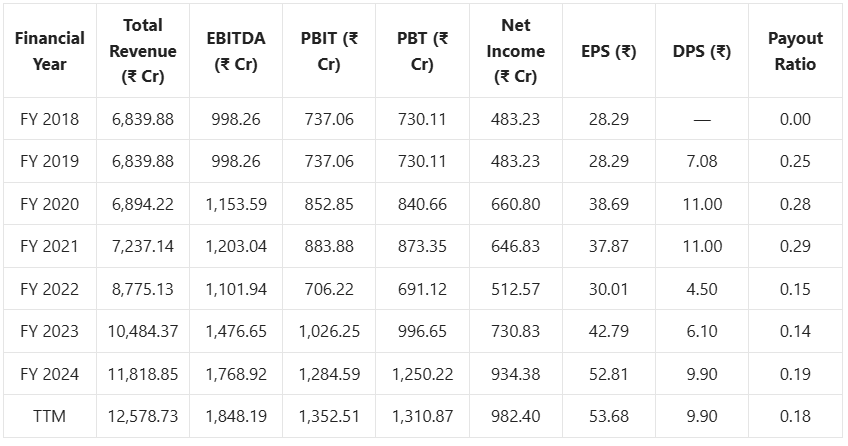

Income Statement

Over the past five years, Amara Raja Energy & Mobility Ltd. has demonstrated a robust financial performance, surpassing industry benchmarks in key areas:

- Revenue Growth: The company achieved a compound annual growth rate (CAGR) of 11.56% in revenue, significantly higher than the industry average of 5.66%. This indicates an enhanced ability to capture market share.

- Market Share Expansion: Amara Raja’s market share increased from 27.01% to 35.31%, reflecting its strengthened position relative to competitors.

- Net Income Growth: The company reported a CAGR of 14.1% in net income, outpacing the industry average of 8.89%. This underscores its superior profitability and effective cost management.

Note: EPS and DPS are in ₹. Other figures are in ₹ crores.

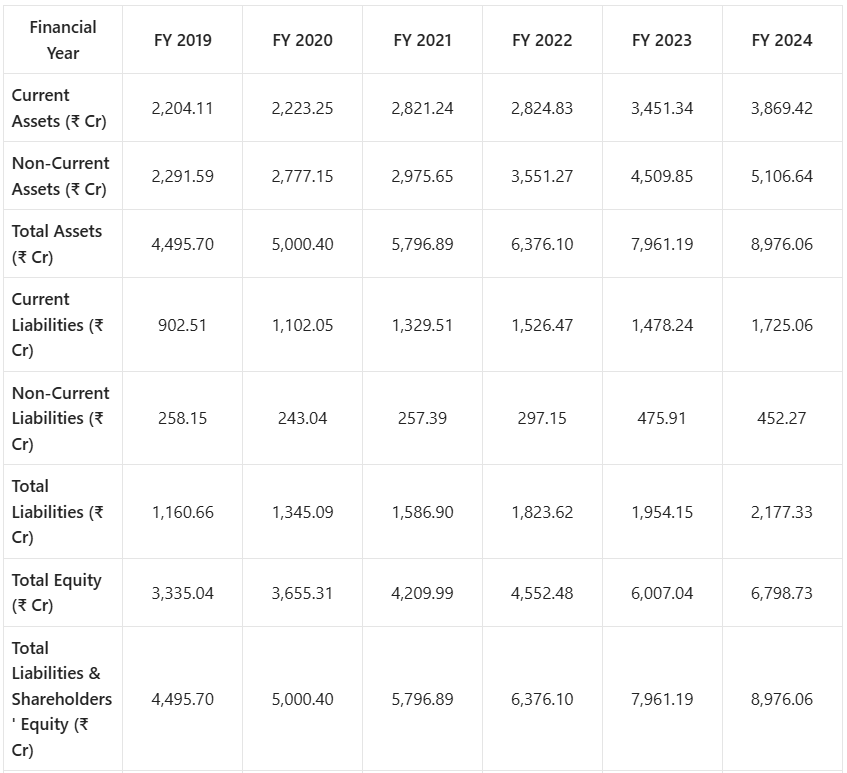

Balance Sheet

Amara Raja Energy & Mobility Ltd., operating within the Electrical Equipment industry, has demonstrated prudent financial management over the past five years.

Debt to Equity Ratio

This ratio indicates the proportion of a company’s financing that comes from debt relative to shareholder equity. A lower ratio suggests a conservative approach to leveraging.

- Company’s Average (Last 5 Years): 2.58%

- Industry Average: 8.51%

Amara Raja’s debt to equity ratio is significantly lower than the industry average, reflecting its conservative debt utilization strategy.

Current Ratio

This metric assesses a company’s ability to meet short-term obligations with its short-term assets. A higher current ratio indicates better liquidity.

- Company’s Average (Last 5 Years): 211.36%

- Industry Average: 176.04%

Note: All figures are in ₹ crores, except for shares outstanding, which are in crores.

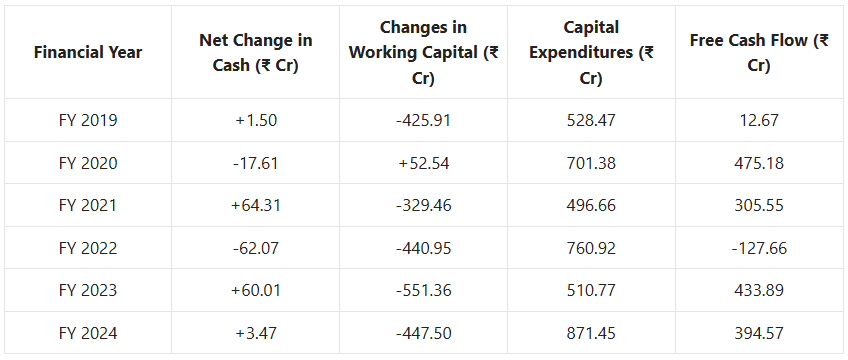

Cash Flow Statement

Amara Raja Energy & Mobility Limited (ARE&M) has demonstrated a robust financial performance over the past five years, particularly in terms of free cash flow (FCF). Free cash flow represents the cash generated by the company after accounting for capital expenditures, serving as a key indicator of financial health and operational efficiency.

Free Cash Flow Growth

- FY2020: ₹4,752 million

- FY2021: ₹3,056 million

- FY2022: ₹(1,277) million (negative FCF)

- FY2023: ₹4,339 million

- FY2024: ₹3,946 million

This trajectory indicates a cumulative growth of approximately 98.92% over the five-year period. In contrast, the industry average for the same period has seen a decline of about 15.89%. This stark difference underscores ARE&M’s superior capability in generating and managing free cash flow compared to its peers.

Analysis

The substantial growth in ARE&M’s free cash flow can be attributed to several factors:

- Operational Efficiency: The company has maintained strong cash flows from operations, increasing from ₹6,333 million in FY2022 to ₹12,660 million in FY2024.

- Capital Expenditure Management: While capital expenditures have increased to support growth initiatives, the company has managed these investments prudently, ensuring that they contribute positively to future cash flows.

- Strategic Investments: Investments in new energy solutions and expansion into international markets have begun to yield returns, contributing to the positive free cash flow.

All figures are in ₹ crores.

Fundamental Analysis

- Company Overview : Amara Raja Energy & Mobility Ltd. has established itself as a leading manufacturer of lead-acid batteries in India, catering to both automotive and industrial sectors. The company operates multiple manufacturing facilities equipped with state-of-the-art technology, ensuring high-quality products and efficient production processes. Over the years, Amara Raja has expanded its product portfolio to include batteries for electric vehicles (EVs), renewable energy storage, and other emerging applications, positioning itself to capitalize on the evolving energy landscape.

- Financial Health

- Revenue and Profitability : The company has consistently grown consistently over the past few years. In FY2023, Amara Raja reported a revenue of ₹10,386 crore, which increased to ₹11,260.30 crore in FY2024, marking a growth of approximately 8.4%. The Earnings Per Share (EPS) for FY2024 stood at ₹49.49.

- Debt Analysis : Amara Raja maintains a conservative approach towards debt. The company’s debt-to-equity ratio is low, indicating prudent financial management and a focus on maintaining a strong balance sheet. This low leverage reduces financial risk and provides flexibility for future capital expenditures.

- Cash Flow and Liquidity : The company has a healthy liquidity position, with a current ratio of 2.14, indicating its ability to meet short-term obligations. The cash flow from operations has been robust, supporting ongoing capital expenditures and dividend payouts without significantly increasing debt levels. This strong cash flow generation underscores the company’s operational efficiency and financial stability.

- Competitive Analysis : In the Indian battery market, Amara Raja’s primary competitor is Exide Industries. Both companies have a significant presence in the automotive and industrial battery segments. While Exide has a longer market presence, Amara Raja has been gaining market share due to its focus on technology, quality, and customer service. The company’s strategic initiatives in the renewable energy and electric vehicle segments further enhance its competitive positioning.

- Growth Prospects

- Market Trends : The global shift towards renewable energy and the increasing adoption of electric vehicles present significant growth opportunities for battery manufacturers. Amara Raja’s investments in lithium-ion battery technology and renewable energy storage solutions position it well to capitalize on these trends. Additionally, government initiatives promoting clean energy and electric mobility are expected to drive demand for advanced battery solutions in India.

- Strategic Initiatives : Amara Raja has been proactive in diversifying its product portfolio and expanding its technological capabilities. The company has invested in research and development to enhance its lithium-ion battery technology and has established partnerships to strengthen its position in the electric vehicle ecosystem. These strategic initiatives are expected to contribute to sustained growth in the coming years.

- Dividend Policy : The company has a track record of consistent dividend payments, reflecting its commitment to returning value to shareholders. In FY2024, the board recommended a final dividend of ₹5.10 per share. The dividend payout ratio has been maintained at a reasonable level, balancing shareholder returns with the need to reinvest in business growth.

- Environmental, Social, and Governance (ESG) Factors : Amara Raja is committed to sustainable business practices. The company has implemented initiatives to reduce its environmental footprint, such as energy-efficient manufacturing processes and waste reduction programs. On the social front, Amara Raja engages in various community development activities, focusing on education, healthcare, and rural development. The company’s governance framework emphasizes transparency, ethical conduct, and accountability, aligning with global best practices.

Key Factors Impacting Share Price

Several factors influence the share price of Amara Raja Energy & Mobility Ltd.:

- Market Demand: The increasing adoption of electric vehicles (EVs) and renewable energy solutions is driving demand for advanced battery technologies. Amara Raja’s investments in lithium-ion battery production position it to capitalize on this trend.

- Technological Advancements: Continuous investment in research and development enables the company to innovate and stay competitive. Developing efficient and durable battery solutions can enhance market share and profitability.

- Regulatory Environment: Government policies promoting clean energy and electric mobility can boost demand for the company’s products. Conversely, stringent environmental regulations could increase compliance costs.

- Raw Material Availability: The supply and cost of essential materials like lithium and cobalt can impact production costs and profit margins. Securing stable supply chains is crucial.

- Competitive Landscape: The presence of strong competitors in the battery manufacturing sector necessitates continuous innovation and efficient operations to maintain market position.

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and economic growth influence consumer spending and industrial activities, affecting the demand for batteries.

Amara Raja Batteries Share Price Target 2025 to 2030 :Detailed Yearly Targets

Amara Raja Batteries Share Price Target 2025

- Target 1: ₹ 1450

- Target 2: ₹ 1550

Analysis: The anticipated growth in the EV market and Amara Raja’s strategic initiatives in lithium-ion battery production are expected to drive revenue growth. Analysts have set an average target price of ₹1,412.53 for 2025.

Amara Raja Batteries Share Price Target 2026

- Target 1: ₹1600

- Target 2: ₹1800

Analysis: Continued expansion in renewable energy storage solutions and potential partnerships in the energy sector could further enhance the company’s market position, leading to an expected share price increase.

Amara Raja Batteries Share Price Target 2027

- Target 1: ₹ 1900

- Target 2: ₹ 2250

Analysis: By this year, Amara Raja’s investments in advanced battery technologies are projected to yield significant returns, bolstering profitability and investor confidence.

Amara Raja Batteries Share Price Target 2028

- Target 1: ₹ 2200

- Target 2: ₹ 2800

Analysis: The company’s focus on sustainability and potential entry into new international markets could drive substantial revenue growth, reflecting in higher share valuations.

Amara Raja Batteries Share Price Target 2029

- Target 1: ₹ 2900

- Target 2: ₹ 3500

Analysis: Amara Raja’s established presence in the global battery market and continuous innovation are expected to maintain its competitive edge, contributing to steady share price appreciation.

Amara Raja Batteries Share Price Target 2030

- Target 1: ₹ 3800

- Target 2: ₹ 5000

Analysis: By 2030, the company is anticipated to be a key player in the energy storage sector, with diversified products and services driving sustained growth and higher share prices.

Summary of Amara Raja Batteries Share Price Target 2025 to 2030

| Year | Target 1 (₹) | Target 2 (₹) |

|---|---|---|

| 2025 | 1,450 | 1,550 |

| 2026 | 1600 | 1,800 |

| 2027 | 1,900 | 2250 |

| 2028 | 2200 | 2800 |

| 2029 | 2900 | 3500 |

| 2030 | 3800 | 5000 |

Conclusion

Amara Raja Energy & Mobility Ltd. is well-positioned to capitalize on the growing demand for advanced battery solutions, driven by the global shift towards electric vehicles and renewable energy. The company’s strategic investments in technology, focus on sustainability, and expansion into new markets are key drivers that could significantly enhance its financial performance and shareholder value in the coming years. However, investors should remain cognizant of potential risks, including raw material supply constraints and competitive pressures, and consider these factors when making investment decisions.

Frequently Asked Questions (FAQs) about Amara Raja Batteries Share Price Target 2025 to 2030

1. What is the current Amara Raja Batteries Share Price?

As of February 7, 2025, the share price of Amara Raja Energy & Mobility Ltd. is ₹1,090.

2. What are the key financial metrics of Amara Raja Batteries Share Price ?

Key financial metrics include:

- Market Capitalization: ₹23,440.97 Cr

- Return on Equity (ROE): 14.97%

- Return on Capital Employed (ROCE): 19.23%

- Price-to-Earnings (P/E) Ratio: 24.6

- Price-to-Book (P/B) Ratio: 3.24

- Dividend Yield: 0.77%

- Book Value per Share: ₹395.39

- Face Value: ₹1

- Earnings Per Share (EPS) (TTM): ₹52.07

- 52-Week High: ₹1,774.90

- 52-Week Low: ₹729.45

3. What is the shareholding pattern of the company?

The shareholding pattern is as follows:

- Promoters: 32.86%

- Foreign Institutions: 22.34%

- Mutual Funds: 6.25%

- Other Domestic Institutions: 9.11%

- Retail and Others: 29.44%

4. How has Amara Raja Batteries Share Price revenue grown over the past five years?

Over the past five years, Amara Raja Energy & Mobility Ltd. has achieved a compound annual growth rate (CAGR) of 11.56% in revenue, significantly higher than the industry average of 5.66%.

5. What is the Amara Raja Batteries Share Price debt-to-equity ratio compared to the industry average?

The company’s average debt-to-equity ratio over the last five years is 2.58%, which is significantly lower than the industry average of 8.51%, indicating a conservative approach to leveraging.

6. How has the Amara Raja Batteries Share Price free cash flow (FCF) trended over the past five years?

The company has demonstrated a cumulative growth of approximately 98.92% in free cash flow over the past five years, contrasting with an industry average decline of about 15.89%.

7. What strategic initiatives has the company undertaken to enhance growth?

Amara Raja has invested in research and development to enhance its lithium-ion battery technology and has established partnerships to strengthen its position in the electric vehicle ecosystem.

8. What are the projected Amara Raja Batteries Share Price Target 2025 to 2030?

The projected share price targets are as follows:

- 2025: ₹1,450 – ₹1,550

- 2026: ₹1,600 – ₹1,800

- 2027: ₹1,900 – ₹2,250

- 2028: ₹2,200 – ₹2,800

- 2029: ₹2,900 – ₹3,500

- 2030: ₹3,800 – ₹5,000

9. What factors could impact Amara Raja Batteries Share Price in the future?

Factors include market demand for electric vehicles and renewable energy solutions, technological advancements, regulatory environment, raw material availability, competitive landscape, and overall economic conditions.

10. How does the company approach Environmental, Social, and Governance (ESG) factors?

Amara Raja is committed to sustainable business practices, including energy-efficient manufacturing processes and waste reduction programs. The company engages in community development activities focusing on education, healthcare, and rural development, and emphasizes transparency, ethical conduct, and accountability in its governance framework.