Servotech Ltd Share Price Target 2025 to 2030:A Detailed Analysis

Company Overview

Servotech Power Systems Ltd. is a prominent player in the electric equipment sector, specializing in renewable energy solutions. As of December 31, 2024, the company reported a net profit after tax of ₹7.99 crore. The promoter holding stood at 59.34%, with 3.78% of these shares pledged. Foreign institutional investors held a 5.96% stake during the same period.

Key Metrics of Servotech Power Systems Ltd Share

| Metric | Value |

|---|---|

| Market Cap | ₹3,559.38 Cr |

| Return on Equity (ROE) | 13.21% |

| Return on Capital Employed (ROCE) | 11.27% |

| Price-to-Earnings (P/E) Ratio | 174.4 |

| Price-to-Book (P/B) Ratio | 26.84 |

| Dividend Yield | 0.15% |

| Book Value | ₹6.03 |

| Face Value | ₹1 |

| Earnings Per Share (EPS) (TTM) | ₹0.93 |

| 52-Week High | ₹205.40 |

| 52-Week Low | ₹73.50 |

Shareholding Pattern

| Category | Percentage |

|---|---|

| Promoters | 59.34% |

| Foreign Institutions | 5.95% |

| Retail & Others | 34.71% |

Servotech Ltd Share Price Chart of Last 5 Years

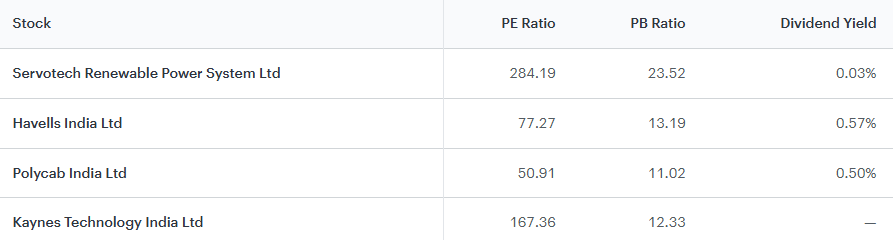

Peers & Comparison

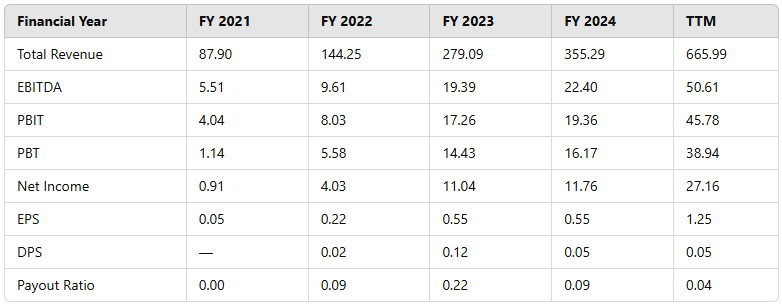

Income Statement

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

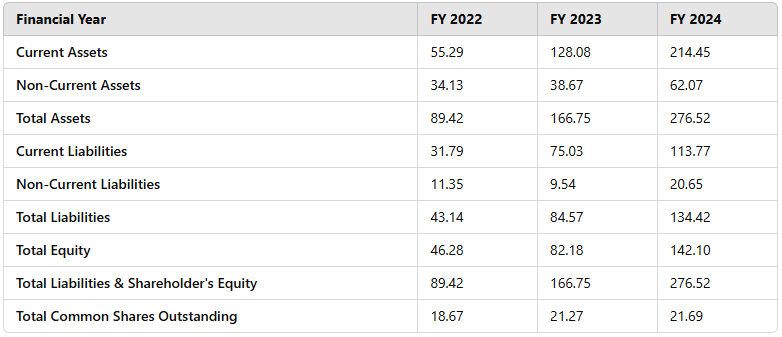

Balance Sheet

Shares outstanding numbers in cr. Other numbers in ₹ cr

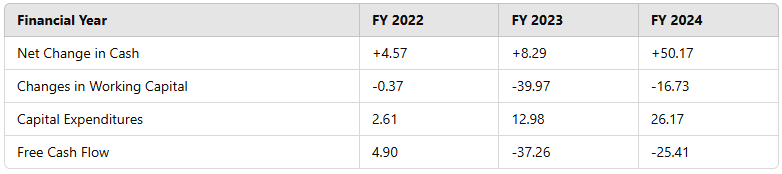

Cash Flow Statement

All numbers in ₹ cr

Fundamental Analysis

- Company Overview : Servotech Power Systems Ltd., established in 2004, operates in the electric and electronics sector. The company specializes in manufacturing and distributing a range of products, including LED lighting solutions, solar products, and electric vehicle (EV) charging equipment. Over the years, Servotech has expanded its product portfolio to cater to the growing demand for renewable energy solutions and energy-efficient products.

- Financial Health

- Revenue and Profit Growth : Over the past three years, Servotech has demonstrated impressive financial performance, with a profit growth of 131.05% and revenue growth of 52.03%.

- Debt Analysis : As of the latest financial statements, the company’s long-term borrowings stand at ₹13.10 Cr, a significant increase from ₹7.51 Cr in the previous year.

- Cash Flow and Liquidity : Detailed cash flow statements are not available in the provided data. However, the company’s liquidity position can be inferred from its current ratio and quick ratio, which indicate its ability to meet short-term obligations.

- Competitive Analysis : In the renewable energy and electronics sector, Servotech faces competition from both established players and emerging startups. The company’s focus on innovation and quality has enabled it to maintain a competitive edge. Its diversified product portfolio, including LED lighting, solar solutions, and EV charging infrastructure, positions it well to capitalize on industry trends.

- Growth Prospects

- Market Trends : The global shift towards renewable energy and sustainable solutions presents significant growth opportunities for Servotech. The increasing adoption of electric vehicles and the emphasis on energy efficiency are expected to drive demand for the company’s products.

- Strategic Initiatives : Servotech has been proactive in expanding its market presence through strategic partnerships and product innovations. The company’s initiatives in the EV charging space and its focus on solar energy solutions align with current market trends, potentially contributing to future growth.

- Dividend Policy : With a dividend yield of 0.15%, Servotech has a modest dividend distribution. The company’s policy appears to prioritize reinvestment into business operations and growth initiatives, which is common among companies in expansion phases.

- Environmental, Social, and Governance (ESG) Factors: Servotech’s product offerings in renewable energy and energy-efficient solutions underscore its commitment to environmental sustainability. While specific ESG metrics are not provided, the company’s focus on green technologies suggests a positive alignment with ESG principles.

Key Factors Impacting Share Price

- Market Demand: Growing demand for renewable energy solutions and EV infrastructure could boost sales and profitability.

- Regulatory Environment: Government policies promoting clean energy and sustainability may provide incentives or subsidies, benefiting the company.

- Technological Advancements: Innovation in product offerings can enhance competitiveness and market share.

- Economic Conditions: Macroeconomic factors, including interest rates, inflation, and economic growth, can impact consumer spending and investment.

- Competitive Landscape: Actions by competitors, such as pricing strategies or new product launches, could affect market dynamics.

Servotech Ltd Share Price Target 2025 to 2030

Servotech Ltd Share Price Target 2025

- Target 1: ₹150

- Target 2: ₹160

Analysis: Given the company’s consistent revenue growth and stable profit margins, a modest increase in share price is anticipated in 2025. The targets reflect a cautious optimism, accounting for potential market volatility.

Servotech Ltd Share Price Target 2026

- Target 1: ₹170

- Target 2: ₹180

Analysis: Assuming continued expansion in the renewable energy sector and Servotech’s active participation, the share price could experience further appreciation. The targets consider the company’s strategic initiatives and market trends.

Servotech Ltd Share Price Target 2027

- Target 1: ₹190

- Target 2: ₹200

Analysis: By 2027, with sustained growth and potential new product launches, Servotech may achieve higher valuations. The targets are based on projected earnings growth and market expansion.

Servotech Ltd Share Price Target 2028

- Target 1: ₹210

- Target 2: ₹220

Analysis: Continued innovation and market penetration could drive the share price upward. The targets reflect expectations of increased market share and profitability.

Servotech Ltd Share Price Target 2029

- Target 1: ₹230

- Target 2: ₹240

Analysis: Assuming favorable market conditions and effective execution of business strategies, the share price may continue its upward trajectory. The targets are aligned with long-term growth prospects.

Servotech Ltd Share Price Target 2030

- Target 1: ₹250

- Target 2: ₹260

Analysis: With a strong market position and diversified product offerings, Servotech could reach these valuation levels by 2030. The targets consider the culmination of strategic initiatives and market expansion.

Summary of Servotech Ltd Share Price Target 2025 to 2030

| Year | Target 1 | Target 2 |

|---|---|---|

| 2025 | ₹150 | ₹160 |

| 2026 | ₹170 | ₹180 |

| 2027 | ₹190 | ₹200 |

| 2028 | ₹210 | ₹220 |

| 2029 | ₹230 | ₹240 |

| 2030 | ₹250 | ₹260 |

Conclusion

Servotech Power Systems Ltd. has demonstrated robust growth in the renewable energy sector. The projected share price targets from 2025 to 2030 reflect a positive outlook based on historical performance and market trends. However, investors should remain vigilant, considering potential risks such as market volatility, regulatory changes, and technological advancements. Continuous monitoring of the company’s performance and industry developments is essential for informed investment decisions.

Frequently Asked Questions (FAQs)

Q1: What is Servotech Power Systems Ltd.?

A1: Servotech Power Systems Ltd. is an electric equipment company specializing in renewable energy solutions, including LED lighting, solar products, and EV charging stations.

Q2: What is the current market cap of Servotech Ltd Share Price?

A2: The market capitalization of Servotech Power Systems Ltd. is ₹3,559.38 crore.

Q3: What is the promoter holding in Servotech?

A3: The promoter holding in Servotech is 59.34%, with 3.78% of these shares pledged.

Q4: What are the key financial metrics of Servotech?

A4: Key metrics include an ROE of 13.21%, ROCE of 11.27%, P/E ratio of 174.4, and a dividend yield of 0.15%.

Q5: What are the growth prospects for Servotech?

A5: Growth prospects include expansion in renewable energy markets, increased adoption of EV charging solutions, and strategic partnerships.

Q6: What are the Servotech Ltd Share Price Target 2025 to 2030?

A6: The targets range from ₹150-₹160 in 2025 to ₹250-₹260 in 2030, based on expected market trends and financial performance.

Q7: What factors impact Servotech’s share price?

A7: Key factors include market demand, regulatory policies, technological advancements, economic conditions, and competition.

Q8: What is Servotech’s dividend policy?

A8: Servotech has a dividend yield of 0.15% and prioritizes reinvestment into business growth over high dividend payouts.

Q9: How does Servotech compare with its competitors?

A9: Servotech competes with companies in the renewable energy and electronics sector, leveraging its diversified product portfolio for competitive advantage.

Q10: What role does ESG play in Servotech’s business strategy?

A10: Servotech focuses on environmental sustainability by offering energy-efficient solutions and promoting clean energy initiatives.

3 thoughts on “Servotech Ltd Share Price Target 2025 to 2030”