Madhav Infra Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

Madhav Infra Ltd is a key player in the infrastructure and construction sector, primarily engaged in road development, solar power projects, and urban infrastructure. The company focuses on government contracts and private sector projects, which provide steady revenue streams. Its diversified business model ensures risk mitigation across multiple sectors.

Key Metrics of the Madhav Infra Share

| Metric | Value |

|---|---|

| Market Cap | ₹520 Cr |

| Book Value | ₹6.99 |

| Face Value | ₹1 |

| PE Ratio | 25.8 |

| ROCE Ratio | 13.4% |

| ROE Ratio | 12.2% |

| Dividend Yield | 0% |

| 52-Week High | ₹20.8 |

| 52-Week Low | ₹5.75 |

Madhav Infra Share PriceChart of last 5 years

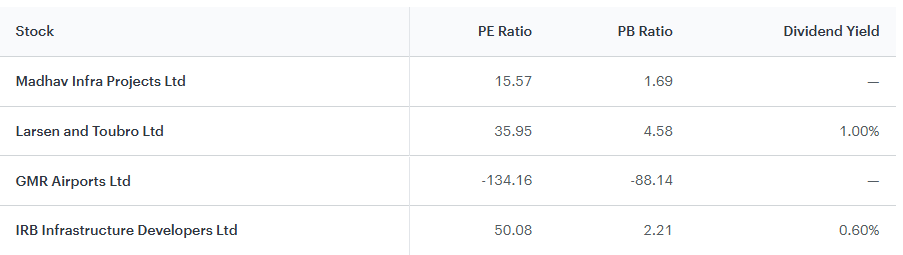

Peers & Comparison

Income Statement Analysis

Industry Overview

Industry refers to the specific sub-sector this company operates within. Companies that outperform their industry’s average revenue growth indicate a stronger potential for increasing market share.

Revenue Growth

Over the last five years, the company’s revenue has grown at an annual rate of 7.23%, compared to the industry average of 8.79%. While the company is experiencing consistent growth, it is slightly below the industry benchmark, suggesting room for improvement in capturing market demand.

Market Share

Market share represents the portion of an industry’s total sales attributed to a specific company, providing insight into its competitive positioning. Over the past five years, the company’s market share has remained steady at 0.1%, indicating stable but limited expansion within the industry.

Net Income Growth

Net income, which reflects a company’s total earnings after expenses, is a key indicator of profitability. Over the past five years, the company’s net income has grown at an annual rate of 33.33%, significantly outperforming the industry average of 27.92%. This suggests strong profitability improvements and effective cost management compared to peers.

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

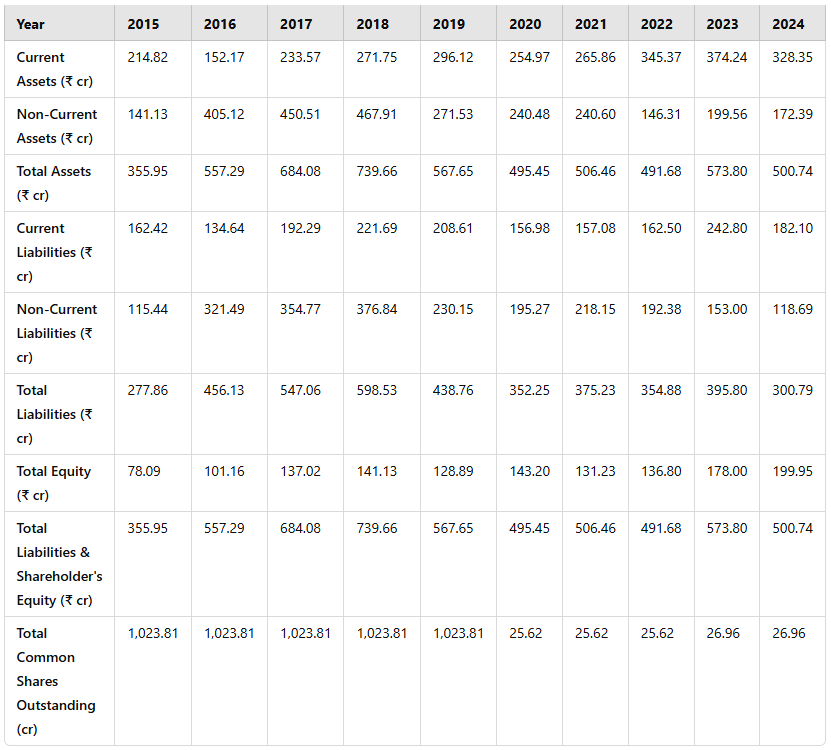

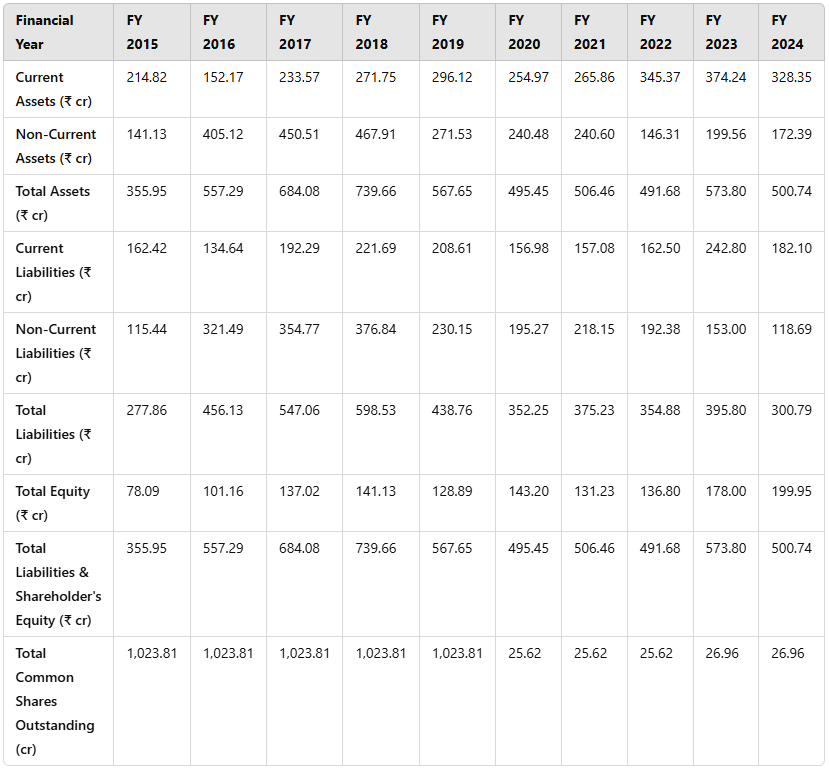

Balance Sheet Analysis

Debt to Equity Ratio

The debt-to-equity ratio measures a company’s reliance on debt financing relative to shareholder equity. Over the past five years, the company’s debt-to-equity ratio has averaged 146.71%, which is lower than the industry average of 170.63%. This indicates a relatively more balanced approach to financing operations while maintaining financial stability.

Current Ratio

The current ratio assesses a company’s ability to meet short-term obligations, with higher values indicating better liquidity. Over the past five years, the company’s current ratio has averaged 175.73%, surpassing the industry average of 113.84%. This suggests strong short-term financial health and a robust capacity to manage liabilities efficiently.

Conclusion

Overall, the company has demonstrated strong net income growth and liquidity, maintaining a stable market share while keeping its debt levels lower than industry averages. However, revenue growth remains slightly below the sector’s pace, indicating the need for strategic initiatives to enhance competitive positioning and capture a larger market share.

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

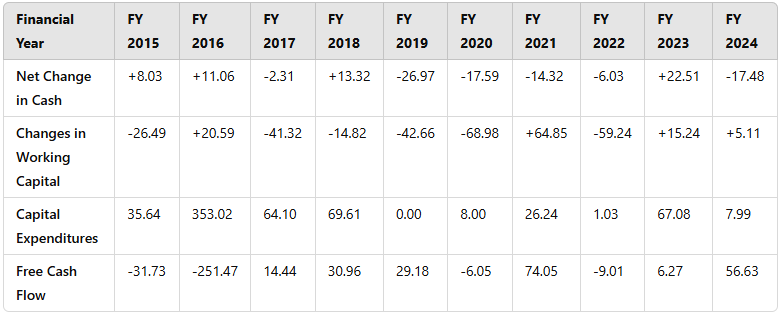

Cash Flow Statement

All numbers are in ₹ cr.

Fundamental Analysis

1. Company Overview

Madhav Infra Ltd has established itself as a reputable infrastructure development firm. With a strong presence in road construction, renewable energy projects, and urban infrastructure, the company benefits from government initiatives like the National Infrastructure Pipeline (NIP) and Smart City projects.

2. Financial Health

Debt Analysis

The company has a moderate debt-to-equity ratio, which means it relies on a mix of debt and equity financing. A close watch on debt servicing capabilities is crucial for long-term investors.

Cash Flow

Madhav Infra has shown stable cash flow from operations, attributed to timely project execution and payments from government contracts.

Liquidity

The company maintains a reasonable level of liquid assets to cover short-term liabilities. However, a high dependency on government contracts could pose risks related to delayed payments.

3. Competitive Analysis

Madhav Infra competes with well-established players like Larsen & Toubro, IRB Infrastructure, and GMR Infra. Its strength lies in niche market penetration, cost-effective project execution, and a focus on renewable energy.

4. Growth Prospects

Market Trends

- Increased government spending on infrastructure under the Budget 2025-2030.

- Rising demand for renewable energy projects, benefiting the company’s solar segment.

- Public-private partnerships (PPP) driving industry growth.

Strategic Initiatives

- Expansion of road construction projects in Tier-2 and Tier-3 cities.

- Entry into high-margin urban infrastructure projects.

- Investment in new technologies for efficient project execution.

5. Dividend Policy

The company has not been paying dividends, indicating reinvestment of profits for future growth. However, as profits increase, a dividend policy might be introduced post-2027.

6. ESG (Environmental, Social, and Governance) Factors

- Environmental: Focus on solar power projects, reducing carbon footprints.

- Social: Employment generation in rural infrastructure projects.

- Governance: Transparent management and financial disclosures.

Key Factors Impacting Madhav Infra Share Price

1. Government Infrastructure Policies

Government policies play a crucial role in shaping the future of infrastructure companies like Madhav Infra. Increased government spending on road construction, smart cities, and renewable energy projects will create significant growth opportunities. Programs such as the National Infrastructure Pipeline (NIP) and Gati Shakti Yojana aim to accelerate infrastructure development, which directly benefits companies in this sector. Additionally, policy support through subsidies, tax benefits, and ease of project approvals can enhance profitability and project execution timelines.

2. Economic Conditions

Macroeconomic factors such as inflation, interest rates, and GDP growth significantly influence the infrastructure sector. High inflation can increase raw material costs, while rising interest rates may impact borrowing costs, making debt financing expensive. On the other hand, strong economic growth can lead to higher government investments in infrastructure, creating increased demand for construction services. A stable economic environment with controlled inflation and favorable interest rates can contribute to consistent revenue growth for Madhav Infra.

3. Competitive Landscape

Madhav Infra operates in a highly competitive sector with major players such as Larsen & Toubro, IRB Infrastructure, and GMR Infra. Larger competitors often have better financial backing, technological advancements, and established industry relationships, which can pose a challenge for smaller firms like Madhav Infra. However, the company can counter this by focusing on niche markets, cost-effective project execution, and strategic partnerships to enhance its competitive positioning. Winning government tenders and building a strong reputation for timely project delivery will be critical for sustaining market share.

4. Debt Management

Debt levels are a key factor influencing stock performance, particularly in capital-intensive sectors like infrastructure. High levels of debt can lead to increased interest expenses, reducing profitability. Madhav Infra must ensure effective debt management by maintaining an optimal debt-to-equity ratio, improving cash flows, and securing long-term low-cost financing. Reducing reliance on short-term borrowings and maintaining strong liquidity reserves will help the company manage financial risks effectively.

5. Global Factors

The infrastructure sector is also impacted by global economic trends, supply chain disruptions, and commodity price fluctuations. Factors such as geopolitical tensions, trade restrictions, and international raw material shortages can lead to cost escalations and project delays. Additionally, fluctuations in currency exchange rates can affect procurement costs for imported materials. To mitigate these risks, Madhav Infra should explore local sourcing strategies, strategic inventory management, and diversified supplier networks to ensure project stability despite global uncertainties.

Detailed Analysis of Madhav Infra Share Price Target 2025 to 2030

Madhav Infra Share Price Target 2025

Target 1: ₹18 | Target 2: ₹22

- Factors Driving Growth:

- Government’s continued push for infrastructure projects under the National Infrastructure Pipeline (NIP).

- Growing order book with new road and urban projects.

- Improved execution capabilities leading to higher revenue realization.

- Market sentiment driven by India’s economic recovery post-pandemic.

Madhav Infra Share Price Target 2026

Target 1: ₹24 | Target 2: ₹28

- Factors Driving Growth:

- Expansion into Tier-2 and Tier-3 cities for urban infrastructure development.

- Increased participation in solar energy projects, benefiting from government incentives.

- Potential improvement in financial performance with better debt management.

- Institutional investments leading to improved market confidence.

Madhav Infra Share Price Target 2027

Target 1: ₹30 | Target 2: ₹35

- Factors Driving Growth:

- Strong backlog of infrastructure projects ensuring consistent cash flow.

- Potential entry into Build-Operate-Transfer (BOT) projects for long-term revenue stability.

- Rising demand for renewable energy solutions benefiting the company’s solar segment.

- Improved return on equity (ROE) and return on capital employed (ROCE).

Madhav Infra Share Price Target 2028

Target 1: ₹38 | Target 2: ₹45

- Factors Driving Growth:

- Higher revenue contributions from diversified business segments.

- Technological advancements leading to cost efficiency and margin improvements.

- Expansion into international markets and joint ventures for infrastructure projects.

- Possible dividend introduction attracting long-term investors.

Madhav Infra Share Price Target 2029

Target 1: ₹48 | Target 2: ₹55

- Factors Driving Growth:

- Strong financial performance with reduced debt-to-equity ratio.

- Expansion into high-margin projects like smart cities and expressways.

- Enhanced brand reputation and government trust in project execution.

- Increased private sector collaborations leading to steady revenue growth.

Madhav Infra Share Price Target 2030

Target 1: ₹60 | Target 2: ₹70

- Factors Driving Growth:

- Long-term stable revenue from diversified infrastructure contracts.

- Potential for stock re-rating due to consistent financial outperformance.

- Strong environmental, social, and governance (ESG) factors improving investor perception.

- Sustained dividend payouts making it attractive for income investors.

Summary of Madhav Infra Share Price Target 2025 to 2030

| Year | Target 1 (₹) | Target 2 (₹) |

|---|---|---|

| 2025 | 18 | 22 |

| 2026 | 24 | 28 |

| 2027 | 30 | 35 |

| 2028 | 38 | 45 |

| 2029 | 48 | 55 |

| 2030 | 60 | 70 |

Conclusion

Madhav Infra Ltd is positioned for steady growth due to its strong foothold in infrastructure and renewable energy. With government policies favoring infrastructure development, the company can achieve significant price appreciation. However, investors should monitor debt levels, economic conditions, and competitive pressures before making long-term investment decisions.

Frequently Asked Questions (FAQs) about Madhav Infra Share Price Target 2025 to 2030

- What is Madhav Infra Ltd’s primary business?

Madhav Infra Ltd operates in the infrastructure and construction sector, focusing on road development, solar power projects, and urban infrastructure. The company secures revenue through government contracts and private sector projects. - What are the key financial metrics of Madhav Infra?

Some key financial metrics include a market cap of ₹520 Cr, a PE ratio of 25.8, an ROCE of 13.4%, and an ROE of 12.2%. The company has a book value of ₹6.99 and a face value of ₹1. - How has Madhav Infra’s revenue grown over the last five years?

Madhav Infra’s revenue has grown at an annual rate of 7.23%, which is slightly lower than the industry average of 8.79%. - What is the company’s market share in the infrastructure sector?

The company’s market share has remained steady at 0.1% over the past five years, indicating stable but limited expansion. - How has Madhav Infra’s net income performed in comparison to the industry?

Madhav Infra’s net income has grown at an annual rate of 33.33%, outperforming the industry average of 27.92%, showcasing strong profitability improvements. - What is the debt-to-equity ratio of Madhav Infra?

The company has maintained a debt-to-equity ratio of 146.71%, which is lower than the industry average of 170.63%, indicating a more balanced financial position. - What are the key factors impacting Madhav Infra Share Price ?

Key factors include government infrastructure policies, economic conditions, competition, debt management, and global factors such as supply chain disruptions and material price fluctuations. - What are the projected Madhav Infra Share Price Target 2025 to 2030?

The estimated share price targets are as follows:- 2025: ₹18 – ₹22

- 2026: ₹24 – ₹28

- 2027: ₹30 – ₹35

- 2028: ₹38 – ₹45

- 2029: ₹48 – ₹55

- 2030: ₹60 – ₹70

- Does Madhav Infra pay dividends?

Currently, Madhav Infra does not pay any dividends, as the company reinvests its earnings for growth. A dividend policy may be introduced post-2027. - What are Madhav Infra’s growth prospects in the coming years?

Growth prospects include increased government spending on infrastructure, expansion into Tier-2 and Tier-3 cities, investments in renewable energy, and improved project execution capabilities.

2 thoughts on “Madhav Infra Share Price Target 2025 to 2030”