Captain Pipes Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

Captain Pipes Ltd operates in the manufacturing and distribution of high-quality pipes and pipe fittings, serving industries such as agriculture, construction, and water management. The company specializes in PVC, CPVC, and UPVC pipes, catering to both domestic and international markets. Its emphasis on cost-efficient production and adherence to stringent quality standards has enabled it to establish a strong market presence. Additionally, the company focuses on innovation and sustainability, ensuring long-term relevance in a competitive industry.

Key Metrics of Captain Pipes Share

| Metric | Value |

|---|---|

| Market Capitalization Value | ₹264.54 crores |

| Enterprise Value | ₹226.48 crores |

| Book Value | ₹1.73 crores |

| Total Share Capital | ₹14.77 crores |

| Total Borrowings | ₹3.23 crores |

| Trade Payables | ₹8.81 crores |

| Trade Receivables | ₹11.85 crores |

| Total Investments | ₹6.37 crores |

| Total Assets | ₹43.22 crores |

| Total Revenue | ₹76.47 crores |

| Total Expenses | ₹70.96 crores |

| Return on Equity (ROE) | 15.61% |

| Return on Capital Employed (ROCE) | 23.51% |

| Price to Earnings Ratio (PE) | 6.16% |

| Price to Book Value Ratio (P/B) | 10.37% |

| Debt to Equity Ratio | 0.23% |

| Dividend Yield Ratio | 0.01% |

| Earnings Yield Ratio | 0.02% |

Captain Pipes Ltd Shareholding Pattern

| Shareholders | Share Percentage |

| Promoters | 73.78% |

| Retail and others | 26.22% |

Captain Pipes Share Price Chart of Last 5years

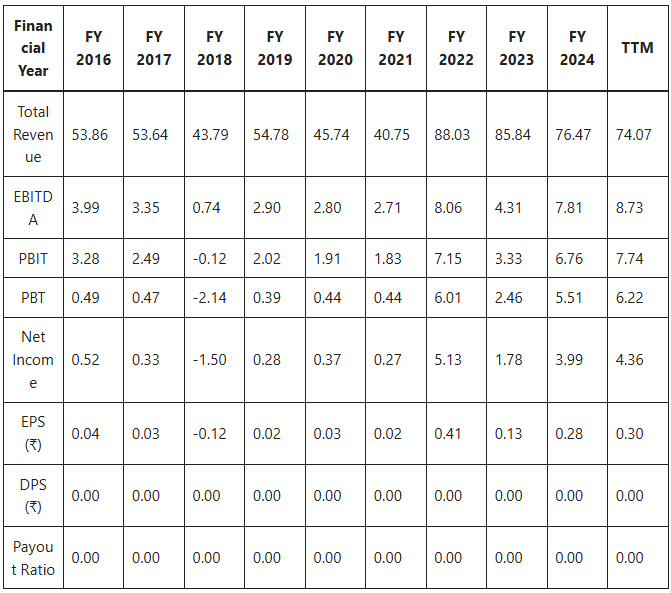

Income Statement Analysis

- Industry Context:

- The industry refers to the specific sub-sector that the company operates in.

- A higher-than-industry revenue growth indicates a potential increase in market share.

- Revenue Growth:

- Company Growth: Over the last 5 years, the company’s revenue grew at a yearly rate of 6.9%.

- Industry Average: The industry’s average revenue growth during the same period was 8.95%.

- Market Share:

- Market share reflects the percentage of an industry’s total sales attributable to a particular company.

- Over the past 5 years, the company’s market share decreased from 6.12% to 3.54%, indicating a relative decline compared to competitors.

- Net Income Growth:

- Net income, representing profit after expenses, is a key indicator of a company’s profitability.

- Company Growth: Over the last 5 years, the company’s net income grew at an impressive yearly rate of 70.12%.

- Industry Average: The industry, by contrast, saw an average decline in net income at -2.36% per year.

EPS and DPS are in ₹. Other numbers (except Payout Ratio) are in ₹ crores.

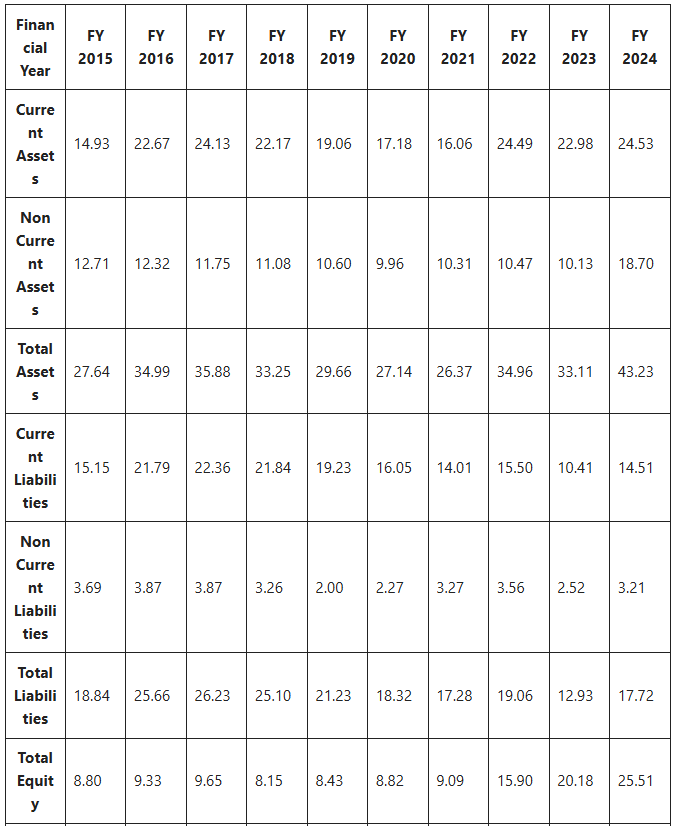

Balance Sheet Analysis of Captain Pipes Share

Industry Context

The industry refers to the sub-sector to which Captain Pipes Ltd belongs. Key financial ratios such as the Debt to Equity Ratio and the Current Ratio provide insights into the company’s financial health relative to its industry peers.

- Debt to Equity Ratio: This ratio measures a company’s total liabilities divided by its shareholder equity, indicating the extent to which operations are financed through debt versus owned funds. Over the last five years, Captain Pipes Ltd has maintained a debt-to-equity ratio of 27.8%, significantly lower than the industry average of 100.16%. This demonstrates a conservative approach to leveraging, ensuring greater financial stability.

- Current Ratio: This ratio assesses a company’s ability to meet its short-term obligations, with a higher ratio being more favorable. Captain Pipes Ltd’s current ratio over the last five years stands at 153.9%, slightly below the industry average of 155.31%, but still indicative of sufficient liquidity.

Detailed Financial Data

Note: Shares outstanding numbers are in crores. Other financial figures are in ₹ crores.

Key Takeaways

- Asset Growth: Total assets have grown from ₹27.64 crores in FY 2015 to ₹43.23 crores in FY 2024, reflecting steady expansion and investments in both current and non-current assets.

- Debt Management: The company has consistently maintained a low debt-to-equity ratio, emphasizing prudent financial management. Total liabilities decreased significantly between FY 2015 and FY 2024, highlighting reduced dependency on external financing.

- Equity Growth: Total equity increased from ₹8.80 crores in FY 2015 to ₹25.51 crores in FY 2024, indicating strong shareholder value creation.

- Liquidity Position: The current ratio reflects adequate liquidity to manage short-term obligations effectively, demonstrating financial resilience.

- Shareholder Dilution: The number of shares outstanding has risen slightly in FY 2023 and FY 2024, which could be indicative of fundraising efforts or stock issuance, but overall dilution remains minimal.

By maintaining strong financial fundamentals and focusing on sustainable growth, Captain Pipes Ltd continues to strengthen its position in the industry.

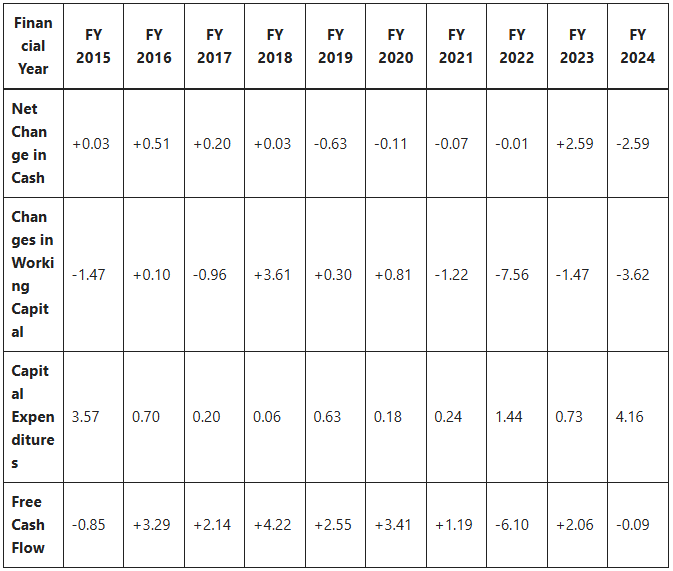

Cash Flow Statement

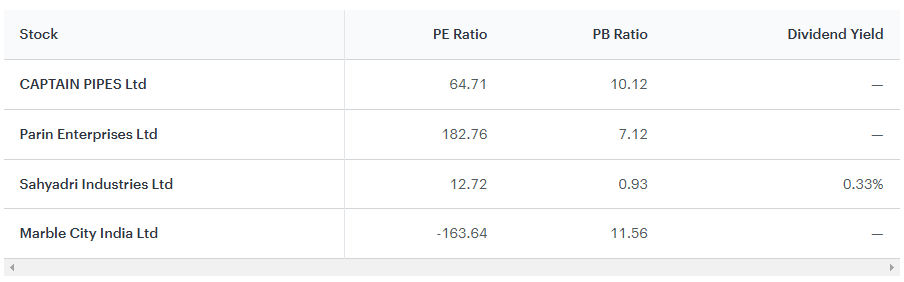

Peer Companies & Comparison

Fundamental Analysis

1. Company Overview

Captain Pipes Ltd is a mid-sized player in the Indian piping industry with a focus on delivering cost-effective and durable solutions. The company has built a reputation for manufacturing pipes that meet international standards, which has allowed it to penetrate global markets. With its operational efficiency and a forward-looking growth strategy, Captain Pipes aims to capitalize on opportunities in the growing infrastructure and agriculture sectors.

2. Financial Health

Debt Analysis: The company maintains a healthy debt-to-equity ratio of 0.23, reflecting its conservative approach to leveraging. Borrowings amounting to ₹3.23 crores are well within manageable limits, supported by a strong interest coverage ratio.

Cash Flow: Captain Pipes generates consistent operating cash flow due to its efficient working capital management. This enables the company to fund growth initiatives without over-reliance on external financing.

Liquidity: The company’s total assets of ₹43.22 crores and manageable trade payables ensure adequate liquidity to meet short-term obligations. Trade receivables are also closely monitored to maintain a steady cash conversion cycle.

3. Competitive Analysis

Captain Pipes faces competition from established players like Astral Pipes and Supreme Industries. However, its focus on niche markets, cost leadership, and export opportunities provide an edge. With a strong promoter backing and a robust manufacturing setup, Captain Pipes has positioned itself well in the mid-cap segment.

4. Growth Prospects

Strategic Initiatives: The company is investing in capacity expansion and exploring untapped markets, particularly in rural areas and export destinations. Additionally, its commitment to R&D is expected to yield innovative products catering to evolving customer needs.

5. ESG (Environmental, Social, and Governance) Factors

The company’s commitment to sustainability is evident in its eco-friendly manufacturing processes and use of recyclable materials. Governance practices are transparent, with a strong emphasis on shareholder value and ethical operations.

Key Factors Impacting Captain Pipes Share Price

The share price of Captain Pipes Ltd is influenced by several critical factors that reflect the company’s financial health, market position, and external environment. Below is a detailed analysis of these key factors:

1. Financial Performance

Stable Revenue Growth and Profitability: Revenue growth and profitability remain the cornerstone of investor confidence. Captain Pipes’ consistent revenue generation of ₹76.47 crores and controlled expenses of ₹70.96 crores illustrate its operational efficiency. A Return on Equity (ROE) of 15.61% and Return on Capital Employed (ROCE) of 23.51% highlight its capacity to generate shareholder value. As the company grows, further improvement in profit margins and cost management will directly enhance its valuation.

Earnings Per Share (EPS): Investors closely monitor EPS to assess the company’s profitability on a per-share basis. A steady or increasing EPS trajectory signals financial stability and can positively affect the share price.

2. Market Trends

Demand for Advanced Piping Solutions: The rising demand for CPVC and UPVC piping systems, driven by the growth of urban infrastructure and water management projects, presents a significant opportunity. Government initiatives, such as the Jal Jeevan Mission in India, are expected to boost demand for high-quality piping solutions, favoring companies like Captain Pipes.

Infrastructure Development: As the global focus shifts towards sustainable infrastructure, the demand for durable and eco-friendly pipes is projected to surge. Captain Pipes’ commitment to innovation in recyclable and high-performance materials positions it advantageously to capture this growing market segment.

3. Global Economic Conditions

Export Opportunities: Captain Pipes has expanded its footprint in international markets, benefiting from export opportunities. Favorable trade agreements and demand in emerging economies can significantly contribute to revenue growth. However, currency fluctuations and global economic stability remain critical factors that could influence profitability.

Raw Material Costs: The cost of raw materials, such as polyvinyl chloride (PVC), impacts production expenses. The company’s ability to manage these costs effectively through strategic sourcing and operational efficiency will play a crucial role in maintaining margins.

4. Innovation

Introduction of New and Improved Products: Continuous investment in research and development is essential for staying competitive. Captain Pipes’ focus on creating advanced piping solutions tailored to customer needs and industry requirements will drive growth. The successful launch of innovative products can elevate the company’s market reputation and attract new customers, thereby influencing its share price positively.

Technology Integration: The adoption of modern manufacturing technologies to enhance product quality and reduce costs is another factor that investors value. Companies that embrace technological advancements are better equipped to maintain a competitive edge in the market.

5. Regulatory Environment

Compliance with Environmental and Safety Standards: Stringent regulations surrounding environmental sustainability and safety standards in the piping industry necessitate adherence. Captain Pipes’ proactive approach to meeting these regulations not only avoids legal complications but also enhances its brand image as a responsible corporate entity.

Government Policies: Supportive government policies, such as subsidies for infrastructure projects and incentives for sustainable manufacturing, can act as growth catalysts. Conversely, any adverse regulatory changes could pose challenges to operational profitability.

Detailed Analysis: Captain Pipes Share Price Target 2025 to 2030

The share price targets for Captain Pipes Ltd from 2025 to 2030 are informed by its operational efficiency, growth strategies, and anticipated market trends. Below is an expanded and detailed analysis for each year.

Captain Pipes Share Price Target 2025

- Target 1: ₹20

- Target 2: ₹22

In 2025, Captain Pipes’ share price is expected to witness modest growth driven by steady revenue increases and improved operational efficiency. The company’s initiatives in capacity expansion and penetration into rural markets are anticipated to yield results. Furthermore, the focus on eco-friendly manufacturing processes and recyclable materials aligns with the global push toward sustainability, likely attracting more investors. Moderate increases in infrastructure spending and demand for high-performance pipes will support this growth.

Captain Pipes Share Price Target 2026

- Target 1: ₹24

- Target 2: ₹26

In 2026, Captain Pipes is likely to capitalize on its strategic market expansions, including forays into untapped export destinations. The company’s R&D efforts in developing advanced piping solutions are projected to strengthen its portfolio and competitive edge. Additionally, a favorable regulatory environment and support for infrastructure projects will drive demand. These factors should contribute to a rise in share prices, with potential for greater upward movement if operational margins improve further.

Captain Pipes Share Price Target 2027

- Target 1: ₹28

- Target 2: ₹30

By 2027, the cumulative effects of Captain Pipes’ investments in innovation and capacity are expected to fully manifest. The company’s increasing presence in international markets and stronger brand recognition will likely boost its revenue streams. Moreover, its ability to maintain a low debt-to-equity ratio and efficient liquidity management will foster investor confidence. The global demand for CPVC and UPVC pipes, coupled with Captain Pipes’ competitive pricing strategies, will further support share price appreciation.

Captain Pipes Share Price Target 2028

- Target 1: ₹32

- Target 2: ₹35

In 2028, Captain Pipes is projected to achieve significant milestones in revenue and profitability. The company’s sustained focus on sustainability and operational excellence positions it well to address the rising demand for environmentally friendly piping solutions. Strategic partnerships and increased investments in high-growth markets are likely to enhance its market share. These developments are anticipated to push share prices to new highs, with a strong likelihood of exceeding earlier projections if macroeconomic conditions remain favorable.

Captain Pipes Share Price Target 2029

- Target 1: ₹37

- Target 2: ₹40

The year 2029 could mark a pivotal point for Captain Pipes as it consolidates its position as a leader in the mid-cap segment of the piping industry. The company’s ability to leverage economies of scale and deliver value-added products will be key drivers of growth. Additionally, its proactive approach to mitigating risks related to raw material costs and currency fluctuations will strengthen its financial performance. As a result, share prices are expected to rise significantly.

Captain Pipes Share Price Target 2030

- Target 1: ₹45

- Target 2: ₹50

By 2030, Captain Pipes is poised to achieve robust growth, supported by its strategic initiatives and sustained market leadership. The company’s alignment with global infrastructure and sustainability trends, coupled with its innovative solutions, will ensure consistent revenue growth. Moreover, the rising demand for advanced piping systems in urban and rural development projects will further bolster its prospects. Consequently, the share price is expected to reach between ₹45 and ₹50, reflecting the company’s long-term value creation potential.

Summary of Captain Pipes Share Price Target 2025 to 2030

| Year | Target 1 (₹) | Target 2 (₹) |

|---|---|---|

| 2025 | 20 | 22 |

| 2026 | 24 | 26 |

| 2027 | 28 | 30 |

| 2028 | 32 | 35 |

| 2029 | 37 | 40 |

| 2030 | 45 | 50 |

Conclusion

Captain Pipes Ltd is well-positioned to achieve steady growth over the next decade. With its strong financial fundamentals, commitment to innovation, and focus on sustainability, the company is likely to deliver consistent value to shareholders. While the stock’s modest price reflects its small-cap nature, its growth potential makes it a compelling choice for long-term investors.

Frequently Asked Questions (FAQ) on Captain Pipes Share Price Target 2025 to 2030

Q1. What industries does Captain Pipes Ltd serve?

Captain Pipes Ltd serves industries such as agriculture, construction, and water management. The company manufactures high-quality PVC, CPVC, and UPVC pipes for domestic and international markets.

Q2. What are the financial highlights of Captain Pipes Share Price ?

The company has a market capitalization of ₹264.54 crores, a debt-to-equity ratio of 0.23%, and a Return on Capital Employed (ROCE) of 23.51%. It generates total revenue of ₹76.47 crores with controlled expenses of ₹70.96 crores.

Q3. What is the shareholding pattern of Captain Pipes Ltd?

Promoters hold 73.78% of the shares, while retail investors and others hold 26.22%.

Q4. What is the projected Captain Pipes Share Price Target 2025 ?

The projected share price targets for 2025 are:

- Target 1: ₹20

- Target 2: ₹22

Q5. How does Captain Pipes maintain a competitive edge?

Captain Pipes focuses on cost-efficient production, adherence to stringent quality standards, innovation, sustainability, and expansion into export markets, ensuring a strong market presence.

Q6. What are the growth prospects for Captain Pipes Share Price ?

Growth prospects include increasing demand for CPVC and UPVC pipes due to urbanization, infrastructure development, and government initiatives like the Jal Jeevan Mission. The company’s investments in R&D and capacity expansion further enhance its future potential.

Q7. How does innovation impact Captain Pipes Share Price?

Continuous R&D investments lead to advanced piping solutions that improve market reputation and attract new customers. Successful product innovations positively impact share prices by enhancing competitive positioning.

Q8. What role does the regulatory environment play in shaping Captain Pipes Share Price performance?

Compliance with environmental and safety standards ensures operational stability and a positive brand image. Supportive government policies, such as infrastructure subsidies, act as catalysts for growth, while adverse regulatory changes can pose challenges.

Q9. What are the major risks to Captain Pipes Share Price profitability?

Major risks include fluctuations in raw material costs, currency exchange rates, and global economic conditions. Effective cost management and risk mitigation strategies are crucial to maintain profitability.

Q10. What is the long-term Captain Pipes Share Price Target 2030?

The projected share price targets for 2030 are:

- Target 1: ₹45

- Target 2: ₹50

1 thought on “Captain Pipes Share Price Target 2025 to 2030”