Genus Power Share Price Target 2025 to 2030: A Detailed Analysis

The current share price of Genus Power is ₹336, making it a prominent stock in the energy and power sector. This article provides an in-depth analysis of Genus Power’s share price target from 2025 to 2030, examining its business model, financial health, competitive standing, and future growth potential.

Understanding Business Model

Genus Power is a key player in the power infrastructure sector, specializing in the manufacturing of electricity meters, smart meters, and power distribution management solutions. The company serves utilities, government agencies, and private players, playing a critical role in enhancing energy efficiency and grid management. With the ongoing push for smart metering solutions and energy reforms, Genus Power is well-positioned to capitalize on the growing demand for advanced energy technologies.

Key Metrics of Genus Power Share

| Metric | Value |

|---|---|

| P/E Ratio | 92.39 |

| Dividend Yield | 0.15% |

| 52-Week High | ₹476.55 |

| 52-Week Low | ₹204.50 |

| Market Cap | ₹12.14K Cr |

| Face Value | ₹1 |

Shareholding Pattern

| Category | Holding (%) |

| Promoters | 40.66 |

| Retail and Others | 34.63 |

| Foreign Institutions | 17.91 |

| Mutual Funds | 4.43 |

| Other Domestic Institutions | 0.37 |

Genus Power Share Price Chart of Last 5 years

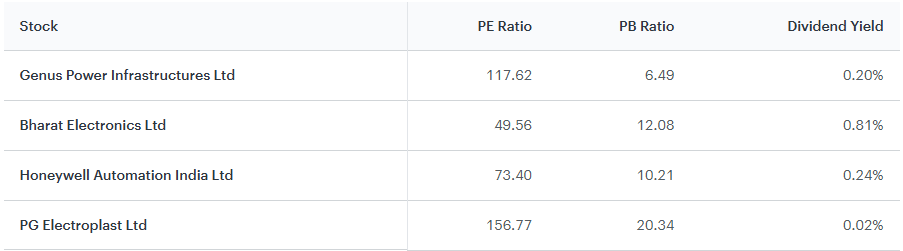

Peer Companies & Comparison

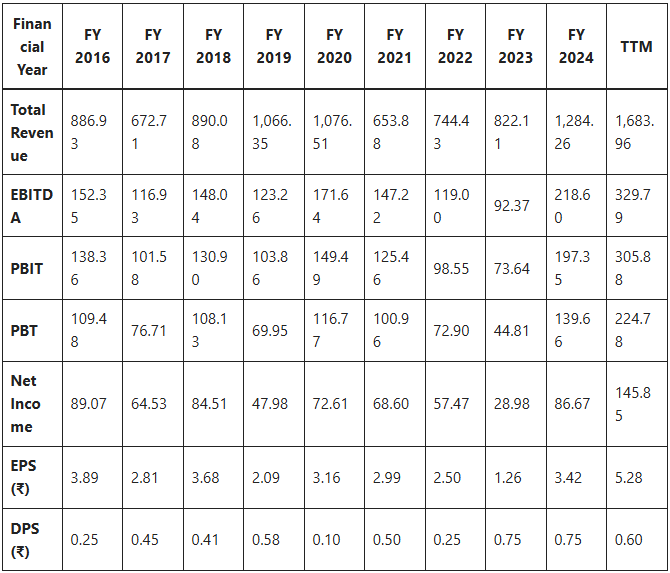

Income Statement Analysis

The income statement provides insights into the company’s performance over time, focusing on revenue growth, profitability, and shareholder returns.

Key Observations:

- Revenue Growth:

- Over the past 5 years, the company’s revenue has grown at a 3.79% yearly rate, significantly lower than the industry average of 9.94%.

- Revenue increased from ₹886.93 cr in FY 2016 to ₹1,284.26 cr in FY 2024 (TTM: ₹1,683.96 cr).

- The company is underperforming compared to its peers, which may indicate a declining competitive position or weaker demand for its products/services.

- Market Share:

- The company’s market share decreased from 5.52% to 3.22% over the past 5 years.

- Declining market share suggests competitors may be capturing a larger portion of industry growth, or the company is losing its competitive edge.

- Net Income Growth:

- Net income has grown at a respectable 12.55% yearly rate, although below the industry average of 16.74%.

- From ₹89.07 cr in FY 2016, net income reached ₹86.67 cr in FY 2024 (TTM: ₹145.85 cr).

- Earnings Per Share (EPS):

- EPS decreased from ₹3.89 in FY 2016 to ₹1.26 in FY 2023 but rebounded to ₹3.42 in FY 2024 (TTM: ₹5.28).

- This fluctuation could reflect dilution, changes in profitability, or inconsistent earnings.

- Dividends Per Share (DPS):

- DPS fluctuated, peaking at ₹0.75 in FY 2023 but declining to ₹0.60 in FY 2024 (TTM).

- The payout ratio has remained moderate, averaging around 0.22, indicating a balanced approach to dividends and reinvestment.

Income Statement Data (₹ cr)

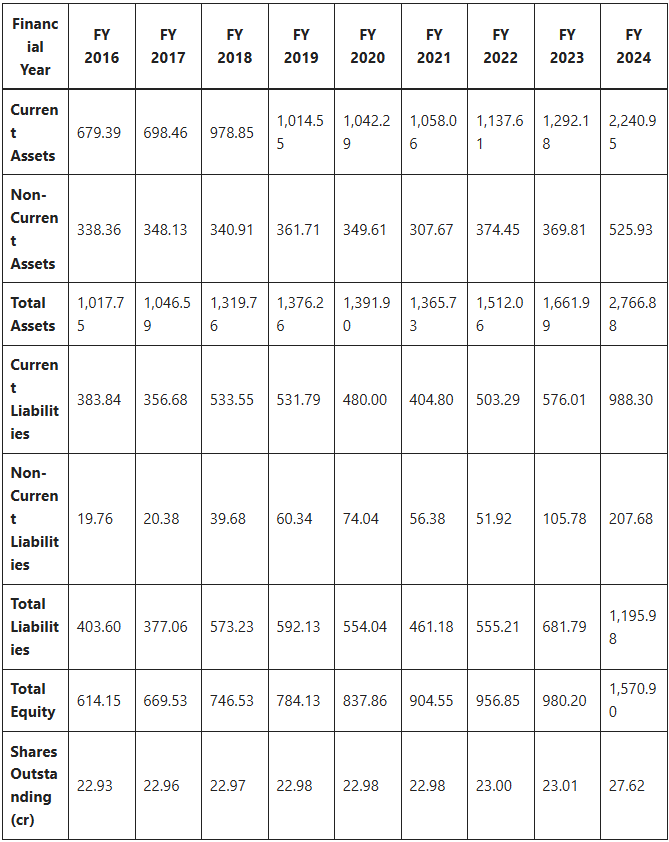

Balance Sheet Analysis

The balance sheet provides insights into the company’s financial position, focusing on assets, liabilities, equity, and key financial ratios.

Key Observations:

- Debt-to-Equity Ratio:

- Over the last 5 years, the average debt-to-equity ratio was 30.95%, higher than the industry average of 11.56%.

- While not overly leveraged, the company relies more on debt than its peers, which could elevate financial risk during economic downturns.

- Current Ratio:

- The average current ratio was 231.13%, significantly above the industry average of 154.64%.

- This indicates strong liquidity and the ability to cover short-term obligations comfortably.

- Asset Composition:

- Current assets grew consistently, from ₹679.39 cr in FY 2016 to ₹2,240.95 cr in FY 2024, indicating increased operational capacity or short-term investments.

- Non-current assets remained relatively stable, increasing from ₹338.36 cr in FY 2016 to ₹525.93 cr in FY 2024, suggesting limited long-term asset expansion.

- Liabilities:

- Total liabilities increased from ₹403.60 cr in FY 2016 to ₹1,195.98 cr in FY 2024, driven by both current and non-current liabilities.

- The increase in liabilities aligns with the higher debt-to-equity ratio.

- Equity Growth:

- Total equity grew from ₹614.15 cr in FY 2016 to ₹1,570.90 cr in FY 2024, indicating shareholder value creation.

- Shares outstanding increased from 22.93 cr to 27.62 cr, which may reflect equity issuance or stock-based compensation.

Balance Sheet Data (₹ cr)

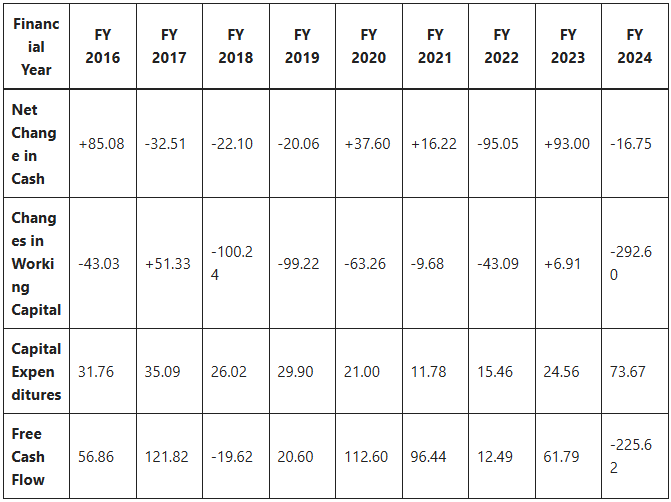

Cash Flow Statement

Fundamental Analysis

1. Company Overview

Genus Power is a leader in the energy metering sector, known for its innovation and robust product portfolio. The company’s focus on smart meters aligns with government initiatives like the Smart Grid Mission, which aims to modernize power distribution systems. Its strong R&D capabilities and strategic partnerships with utilities have contributed to its competitive edge in the market.

2. Financial Health

Debt Analysis

Genus Power maintains a healthy balance sheet with manageable debt levels. The low leverage indicates financial prudence, enabling the company to invest in expansion and R&D without significant financial strain.

Cash Flow

The company’s cash flow remains stable, supported by consistent revenues from long-term contracts with utilities and government projects. Strong operational cash flow provides a cushion for future investments and dividend payouts.

Liquidity

Genus Power exhibits robust liquidity metrics, ensuring its ability to meet short-term obligations. Its liquidity position also enables it to capitalize on emerging opportunities in the energy sector.

3. Competitive Analysis

The energy metering industry is highly competitive, with players like Landis+Gyr, Schneider Electric, and Secure Meters posing significant challenges. Genus Power’s competitive advantages include:

- Strong market presence in India.

- Advanced manufacturing facilities.

- Focus on innovation and smart metering solutions.

However, the company must continue to innovate and address pricing pressures to maintain its market share.

4. Growth Prospects

Market Trends

The global smart meter market is expected to grow at a CAGR of 8-10% over the next decade, driven by:

- Rising demand for energy efficiency.

- Government initiatives for smart grid implementation.

- Increasing investments in renewable energy.

Genus Power’s strategic alignment with these trends positions it for significant growth.

Strategic Initiatives

To sustain growth, the company is focusing on:

- Expanding its product portfolio to include advanced metering solutions.

- Strengthening its export presence to tap into international markets.

- Collaborating with government agencies on large-scale projects.

5. Dividend Policy

Genus Power’s dividend yield of 0.15% reflects its focus on reinvesting earnings into growth initiatives. While the dividend payout is modest, consistent profitability could enable higher payouts in the future, appealing to income-focused investors.

6. ESG (Environmental, Social, and Governance) Factors

Sustainability and governance are critical for Genus Power’s long-term success. The company’s efforts to develop eco-friendly products and maintain transparency in its operations align with global ESG standards, enhancing its appeal to socially responsible investors.

Key Factors Impacting Genus Power Share Price

The share price of Genus Power is influenced by a range of factors, reflecting the company’s performance, market conditions, and strategic initiatives. Here is a detailed analysis of the key elements impacting its share price:

Market Growth

The global smart meter market is expanding rapidly, driven by increasing demand for energy efficiency and government-led initiatives. Key drivers include:

- Smart Meter Adoption: Rising awareness about energy conservation is boosting the demand for smart meters, which provide real-time data on energy usage. Genus Power’s expertise in this segment positions it to benefit from this growth.

- Infrastructure Modernization: Governments worldwide are investing in smart grids to enhance energy distribution and reliability. These projects create significant opportunities for Genus Power.

- Renewable Energy Integration: As renewable energy becomes a critical part of the energy mix, demand for advanced energy management solutions, including smart meters, is expected to rise.

Profitability Metrics

Profitability is a key determinant of investor confidence. Genus Power’s performance in metrics such as Return on Equity (ROE) and Return on Capital Employed (ROCE) will impact its share price. Potential improvements include:

- Enhanced Asset Utilization: By maximizing the efficiency of its production facilities and supply chain, the company can achieve better returns.

- Value-Added Products: Introducing high-margin products like advanced smart metering solutions could boost profitability.

- Operational Efficiency: Cost management and process optimization are critical for improving ROE and ROCE.

Debt Management

Maintaining a low debt-to-equity ratio is crucial for financial stability and investor trust. Genus Power’s approach to debt management includes:

- Prudent Borrowing: Limiting borrowing to fund strategic investments without overleveraging.

- Focus on Internal Funding: Utilizing operational cash flows for expansion and R&D to avoid excessive reliance on debt.

- Financial Flexibility: A strong balance sheet allows the company to respond effectively to market opportunities and challenges.

Market Sentiment

Investor perception plays a pivotal role in share price movements. Positive sentiment can be driven by:

- Strategic Partnerships: Collaborations with government agencies and private players enhance credibility and market visibility.

- Consistent Performance: Delivering steady revenue growth and profitability fosters investor confidence.

- Transparent Communication: Regular updates on business performance and strategic initiatives build trust and attract investors.

Regulatory Environment

Compliance with energy and environmental regulations is critical for sustaining operations and avoiding financial penalties. Key considerations include:

- Adhering to Standards: Meeting global standards for energy efficiency and sustainability ensures market access and competitive positioning.

- Policy Incentives: Leveraging subsidies and incentives for clean energy initiatives can enhance profitability.

- Risk Mitigation: Proactively addressing regulatory risks, such as changes in trade policies, minimizes disruptions.

Genus Power Share Price Target 2025 to 2030

Genus Power Share Price Target 2025

By 2025, the projected share price of Genus Power could range between ₹400-450, primarily driven by:

- Increased Adoption of Smart Meters: With the government’s push for digitization and modernization of the power sector, smart meters are becoming increasingly prevalent. Genus Power, being a key player in this segment, is poised to benefit significantly from this trend.

- Government Support for Energy Reforms: Initiatives like the UDAY scheme and other power distribution reforms are expected to boost the demand for advanced metering solutions, directly impacting the company’s growth.

- Improved Financial Metrics: A focus on improving EBITDA margins and consistent revenue growth will further attract investor confidence.

Genus Power Share Price Target 2026

By 2026, Genus Power’s share price could reach between ₹450-500, supported by:

- Continued Market Penetration: The company’s ability to secure contracts from major utilities will play a vital role in expanding its market share.

- Operational Efficiency: Ongoing investments in advanced manufacturing techniques and supply chain optimization will enhance profitability.

- Technological Leadership: Development of innovative products, such as prepayment meters and smart grid solutions, will strengthen its competitive edge.

Genus Power Share Price Target 2027

By 2027, the share price may rise to ₹500-550, driven by:

- Strategic Initiatives: Diversification of its product portfolio, including offerings tailored for renewable energy integration, will cater to emerging market needs.

- Export Growth: Expansion into international markets, particularly in regions like Southeast Asia and Africa, will open new revenue streams.

- Policy Tailwinds: Continued government initiatives promoting energy efficiency and smart infrastructure will provide a supportive macroeconomic backdrop.

Genus Power Share Price Target 2028

By 2028, Genus Power’s share price could range between ₹550-600, fueled by:

- Expansion into International Markets: Strategic partnerships and collaborations in global markets will enhance the company’s footprint.

- Development of High-Margin Products: Focus on value-added products such as advanced smart meters with integrated software solutions will boost overall profitability.

- Sustained Profitability: Consistent improvement in financial metrics, including ROE and ROCE, will maintain investor interest.

Genus Power Share Price Target 2029

By 2029, the share price could elevate to ₹600-650, backed by:

- Strong Global Presence: Establishing itself as a leader in the smart metering solutions market globally will bolster revenue growth.

- Improved Return Ratios: Enhanced operational efficiency and economies of scale will lead to better returns on equity and capital employed.

- Increased R&D Investments: Innovations in energy management solutions will help differentiate the company from competitors.

Genus Power Share Price Target 2030

By 2030, Genus Power’s share price could reach ₹650-700, provided the company achieves:

- Sustainable Growth: Robust financial performance through consistent revenue growth and margin expansion.

- Risk Mitigation: Effective strategies to counter competitive pressures and global market uncertainties.

- Alignment with ESG Standards: Adoption of environmentally sustainable practices and governance policies will attract long-term institutional investors.

Summary of Genus Power Share Price Target 2025 to 2030

| Year | Target Price (₹) |

|---|---|

| 2025 | 400-450 |

| 2026 | 450-500 |

| 2027 | 500-550 |

| 2028 | 550-600 |

| 2029 | 600-650 |

| 2030 | 650-700 |

Conclusion

Genus Power is well-positioned to capitalize on the growing demand for smart metering solutions and energy reforms. While challenges like competition and pricing pressures exist, the company’s robust financial health, strategic initiatives, and alignment with market trends make it a promising investment for long-term growth. Investors should monitor key developments and regulatory changes to make informed decisions.

FAQs: Genus Power Share Price Target (2025-2030)

1. What is the current share price of Genus Power?

The current share price of Genus Power is ₹336.

2. What is the Genus Power Share Price Target 2025?

By 2025, the share price of Genus Power is projected to range between ₹400-450, driven by increased adoption of smart meters and government support for energy reforms.

3. What factors could influence Genus Power’s share price by 2026?

By 2026, key factors such as continued market penetration, operational efficiency, and advancements in smart meter technology could push the share price to ₹450-500.

4. How does Genus Power plan to achieve growth by 2027?

Genus Power aims to achieve growth by 2027 through strategic initiatives like product diversification, export market expansion, and leveraging government policies promoting energy efficiency. The share price target for 2027 is ₹500-550.

5. What are the growth drivers for Genus Power in 2028?

Key growth drivers in 2028 include:

- Expansion into international markets.

- Development of high-margin, advanced smart metering products.

- Sustained financial performance and profitability.

The share price target for 2028 is ₹550-600.

6. What is the projected share price for Genus Power by 2029?

By 2029, Genus Power’s share price could range between ₹600-650, supported by a strong global presence, improved return ratios, and increased R&D investments.

7. What is the share price target for Genus Power by 2030?

The projected share price for Genus Power by 2030 is ₹650-700, contingent on sustainable growth, effective risk mitigation, and alignment with ESG standards.

8. How does the global smart meter market impact Genus Power?

The global smart meter market, expected to grow at a CAGR of 8-10%, presents significant opportunities for Genus Power. Factors like rising energy efficiency demand and government-led smart grid initiatives drive market growth.

9. What is Genus Power’s dividend policy?

Genus Power has a dividend yield of 0.15%. While modest, the company focuses on reinvesting earnings into growth initiatives, which could lead to higher payouts in the future.

10. What are the key risks to Genus Power’s growth?

Key risks include:

- Intense competition from global and domestic players.

- Fluctuating raw material costs affecting margins.

- Regulatory and policy uncertainties in the energy sector.

Addressing these risks is critical for achieving the projected share price targets from 2025 to 2030.

2 thoughts on “Genus Power Share Price Target 2025 to 2030”