Axita Cotton Share Price Target 2025 to 2030: A Detailed Analysis

Understanding Business Model

Axita Cotton Limited operates in the cotton industry, primarily focusing on the production and export of cotton bales and cottonseed. The company caters to both domestic and international markets, leveraging India’s position as one of the largest cotton producers globally. Its revenue streams primarily include:

- Cotton Bales: Core product offering with a steady demand in textile manufacturing.

- Cottonseed: By-product used for oil extraction and livestock feed.

- Export Operations: A significant portion of revenue comes from exports, particularly to Southeast Asia and European markets.

Axita Cotton aims to maintain strong relationships with farmers and traders, ensuring consistent raw material supply while focusing on quality and cost-efficiency.

Key Metrics of Axita Cotton Share

| Metric | Value |

|---|---|

| Market Capitalization | ₹389 crore |

| P/E Ratio | 31.05 |

| Dividend Yield | 0.6196% |

| Face Value | ₹ 1 |

| Book Value | ₹ 1.86 |

| ROCE Ratio | 37.9% |

| 52-Week High | ₹16.19 |

| 52-Week Low | ₹10.88 |

| Promoters’ Holding | 41.93% |

| Foreign Institutions (FII) | 1.96% |

| Retail and Others | 56.12% |

Axita Cotton Share Price Chart of Last 5years

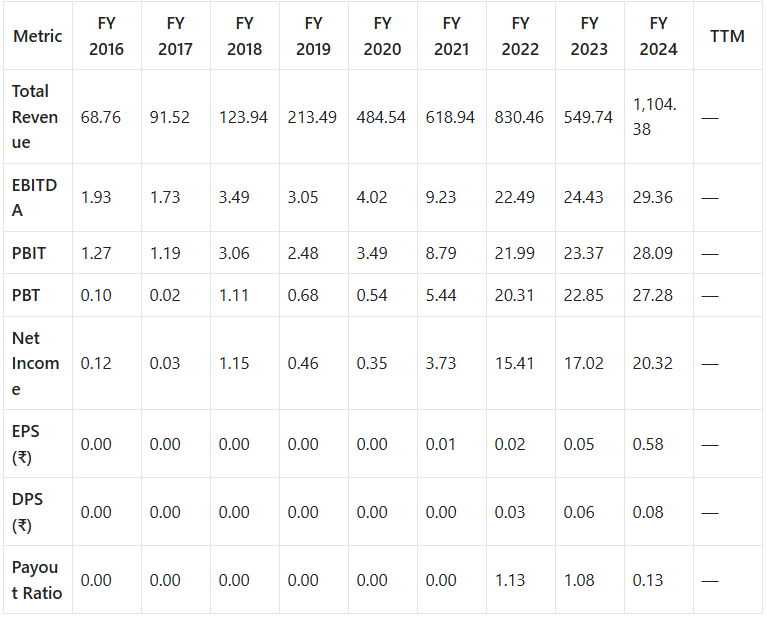

Income Statement Overview

Industry Context

The industry represents the sub-sector in which the company operates. A higher-than-industry revenue growth indicates an increased potential for the company to capture a larger market share.

- Revenue Growth: Over the last 5 years, the company’s revenue grew at an impressive annual rate of 38.91%, significantly outpacing the industry average of 3%.

Market Share

Market share measures the percentage of an industry’s total sales generated by a company, offering insights into its competitiveness.

- 5-Year Trend: The company’s market share grew substantially from 0.15% to 0.63%, demonstrating a strong competitive position.

Net Income

Net income reflects the company’s profitability after expenses.

- Growth Rate: Over the last 5 years, the company achieved a remarkable yearly growth rate of 113.32% in net income, compared to the industry average decline of -9.62%.

Detailed Financial Performance (₹ in Crores)

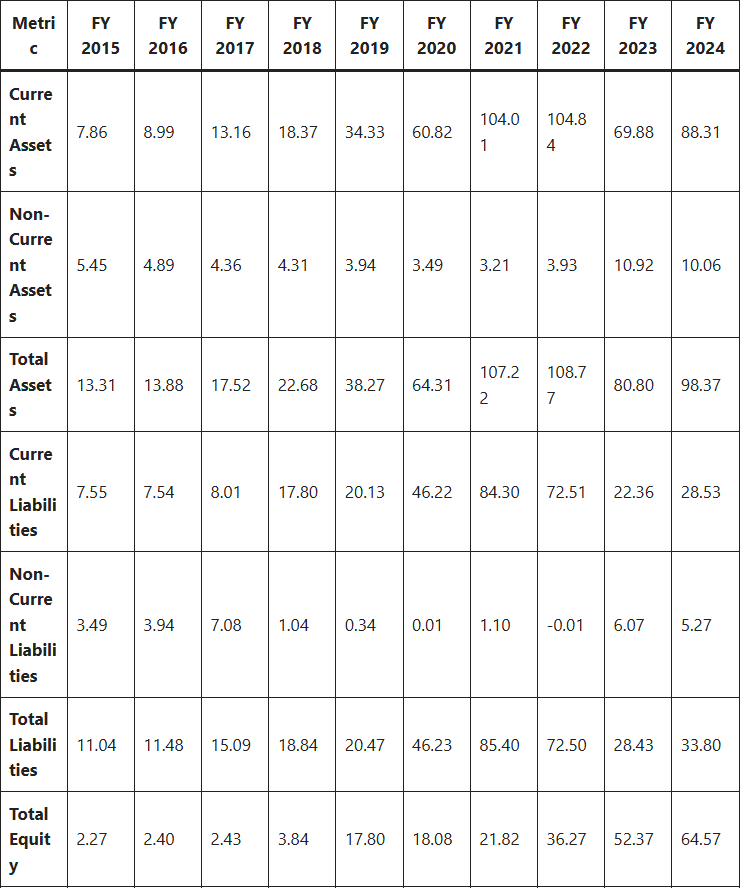

Balance Sheet Highlights

Debt to Equity Ratio

This ratio indicates the proportion of debt to shareholder equity, highlighting how operations are funded.

- 5-Year Average: The company’s debt to equity ratio was 39%, far below the industry average of 195.1%, indicating conservative financial management.

Current Ratio

The current ratio measures the company’s ability to meet short-term obligations. A higher ratio suggests better liquidity.

- 5-Year Average: The company’s current ratio was 204.32%, surpassing the industry average of 123.67%.

Detailed Balance Sheet (₹ in Crores)

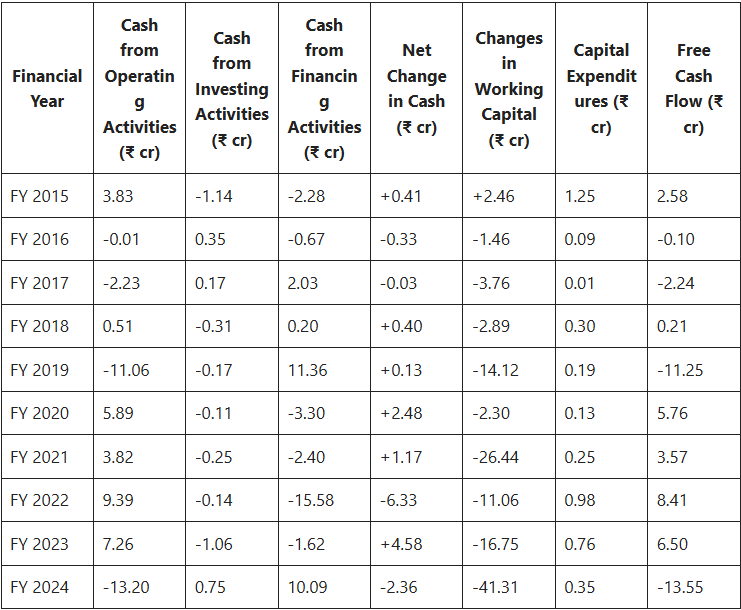

Cash Flow Statement

Financial Performance Overview

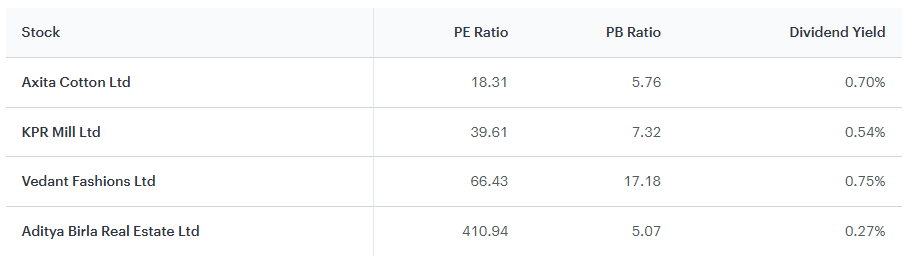

Peers & Comparison

Key Observations

- Cash from Operating Activities: The company experienced volatility over the years, with the highest positive cash inflow in FY 2022 (₹9.39 cr) and significant negative cash flow in FY 2024 (₹-13.20 cr).

- Cash from Investing Activities: Minor fluctuations occurred, with the most significant outflow in FY 2019 (₹-0.31 cr) and a notable inflow in FY 2024 (₹0.75 cr).

- Cash from Financing Activities: Financing activities were marked by inflows in FY 2019 (₹11.36 cr) and outflows in FY 2022 (₹-15.58 cr).

- Net Change in Cash: The net cash position was most favorable in FY 2020 (₹2.48 cr) and saw a decline in FY 2024 (₹-2.36 cr).

- Free Cash Flow: Free cash flow has been inconsistent, with significant negative values in FY 2019 (₹-11.25 cr) and FY 2024 (₹-13.55 cr).

Industry Metrics Comparison

- Revenue Growth: Over the past five years, the company’s revenue growth averaged 7.29%, below the industry average of 12.69%.

- Market Share: The company’s market share decreased from 4.59% to 3.64% over the same period, indicating a decline in competitive positioning.

- Net Income Growth: Despite challenges, net income grew at an average rate of 12.4%, slightly lagging the industry’s 18.31%.

Capital Management

- Changes in Working Capital: The company faced significant working capital challenges, with FY 2024 showing the largest outflow (₹-41.31 cr).

- Capital Expenditures: Investments remained relatively stable, peaking at ₹0.98 cr in FY 2022.

Fundamental Analysis

1. Company Overview

Axita Cotton, founded with a mission to strengthen the cotton value chain, has grown steadily due to its operational efficiency and strategic market positioning. The company’s focus on sustainable practices and export-oriented growth has made it a reliable player in the sector. Investments in technology and quality control processes ensure competitive pricing and high-quality output.

2. Financial Health

Axita Cotton maintains a low debt-to-equity ratio, demonstrating prudent financial management. This enables the company to withstand market volatility and invest in future growth opportunities without over-leveraging.

The company’s positive cash flow is a testament to efficient operations, timely payments from clients, and disciplined expense management. Consistent cash flow supports dividend payouts and reinvestment in business expansion.

Axita Cotton’s liquidity position is robust, with sufficient reserves to meet short-term obligations. Its working capital management ensures smooth operations even during periods of fluctuating raw material prices.

3. Competitive Analysis

Axita Cotton faces competition from both domestic players and international suppliers. Key differentiators include:

- Quality Assurance: Stringent quality checks give Axita Cotton an edge in export markets.

- Cost Efficiency: Proximity to cotton-growing regions reduces transportation costs.

- Market Presence: Strong relationships with international clients ensure steady demand.

4. Growth Prospects

Market Trends

- Rising Global Demand: Increased demand for cotton-based products, especially in emerging markets.

- Shift to Sustainability: Growing preference for natural fibers over synthetic ones aligns with Axita Cotton’s core offerings.

- Government Support: Policies encouraging agricultural exports and incentives for the cotton industry.

Strategic Initiatives

- Capacity Expansion: Investments in processing facilities to meet growing demand.

- Digital Transformation: Leveraging technology for supply chain optimization and market analysis.

- Product Diversification: Exploring value-added products like organic cotton and cottonseed derivatives.

Key Factors Impacting Axita Cotton Share Price

1. Global Cotton Demand

The demand for cotton on a global scale significantly influences Axita Cotton’s share price. Economic growth in major importing countries, consumer preferences for cotton-based products, and climatic conditions that impact crop yields all play a role. For instance, a rise in global apparel demand can lead to increased orders for cotton, boosting Axita’s revenue and stock valuation. Conversely, economic slowdowns or a shift towards synthetic fibers can reduce demand, pressuring margins and share prices.

2. Raw Material Prices

Cotton, being the primary raw material for Axita, directly affects its profit margins. Price volatility in the cotton market, driven by factors such as weather conditions, pest outbreaks, or geopolitical tensions, can impact operational costs. For example, a sharp increase in cotton prices may erode profit margins if the company is unable to pass on the costs to its customers. On the other hand, lower raw material costs can enhance profitability, positively influencing the share price.

3. Export Policies

Government policies regarding cotton exports have a direct impact on Axita Cotton. Incentives like subsidies or tax rebates can make Indian cotton more competitive globally, boosting the company’s export revenues. However, restrictions on exports, such as bans or high tariffs, can limit market access and reduce earnings potential. Monitoring these policies is critical for understanding the company’s growth trajectory and share price movements.

4. Operational Efficiency

Axita Cotton’s ability to manage its operations efficiently is a key determinant of its financial performance and, consequently, its stock price. Measures such as adopting advanced technology, optimizing supply chains, and reducing wastage contribute to cost management and productivity. Companies with higher operational efficiency tend to generate better profit margins, attract more investors, and enjoy a premium valuation in the stock market.

5. Market Sentiment

Investor confidence in the agricultural sector and Axita Cotton’s position within it plays a significant role in determining its share price. Positive sentiment can be driven by strong financial results, favorable industry conditions, or effective management strategies. Conversely, negative sentiment arising from sectoral challenges, such as poor monsoons or declining exports, can lead to stock price declines. Axita’s ability to communicate its growth strategy and deliver consistent performance is critical to maintaining investor trust.

Axita Cotton Share Price Target 2025 to 2030: Detailed Analysis

Axita Cotton Share Price Target 2025

By 2025, Axita Cotton is expected to experience significant benefits from rising global demand for cotton and its efficient operational strategies. The company’s ability to capitalize on export opportunities and maintain cost-effective production processes will likely drive growth. Additionally, favorable government policies supporting agricultural exports could further bolster its financial performance.

Estimated Target Price: ₹16

This projection assumes steady demand growth, prudent cost management, and favorable market conditions.

Axita Cotton Share Price Target 2026

In 2026, Axita Cotton’s continued market expansion and strategic initiatives are expected to propel its growth. The company may focus on enhancing its supply chain efficiency and exploring new markets to diversify its revenue streams. Furthermore, increased investments in technology to improve production quality could solidify its competitive position.

Estimated Target Price: ₹18

This growth outlook reflects Axita Cotton’s adaptability to evolving market trends and its commitment to operational excellence.

Axita Cotton Share Price Target 2027

By 2027, Axita Cotton’s investments in capacity expansion and product diversification are anticipated to yield significant results. The company might explore value-added products, such as organic cotton, to cater to niche markets with higher profit margins. Additionally, strategic partnerships or collaborations with global buyers could enhance its market presence and revenue potential.

Estimated Target Price: ₹20

These initiatives, coupled with robust financial management, are expected to drive shareholder value.

Axita Cotton Share Price Target 2028

In 2028, Axita Cotton’s focus on sustainability and export growth is likely to become a key differentiator. As global consumers increasingly prioritize sustainable and ethically sourced products, Axita’s alignment with these values could open up new revenue opportunities. Expansion into emerging markets and leveraging government incentives for green initiatives may further support its growth trajectory.

Estimated Target Price: ₹22

This projection underscores Axita’s efforts to align with global sustainability trends and its potential to attract socially conscious investors.

Axita Cotton Share Price Target 2029

By 2029, Axita Cotton’s consistent growth and improved profitability are expected to reflect in its share price. Enhanced operational efficiency, reduced debt, and strategic reinvestment of earnings into high-growth areas could strengthen its financial position. Additionally, diversification into allied sectors such as technical textiles might provide new avenues for revenue generation.

Estimated Target Price: ₹24

The combination of strong fundamentals and innovative strategies positions Axita Cotton for sustained success.

Axita Cotton Share Price Target 2030

Looking ahead to 2030, Axita Cotton’s share price is anticipated to reach ₹26, driven by several factors:

- Sustained demand for high-quality cotton in global markets.

- Strategic investments in technology and infrastructure.

- Enhanced profitability through cost optimization and value-added product offerings.

Estimated Target Price: ₹26

This target reflects Axita Cotton’s resilience, adaptability, and ability to capitalize on long-term market trends.

Summary of Axita Cotton Share Price Target 2025 to 2030

| Year | Target Price (₹) |

|---|---|

| 2025 | 16 |

| 2026 | 18 |

| 2027 | 20 |

| 2028 | 22 |

| 2029 | 24 |

| 2030 | 26 |

Conclusion

Axita Cotton’s strong fundamentals, strategic focus on export markets, and commitment to sustainability position it for steady growth in the coming years. While challenges like market volatility and raw material price fluctuations persist, the company’s resilience and adaptability make it a compelling investment opportunity for long-term investors. The Axita Cotton Share Price Target 2025 to 2030 reflect a growth-oriented trajectory supported by sound financial management and favorable market trends.

FAQ’s ( Frequently Asked Questions)

- What is the primary business model of Axita Cotton Limited?

- Axita Cotton Limited operates in the cotton industry, focusing on the production and export of cotton bales and cottonseed. It serves both domestic and international markets, with significant revenue from exports.

- What are the key revenue streams for Axita Cotton?

- The company’s revenue streams include cotton bales as the core product, cottonseed (used for oil extraction and livestock feed), and export operations targeting Southeast Asia and European markets.

- What has been Axita Cotton Share Price revenue growth rate over the last 5 years?

- Axita Cotton’s revenue grew at an impressive annual rate of 38.91%, significantly outpacing the industry average of 3%.

- What is Axita Cotton’s 5-year trend Axita Cotton Share Price market share?

- Over the past 5 years, Axita Cotton’s market share increased from 0.15% to 0.63%, showcasing strong competitiveness.

- How has Axita Cotton’s net income growth compared to the industry average?

- Axita Cotton achieved a remarkable yearly growth rate of 113.32% in net income, while the industry average faced a decline of -9.62%.

- What is the company’s dividend policy?

- Axita Cotton provides consistent but modest dividend payouts. With a dividend yield of 0.6196%, it balances rewarding shareholders and retaining earnings for growth.

- What are the Axita Cotton Share Price key financial metrics?

- Axita Cotton has a market capitalization of ₹389 crore, a P/E ratio of 31.05, and a return on capital employed (ROCE) of 37.9%. Its promoters’ holding stands at 41.93%.

- How does Axita Cotton manage its debt?

- The company maintains a low debt-to-equity ratio of 39%, well below the industry average of 195.1%, indicating conservative financial management.

- What are Axita Cotton Share Price Target 2025 to 2030 ?

- The share price targets are estimated at ₹16 for 2025 and ₹26 for 2030, reflecting growth driven by global demand, operational efficiency, and strategic initiatives.

- What factors impact Axita Cotton Share Price?

- Key factors include global cotton demand, raw material prices, government export policies, operational efficiency, and investor sentiment.

3 thoughts on “Axita Cotton Share Price Target 2025 to 2030”