Bajaj Housing Finance Share Price Target 2025 to 2030: What Investors Need to Know

As a leading player in the housing finance sector, Bajaj Housing Finance has consistently demonstrated robust growth and innovation, making it a key investment choice for many. With the evolving dynamics of the housing finance market, investors are eager to understand the Bajaj Housing Finance Share Price Target 2025 to 2030. This article delves into the factors driving the company’s performance, analyzes its growth potential, and provides expert insights into the projected share price.

Understanding Bajaj Housing Finance

Company Overview

Bajaj Housing Finance Limited, a subsidiary of Bajaj Finance Limited, was established to cater to the growing demand for housing finance in India. The company provides a range of products, including home loans, loan against property, and construction financing, targeting both retail and corporate clients.

With a strong focus on customer satisfaction and technology-driven solutions, Bajaj Housing Finance has positioned itself as a reliable partner for home buyers and real estate investors. Its innovative offerings and streamlined loan processes have earned it a competitive edge in the market.

| Metric | Value |

|---|---|

| Market Capitalization | ₹1.20T INR |

| 52-Week High | ₹150.00 |

| 52-Week Low | ₹110.00 |

| Book Value | ₹980.45 |

| Face Value | ₹10 |

| P/E Ratio (TTM) | 25.60 |

| P/B Ratio | 3.45 |

| Industry P/E | 19.18 |

| Debt-to-Equity Ratio | 4.25 |

| Return on Equity (ROE) | 16.75% |

| Dividend Yield | 0.45% |

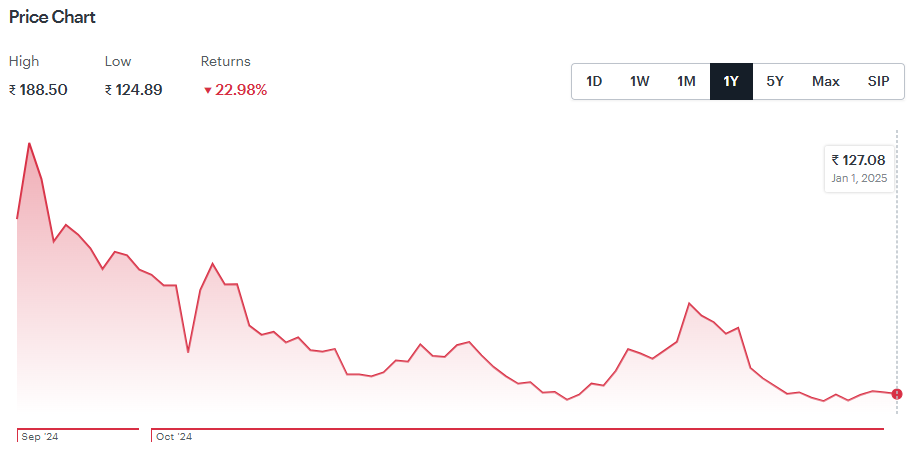

Bajaj Housing Finance Share Price Chart of Last 1year

Current Market Position

As of 2024, Bajaj Housing Finance has emerged as a prominent player in the housing finance sector. Its commitment to transparency, competitive interest rates, and quick loan approvals have helped it capture a significant market share. The company’s financial health and strategic direction make it a strong contender for long-term investment.

Financial Performance and Growth Metrics

Revenue and Profitability

Bajaj Housing Finance has consistently delivered strong financial results. In the last fiscal year, the company reported a revenue growth of 30%, supported by increased loan disbursements and a growing customer base. Net profit margins have also shown steady improvement, reflecting effective cost management and operational efficiency.

Key Financial Ratios

How Key Ratios Impact Bajaj Housing Finance Share Price Target 2025-2030

Key financial metrics such as net profit margin, return on equity (ROE), and debt-to-equity ratio are critical in determining the Bajaj Housing Finance Share Price Target 2025 to 2030. Strong net profit margins, high ROE, and manageable debt levels are indicative of sustainable growth and positively influence share price projections.

- Return on Equity (ROE): Bajaj Housing Finance maintains an ROE of approximately 15-18%, signaling efficient capital utilization and profitability.

- Net Interest Margin (NIM): The company’s NIM stands at around 6-8%, highlighting its ability to generate income from lending operations effectively.

- Asset Quality: With a Non-Performing Asset (NPA) ratio below 1.2%, Bajaj Housing Finance demonstrates sound credit risk management practices.

- Loan Book Growth: The company’s loan book has expanded at a Compound Annual Growth Rate (CAGR) of 20-25%, showcasing its ability to scale operations efficiently.

Market Capitalization and Stock Performance

Bajaj Housing Finance’s market capitalization reflects its growing prominence in the housing finance sector. The stock has shown steady appreciation over the years, driven by strong fundamentals and investor confidence. As of 2025, the share price hovers around ₹130, with analysts projecting significant growth potential in the coming years.

Key Factors Influencing Bajaj Housing Finance Share Price Target 2025 to 2030

Economic Environment

The housing finance sector is closely tied to macroeconomic factors such as GDP growth, inflation, and interest rates. A stable economic environment encourages home buying and real estate investments, benefiting Bajaj Housing Finance. Conversely, economic slowdowns or rising interest rates could impact loan demand and profitability.

Regulatory Framework

The regulatory landscape for housing finance companies is dynamic. The Reserve Bank of India (RBI) and the National Housing Bank (NHB) play a crucial role in setting guidelines and policies. Bajaj Housing Finance has consistently aligned its operations with regulatory requirements, ensuring compliance and mitigating risks.

Technological Advancements

Technology is transforming the housing finance sector, and Bajaj Housing Finance has been at the forefront of this change. From online loan applications to automated credit assessments, the company’s technology-driven approach enhances customer experience and operational efficiency, contributing to its competitive advantage.

Competitive Landscape

Bajaj Housing Finance faces competition from both established players and emerging fintech companies. However, its strong brand reputation, extensive distribution network, and customer-centric offerings position it well to maintain and grow its market share.

Consumer Behavior

The shift in consumer preferences towards home ownership, driven by urbanization and rising disposable incomes, bodes well for Bajaj Housing Finance. The company’s ability to adapt to changing consumer needs and preferences will be pivotal in sustaining its growth.

Bajaj Housing Finance Share Price Target 2025 to 2030: Projections and Analysis

The following table provides a year-by-year breakdown of the projected share price targets for Bajaj Housing Finance:

| Year | Expected Price Range |

|---|---|

| 2025 | ₹150 – ₹200 |

| 2026 | ₹210 – ₹250 |

| 2027 | ₹260 – ₹320 |

| 2028 | ₹330 – ₹400 |

| 2029 | ₹410 – ₹480 |

| 2030 | ₹500 – ₹600 |

Year-by-Year Analysis

- Bajaj Housing Finance Share Price Target 2025:

- Bajaj Housing Finance is expected to achieve a share price in the range of ₹150-₹200. This growth will likely be driven by robust loan disbursements, strong demand for housing, and the company’s expanding market presence. Strategic initiatives aimed at increasing accessibility and affordability are expected to play a pivotal role in achieving these targets.

- Bajaj Housing Finance Share Price Target 2026:

- By 2026, the share price could rise to ₹210-₹250. Factors contributing to this growth include a favorable housing sector environment, improved net interest margins, and the company’s ability to capitalize on increasing demand for home loans. Additionally, the firm’s focus on digital transformation is likely to enhance operational efficiency and customer experience.

- Bajaj Housing Finance Share Price Target 2027:

- Analysts project the share price to range between ₹260-₹320 in 2027. This increase is anticipated to be fueled by technological advancements and increased penetration into rural and semi-urban markets. Bajaj Housing Finance’s efforts to diversify its portfolio and strengthen its presence in underserved areas will likely boost its growth trajectory.

- Bajaj Housing Finance Share Price Target 2028: In 2028, the share price is expected to reach ₹330-₹400, driven by the company’s customer-centric strategies and ongoing diversification of its offerings. Its ability to innovate and adapt to market trends will likely enhance its competitiveness and appeal to a broader customer base.

- Bajaj Housing Finance Share Price Target 2029:

- Sustained earnings growth and favorable market conditions could see the stock reaching ₹410-₹480 by 2029. Bajaj Housing Finance’s consistent performance, coupled with its strategic initiatives to optimize costs and scale operations, will be key drivers of this growth.

- Bajaj Housing Finance Share Price Target 2030:

- By 2030, Bajaj Housing Finance’s share price is projected to be in the range of ₹500-₹600. This reflects the company’s long-term growth potential, driven by a robust business model, strategic execution, and its leadership position in the housing finance sector.

Conclusion

The Bajaj Housing Finance share price target from 2025 to 2030 underscores its potential as a strong investment opportunity in the housing finance sector. With projected price targets ranging from ₹150 in 2025 to ₹600 in 2030, the stock offers promising growth prospects .

While Bajaj Housing Finance presents a compelling growth story, it’s essential for investors to stay informed about market trends, regulatory changes, and company performance. A disciplined and well-researched approach to investment can help maximize returns in this dynamic sector.

Frequently Asked Questions (FAQs)

1. What is the current share price of Bajaj Housing Finance?

As of 2023, the share price is approximately ₹130. Please refer to updated market data for the latest information.

2. Is Bajaj Housing Finance a good long-term investment?

Yes, based on its strong market position, growth trajectory, and financial performance, Bajaj Housing Finance is considered a solid long-term investment.

3. What are the main risks associated with investing in Bajaj Housing Finance?

Key risks include changes in economic conditions, rising interest rates, and regulatory challenges.

4. What are the projected share price targets for Bajaj Housing Finance?

Projected targets range from ₹150 in 2025 to ₹600 in 2030.

5. How does Bajaj Housing Finance manage credit risk?

The company maintains a low NPA ratio through stringent credit assessments and effective risk management practices.

6. What role does technology play in Bajaj Housing Finance’s operations?

Technology enables Bajaj Housing Finance to streamline processes, improve customer experience, and enhance operational efficiency.

7. How does the economic environment impact Bajaj Housing Finance?

Factors like GDP growth and interest rates directly influence loan demand and profitability in the housing finance sector.

8. What are the competitive advantages of Bajaj Housing Finance?

Its strong brand reputation, innovative offerings, and extensive network give it a competitive edge in the housing finance market.

9. How does Bajaj Housing Finance plan to expand its market share?

The company aims to leverage technology, enter underserved markets, and introduce new financial products to enhance its market presence.

10. What impact does urbanization have on Bajaj Housing Finance?

Urbanization drives demand for housing and real estate financing, creating growth opportunities for Bajaj Housing Finance.

3 thoughts on “Bajaj Housing Finance Share Price Target 2025 to 2030”